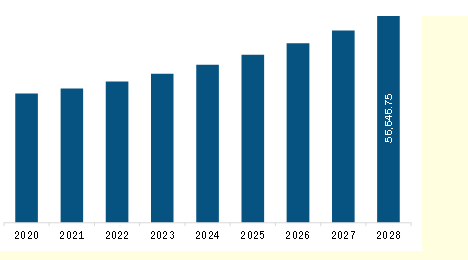

The Asia Pacific composites market is expected to grow from US$ 38,632.54 million in 2022 to US$ 56,646.75 million by 2028. It is estimated to grow at a CAGR of 6.6% from 2022 to 2028.

Applications of Composites in Wind Energy Sector to Provide opportunity for Growth of the Asia Pacific Composites Market

The wind energy sector is one of the fastest-growing sectors across the region and is expected to expand rapidly in the coming years. Wind energy capacity is increasing with the rise in renewable energy infrastructure. Composite is an essential material that is highly adopted for the development of wind energy infrastructure. Rapid developments in material technology have been supporting variations in the structure of wind turbines. Many of these variations were primarily introduced to reduce the prices of turbines. Factors such as mechanical equipment, corrosion resistance, fatigue resistance, breaking toughness, rigidity, weight, and appearance of wind turbines significantly impact their operations. Glass fiber-reinforced plastics (GFRP) are the most used type of composite material in wind turbine manufacturing. Good mechanical properties and corrosion resistance, high-temperature tolerance, simplified manufacturing, and favorable cost are the major benefits conferred by GRPs. Furthermore, the expansion of the wind energy sector in developed and developing economies will boost the demand for composites in the coming years. In 2019, the government of India announced the small wind energy and hybrid systems (SWES) scheme to facilitate the growth of wind power production in the country. The government aims to deploy offshore wind platforms to generate 30 gigawatts (GW) of energy by 2030, sufficient to power 10 million homes with clean energy. Such favorable government initiatives would lead to high demand for composites in the wind energy sector, thereby creating opportunities for the growth of the Asia Pacific composites market during the forecast period.

Asia Pacific Composites Market Overview

Asia Pacific countries such as China and India are amongst the world’s top five countries with installed wind power. Asia Pacific is home to major semiconductor and automobile players across the world, including Samsung Electronics Co., Ltd.; Sony Group Corporation; SK Hynix Inc.; Toyota Motor Corporation; Tata Motors Ltd.; Hyundai Motor Company; Nissan Motor Co., Ltd.; and Honda Motor Co., Ltd. These companies are focused on expansion, research and development, and product innovation.

According to a report published by the China Passenger Car Association, in 2022, Tesla Inc delivered 83,135 made-in-China electric vehicles, indicating growth in sales of electric vehicles from 2021. As per the International Organization of Motor Vehicle Manufacturers report, in 2021, the countries in Asia Pacific produced ~46.73 million units of motor vehicles. Hence, the demand for battery electric vehicles is increasing in Asia Pacific. Thus, growth in end-use industries such as wind power, electronics, and automotive industries are expected to create favorable business opportunities for the composites market during the forecast period.

Asia Pacific Composites Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the Asia Pacific Composites provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Composites refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Composites Strategic Insights

Asia Pacific Composites Report Scope

Report Attribute

Details

Market size in 2022

US$ 38,632.54 Million

Market Size by 2028

US$ 56,646.75 Million

Global CAGR (2022 - 2028)

6.6%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Fiber Type

By Resin Type

By End Use Industry

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Composites Regional Insights

Asia Pacific Composites Market Segmentation

The Asia Pacific composites market is segmented into fiber type, resin type, end use industry, and country.

Based on fiber type, the Asia Pacific composites market is segmented into carbon fiber composites, glass fiber composites, and others. The glass fiber composites segment held the largest share of the Asia Pacific composites market in 2022.

Based on resin type, the Asia Pacific composites market is segmented into thermoset and thermoplastic. The thermoset segment held a larger share of the Asia Pacific composites market in 2022. The thermoset is segmented into polyester, vinyl ester, epoxy, polyurethane, and others. The Thermoplastic is segmented into polypropylene, polyethylene, polyvinylchloride, polystyrene, polyethylene terephthalate, polycarbonate, and others.

Based on end use industry, the Asia Pacific composites market is segmented into automotive, aerospace and defense, wind, construction, marine, sporting goods, and others. The automotive segment held the largest share of the Asia Pacific composites market in 2022.

Based on country, the Asia Pacific composites market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the share of the Asia Pacific composites market in 2022.

DuPont de Nemours Inc; Gurit Holding AG; Hexion Inc; Mitsubishi Chemical Holdings Corp; Nippon Electric Glass Co Ltd; Owens Corning; SGL Carbon SE; Solvay SA; Teijin Ltd; and Toray Industries Inc are the leading companies operating in the Asia Pacific composites market.

The Asia Pacific Composites Market is valued at US$ 38,632.54 Million in 2022, it is projected to reach US$ 56,646.75 Million by 2028.

As per our report Asia Pacific Composites Market, the market size is valued at US$ 38,632.54 Million in 2022, projecting it to reach US$ 56,646.75 Million by 2028. This translates to a CAGR of approximately 6.6% during the forecast period.

The Asia Pacific Composites Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Composites Market report:

The Asia Pacific Composites Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Composites Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Composites Market value chain can benefit from the information contained in a comprehensive market report.