Asia Pacific includes countries such as China, Japan, India, Australia, South Korea and Rest of Asia Pacific. The growing prevalence of chronic disorders such as cancer and other diseases accelerates compounded pharmacies' demand in China. For instance, according to WHO, in 2018, there were around 4.2 million cancer cases recorded, and 2.8 million cancer deaths were reported in China. Moreover, the Chinese government implemented a systematic plan to achieve universal access to health care by 2020. One of the key pillars of the policy is to establish the National Pharmaceutical Policy. Developing hospital facilities and infrastructure coupled with a large patient pool will foster the overall compounding pharmacies market growth. Also, the presence of many market players in the region drives the growth of the market in the region. Furthermore, compounding pharmacies play an essential role in the modern world due to their numerous applications and usages. Therefore, the demand and need for compounded drugs for improved patient management will escalate the overall market expansion during the forthcoming years.

Countries in Asia Pacific are facing challenges due to increasing incidences of COVID-19. As per the data of Worldometer, as of March 22, 2021, China reported a total of 90,049 COVID-19 cases, while in Japan it stood at 446,873 India recorded 11,385,339 cases, and Australia reported 29,126 confirmed cases. The widespread occurrence of COVID-19 and the shortage of drugs is fueling the need for compounded medication. Drug shortages can be mainly linked with production delays and supply chain issues and unavailability of raw materials. These trends have been largely observed during the ongoing COVID-19 pandemic. Compounding pharmacies could help play a crucial role in filling the demand-supply gap by producing medicines that are unavailable or experiencing shortage. Further, Drug manufacturers in China may have cut production by almost 40% early this year as the novel coronavirus spread there, according to a U.S.-based group that supplies the basic tools for testing the quality of many medicines. China is the backbone of the world’s drug supply. Any disruption in the country’s output could result in shortages of medications which will open wide opportunities for the compounding pharmacies market thereby impacting positively in the region. However, in India adoption of compounding pharmacies is very low which might hamper the growth during the pandemic.

Strategic insights for the Asia-Pacific Compounding Pharmacies provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

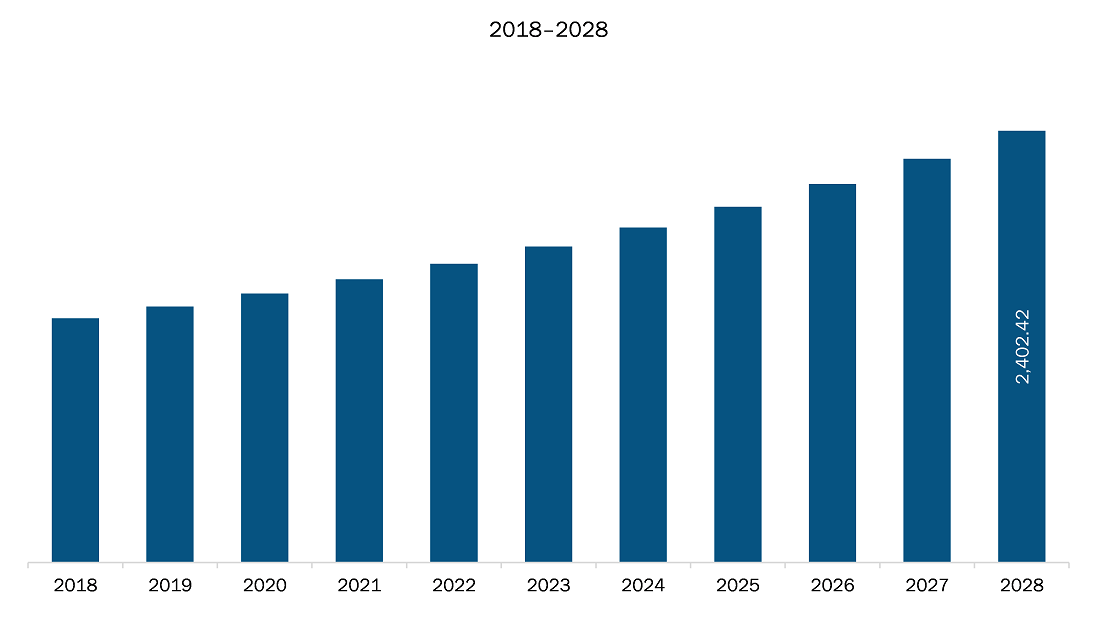

| Market size in 2021 | US$ 1,576.04 Million |

| Market Size by 2028 | US$ 2,402.42 Million |

| Global CAGR (2021 - 2028) | 6.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia-Pacific Compounding Pharmacies refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The compounding pharmacies market in APAC is expected to grow from US$ 1,576.04 million in 2021 to US$ 2,402.42 million by 2028; it is estimated to grow at a CAGR of 6.2% from 2021 to 2028. Rise in outsourcing facilities for manufacturing and sales of products; Based on pharmacy type, the compounding pharmacies market is categorized into 503A and 503B. 503A compounding pharmacies are not governed as strictly as 503Bs from a manufacturing viewpoint as they focus on compounding different topical cream products for pain management and modifying the route of administration of other medications. Due to the COVID-19 pandemic, hospitals are facing a shortage of required medicines to treat patients. Moreover, 503Bs offer affordable and competitive alternatives to the conventional 503A model, enabling 503Bs to become a part of the hospital's drug supply chain. According to the Alliance for Pharmacy Compounding (APC), due to shortage of medicine in the period of COVID-19 pandemic, Compounders' Shortage Drug Source for Hospitals (CSDSH) was founded to assist hospitals to meet a need for COVID-19 treatment medications. Therefore, to fulfil hospital’s needs, in April 2020, APC launched a free resource for connecting hospitals with 503B outsourcing facilities, or 503A sterile compounding pharmacies. Based on above factors, the compounding pharmacies market is likely to grow during the forecast period. This is bolstering the growth of the compounding pharmacies market.

Based on product, the market is segmented into oral medications, topical medications, suppositories, and others. In 2020, the oral medications segment held the largest share APAC compounding pharmacies market. Based on therapeutic area, the market is divided into pain medications, hormone replacement therapies, dermatological applications, and others. In 2020, the pain medications segment held the largest share APAC compounding pharmacies market.

A few major primary and secondary sources referred to for preparing this report on the compounding pharmacies market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are B.Braun Melsungen AG; Belle Santé Diagnostic & Therapeutic Institute Pvt. Ltd; Elixir Compounding Pharmacy; Fagron, Inc; Fresenius Kabi AG.

The Asia-Pacific Compounding Pharmacies Market is valued at US$ 1,576.04 Million in 2021, it is projected to reach US$ 2,402.42 Million by 2028.

As per our report Asia-Pacific Compounding Pharmacies Market, the market size is valued at US$ 1,576.04 Million in 2021, projecting it to reach US$ 2,402.42 Million by 2028. This translates to a CAGR of approximately 6.2% during the forecast period.

The Asia-Pacific Compounding Pharmacies Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Compounding Pharmacies Market report:

The Asia-Pacific Compounding Pharmacies Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Compounding Pharmacies Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Compounding Pharmacies Market value chain can benefit from the information contained in a comprehensive market report.