Strong Growth of the Construction Industry in Developing Countries

The construction chemicals help to enhance the workability, performance, functionality, chemical resistance, and durability of the construction materials. India is one of the largest construction markets. In India, the growth in the construction activities is driven by continuing industrialization, urbanization, increasing population, growth in middle-class income, and the increase in infrastructural developments. According to the Department for Promotion of Industry and Internal Trade (DPIIT), foreign direct investments (FDIs) in the construction development sector and construction (infrastructure) activities stood at US$ 26.20 billion and US$ 27.92 billion, respectively, between April 2000-March 2022. The government of India has given a massive push to the infrastructure sector by allocating US$ 130.57 billion in order to enhance the infrastructure sector. According to the India Brand Equity Foundation, the country is planning to spend US$ 1.4 trillion on infrastructure projects through the National Infrastructure Pipeline (NIP), from 2019 to 2023, to ensure sustainable development in the country. The government of India has also decided to come up with a single window clearance facility to accord speedy approval of construction projects to boost the construction of buildings in the country. All these factors contribute to the strong growth of the construction industry in India. Further, as per the Ministry of Statistics and Program Implementation, the construction sector in India is expected to increase at 10.7% in 2022 in a rebound from a decrease of 8.6% in 2021, due to the government’s boosted focus on infrastructure projects and smart recovery of demand for residential and commercial segments. Hence, the strong growth of the construction industry in these developing countries is mainly driving the Asia Pacific construction chemicals market growth.

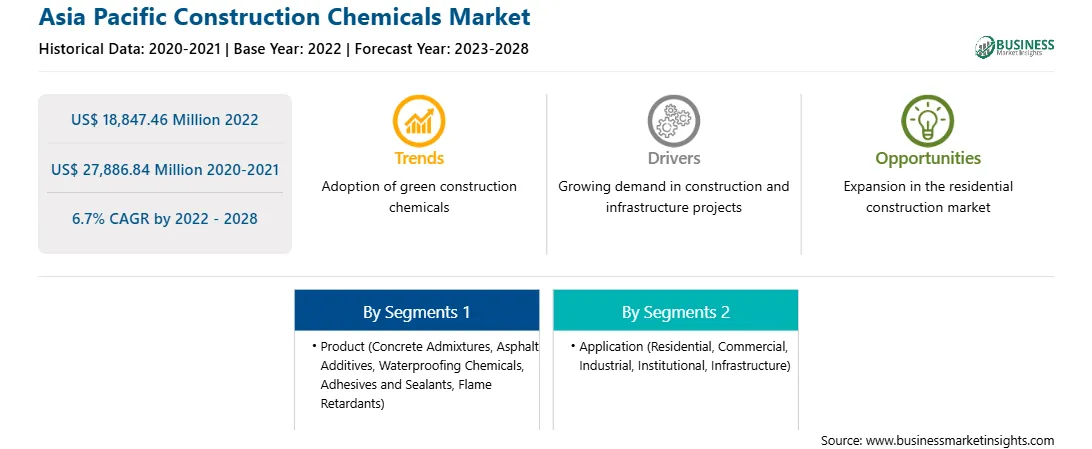

Market Overview

Australia, China, India, Japan, South Korea, and rest of Asia Pacific are the key contributors to the construction chemicals market in the Asia Pacific. The Asia Pacific has been promoted as one of the leading markets for using construction chemicals owing to the surge in construction activities. Moreover, government policies and initiatives such as Make-in-India encourage the setup of different manufacturing plants in India. Further, rising government and foreign investments in mega projects in the Asia Pacific are encouraging construction chemical manufacturers in the region to push strongly toward incorporating sustainable and technologically advanced materials in concrete admixtures, waterproofing, and industrial flooring. The growing number of construction chemicals used in many residential and non-residential sectors is anticipated to increase the construction chemicals demand in the Asia Pacific region. The building and construction industry contributes to the market's growth. For instance, in India, the construction industry is the second largest industry after agriculture, accounting for about 11% of the country's GDP. Further, key players operating in the Asia Pacific construction chemicals market are Hume Cemboard Industries Sdn Bhd, Tepe Betopan A.Ş., Nichiha Co., Ltd Dow Inc., etc. In recent years, the major market players in the region have invested heavily in R&D initiatives. This significant increase in research and development activity investment is expected to propel the Asia Pacific construction chemicals market growth.

Asia Pacific Construction Chemicals Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the Asia Pacific Construction Chemicals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Construction Chemicals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Construction Chemicals Strategic Insights

Asia Pacific Construction Chemicals Report Scope

Report Attribute

Details

Market size in 2022

US$ 18,847.46 Million

Market Size by 2028

US$ 27,886.84 Million

Global CAGR (2022 - 2028)

6.7%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Construction Chemicals Regional Insights

Asia Pacific Construction Chemicals Market Segmentation

The Asia Pacific construction chemicals market is segmented into product, application, and country.

Based on product, the market is segmented into concrete admixtures, asphalt additives, waterproofing chemicals, adhesives and sealants, flame retardants, and others. The concrete admixtures segment registered the largest market share in 2022.

Based on application, the market is segmented into residential, commercial, industrial, institutional, and infrastructure. The residential segment held the largest market share in 2022.

Based on country, the market is segmented into Australia, China, India, Japan, South Korea, and rest of Asia Pacific. China dominated the market share in 2022.

Ashland Global Holdings Inc; BASF SE; MAPEI S.p.A; Sika AG; Compagnie de Saint-Gobain S.A.; Pidilite Industries Limited; Fosroc, Inc; Choksey Chemicals Pvt ltd; RPM International Inc; and Dow Chemicals Company are the leading companies operating in the construction chemicals market in the Asia Pacific region.

The Asia Pacific Construction Chemicals Market is valued at US$ 18,847.46 Million in 2022, it is projected to reach US$ 27,886.84 Million by 2028.

As per our report Asia Pacific Construction Chemicals Market, the market size is valued at US$ 18,847.46 Million in 2022, projecting it to reach US$ 27,886.84 Million by 2028. This translates to a CAGR of approximately 6.7% during the forecast period.

The Asia Pacific Construction Chemicals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Construction Chemicals Market report:

The Asia Pacific Construction Chemicals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Construction Chemicals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Construction Chemicals Market value chain can benefit from the information contained in a comprehensive market report.