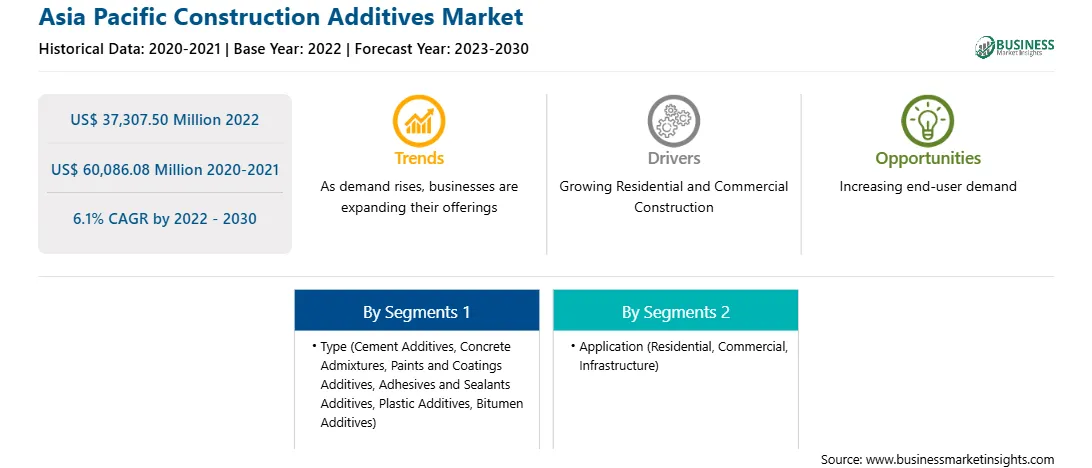

The Asia Pacific construction additives market was valued at US$ 37,307.50 million in 2022 and is projected to reach US$ 60,086.08 million by 2030; it is estimated to record a CAGR of 6.1% from 2022 to 2030.

The key manufacturers operating in the market are investing significantly in strategic development initiatives such as product innovation, R&D, mergers & acquisitions, and business expansion to attract a wide customer base and enhance their market position.

• In 2023, a researcher from Sarsam and Associates Consult Bureau (Iraq) reviewed the utilization of micro-sized fly ash and nano-sized silica fumes to extend the fatigue life of the pavement.

• In 2022, SoyLei Innovations aimed at developing a rejuvenator product, a compound made of soybean oil that can be mixed with recycled asphalt.

• In 2022, Aggregate Industries launched Foamix, a cold-mix asphalt containing 92% recycled materials and 85% reclaimed asphalt pavement.

• In 2022, Euclid Chemical Company announced the acquisition of Chryso's cement grinding aids and additives business.

• In October 2023, Gerdau Graphene announced the launch of two paint & coatings additives, namely, NanoDUR and NanoLAV. These two additives utilize graphene nanoplatelets for water-based paints & coatings.

• In December 2023, PETRONAS launched an ultra-high barrier paint additive to prevent corrosion, ProShield+, for steel structures.

• In 2023, Evonik Industries AG launched TEGO Guard 9000, an additive for building façade coatings.

Thus, rising strategic product innovations and research by key market players are expected to create lucrative opportunities for the construction additives market during the forecast period.

According to the International Trade Administration, total investment in China’s infrastructure during the 14th Five-Year Plan period (2021–2025) is estimated to reach ~US$ 4.2 trillion. In 2022, the National Development and Reform Commission (NDRC) and the Ministry of Transport (China) unveiled the National Highway Network Planning document aimed at the construction of a functional, efficient, green, intelligent, and safe modern highway network by 2035. The plan also encompasses the construction of a 461,000 km highway, which includes 162,000 km of expressways. According to the National Bureau of Statistics, China increased its fixed asset investment to US$ 8.5 trillion in 2022, driving investment in infrastructure development. In 2021, Shell Singapore and United E&P Pte Ltd signed a non-binding Memorandum of Understanding (MOU) for the development of a strategic alliance to construct sustainable roads in Singapore.

In 2022, Obayashi Corporation, a Japanese construction company, began testing the new system of road infrastructure at the Technical Research Center (Tokyo) in collaboration with various partners from the construction industry. Therefore, the growing construction and research and development pertaining to road infrastructure in Asia Pacific are projected to boost the demand for construction additives during the forecast period.

Strategic insights for the Asia Pacific Construction Additives provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 37,307.50 Million |

| Market Size by 2030 | US$ 60,086.08 Million |

| Global CAGR (2022 - 2030) | 6.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Construction Additives refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific construction additives market is categorized into type, application, and country.

Based on type, the Asia Pacific construction additives market is segmented into cement additives, concrete admixtures, precast concrete, ready-mix concrete, paints and coatings additives, adhesives and sealants additives, plastic additives, bitumen additives, and others. The cement additives segment held the largest market share in 2022.

In terms of application, the Asia Pacific construction additives market is categorized into residential, commercial, infrastructure, and others. The residential segment held the largest market share in 2022.

By country, the Asia Pacific construction additives market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific construction additives market share in 2022.

W. R. Grace & Co, Chryso SAS, Dow Inc, BASF SE, Heidelberg Materials AG, Cemex SAB de CV, Fosroc International Ltd, CICO Technologies Ltd, Sika AG, Evonik Industries AG, RPM International Inc, Mapei SpA, and Holcim Ltd. are some of the leading companies operating in the Asia Pacific construction additives

market.

The Asia Pacific Construction Additives Market is valued at US$ 37,307.50 Million in 2022, it is projected to reach US$ 60,086.08 Million by 2030.

As per our report Asia Pacific Construction Additives Market, the market size is valued at US$ 37,307.50 Million in 2022, projecting it to reach US$ 60,086.08 Million by 2030. This translates to a CAGR of approximately 6.1% during the forecast period.

The Asia Pacific Construction Additives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Construction Additives Market report:

The Asia Pacific Construction Additives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Construction Additives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Construction Additives Market value chain can benefit from the information contained in a comprehensive market report.