APAC is the largest continent in the world and is well-known for technological innovations taking place in countries such as India, China, Japan, and South Korea. Rapid developments in technologies, initiatives by governments, digitalization of economies, and rise in disposable income of the middle-income class group are a few factors propelling the overall economic growth of the region and driving it from a developing to a developed phase. In APAC, the demand for natural gas is rising due to rapid urbanization and industrialization across the region. According to BP Statistical Review of World Energy 2020, China recorded around 18% of increase in the consumptions of natural gas. Further, in APAC, China is the leading producer of natural gas and produced around 6.4 exajoules in 2019, followed by Australia, Malaysia, and Indonesia. The governments of APAC are also taking initiatives to increase natural gas production activities. For instance, in June 2019, the Inpex Company signed a US$ 20 billion annual agreement with the Indonesian government to explore approximately 9.5 million tons of liquid natural gas (LNG). Furthermore, the region is witnessing the discovery of new oil and gas field, which is further accelerating the production of natural gas in APAC. For Instance, in June 2021, China discovered a new 900-million-tonne oil and gas field in the Tarim Basin in northwestern Xinjiang Uygur Autonomous Region. Thus, the discovery of new oil & gas fields, initiatives by governments, and increasing consumptions of natural gas are creating lucrative opportunities for the growth of the APAC cryogenic control valve market.

APAC constitutes the world’s two most populated countries China and India. China, Australia, Indonesia, and Malaysia are a few prominent natural gas producing countries. In addition, China, Japan, South Korea, and India are among the major consumers of natural gas. The government of China imposed strict lockdown and social isolation measures in early 2020, which led to the discontinuation of exploration activities and lowering of demand for oil and other energy commodities. Thus, natural gas storage and transportation activities across China plummeted significantly and resulted in weak demand for cryogenic valves. Similarly, Australia imposed nationwide lockdown to control the growing number of COVID-19 cases, which disrupted oil & gas supply chains and reduced oil & gas product demand. Thus, the overall decline of E&P activities in oil & gas industries hampered the demand for cryogenic valves across APAC during the first two quarter of 2020. However, with the resumption of work in several economies in the region, the exploration activities of natural gas products and rise in demand of these products are supporting the cryogenic control valve market growth. Thus, the market is projected to recover steadily over the coming period and gain traction for cryogenic control valve during the forecast period.

Strategic insights for the Asia-Pacific Cryogenic Control Valve provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

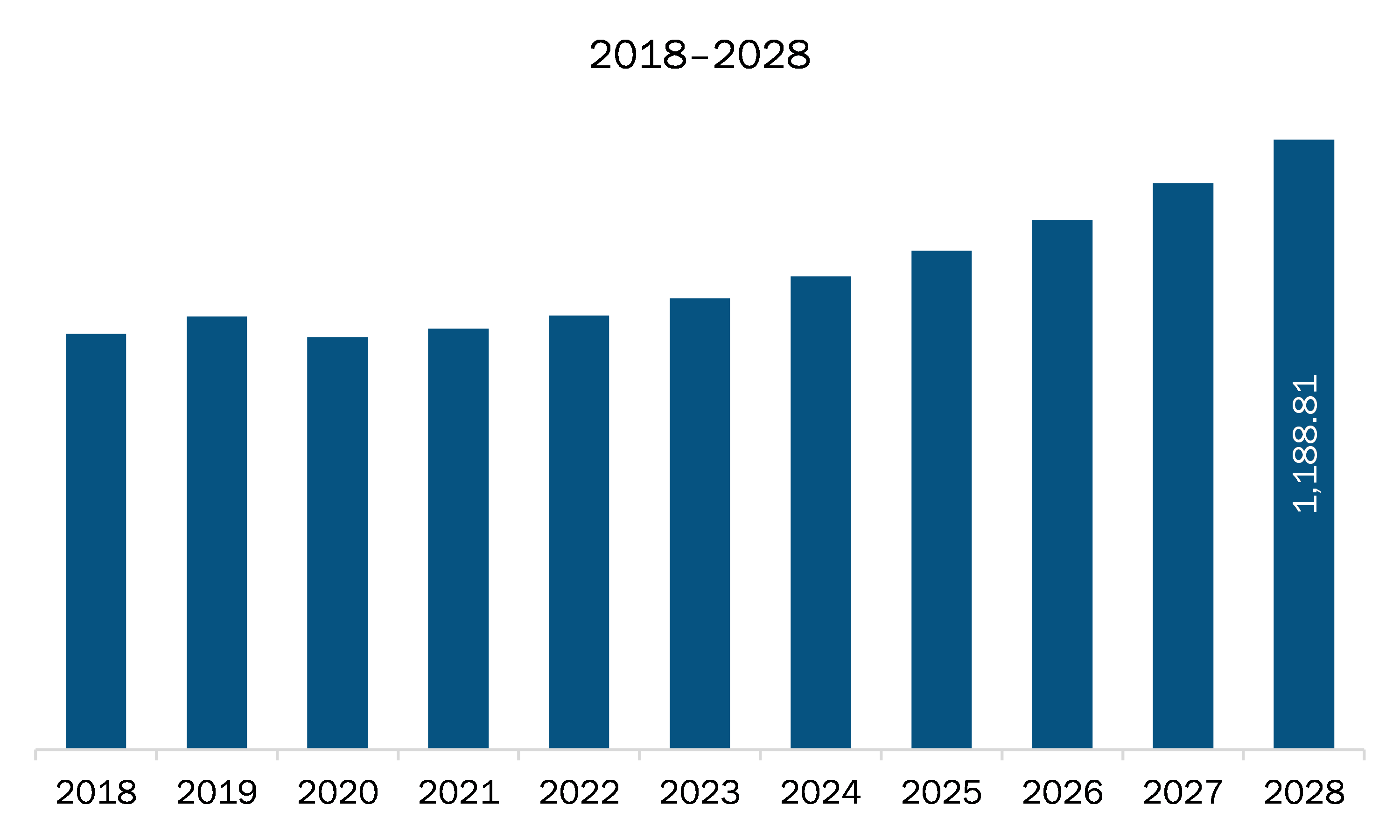

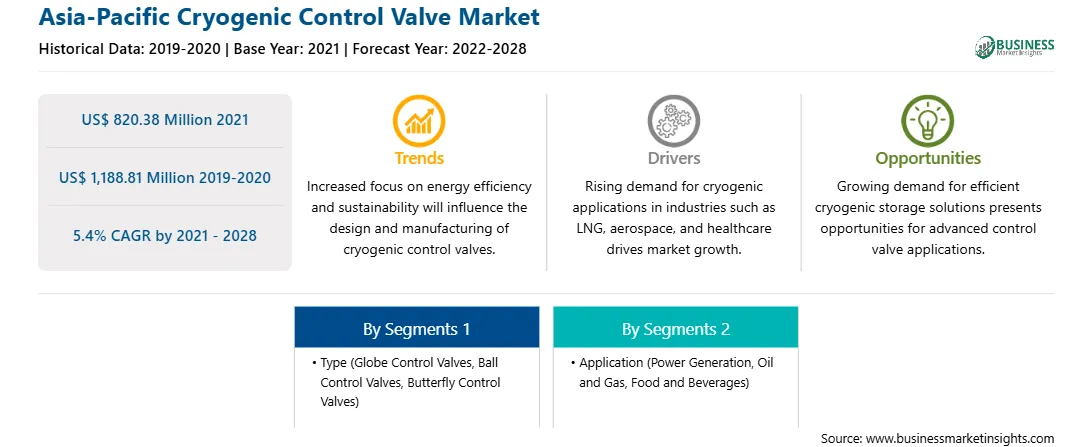

| Market size in 2021 | US$ 820.38 Million |

| Market Size by 2028 | US$ 1,188.81 Million |

| Global CAGR (2021 - 2028) | 5.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia-Pacific Cryogenic Control Valve refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The cryogenic control valve market in APAC is expected to grow from US$ 820.38 million in 2021 to US$ 1,188.81 million by 2028; it is estimated to grow at a CAGR of 5.4% from 2021 to 2028 In APAC, India is becoming an epicenter of the COVID-19 outbreak. The country recently faced the second wave of the outbreak, which has slowed down the growth of many industries in the country. However, rest of the major oil & gas consuming countries such as Chia, Australia, Japan, and South Korea prevented the spread of the virus by introducing COVID-19 vaccination. The slow resumptions of economy in APAC are gradually helping oil & gas companies to start E&P activities. Hence, the economy recovery is expected to propel the growth of the APAC cryogenic control valve market in the coming years.

The APAC cryogenic control valve market is bifurcated on the bases of type, application, and country. The market, based on type, is segmented into globe control valves, ball control valves, butterfly control valves, and others. In 2020, the ball control valves segment accounted for the largest market share. By application, the market is segmented into power generation, oil & gas, food & beverages, and others. The oil & gas segment held substantial market share in 2020. Based on country, the APAC cryogenic control valve market is segmented into Australia, China, India, Japan, South Korea, and rest of APAC. China held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the cryogenic control valve market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Bac Valves; Baker Hughes Company; Emerson Electric Co.; Flowserve Corporation; KORVAL Co., Ltd.; Larsen & Toubro Limited; Neles Corporation; Richards Industrials; SAMSON USA; and Velan Inc.

The Asia-Pacific Cryogenic Control Valve Market is valued at US$ 820.38 Million in 2021, it is projected to reach US$ 1,188.81 Million by 2028.

As per our report Asia-Pacific Cryogenic Control Valve Market, the market size is valued at US$ 820.38 Million in 2021, projecting it to reach US$ 1,188.81 Million by 2028. This translates to a CAGR of approximately 5.4% during the forecast period.

The Asia-Pacific Cryogenic Control Valve Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Cryogenic Control Valve Market report:

The Asia-Pacific Cryogenic Control Valve Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Cryogenic Control Valve Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Cryogenic Control Valve Market value chain can benefit from the information contained in a comprehensive market report.