Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market

No. of Pages: 215 | Report Code: TIPRE00025229 | Category: Automotive and Transportation

No. of Pages: 215 | Report Code: TIPRE00025229 | Category: Automotive and Transportation

Asia Pacific comprises economies such as China, India, Vietnam, Japan, South Korea, and Australia. The economy of the region is gaining traction owing to the numerous technological and infrastructural developments. The region has a robust automotive sector supported by the growing automotive manufacturing industry in countries such as China, India, and South Korea. China, Japan, and India are a few of the leading commercial vehicle manufacturing countries worldwide. For instance, as per the OICA report, China was the largest commercial vehicle-producing country in year 2020 in ASIA PACIFIC. The country had produced 5,231,161 commercial vehicles in 2020. In addition, Japan produced 1,107,532 units of commercial vehicles in 2020. In the same year, India also produced 543,178 units of commercial vehicles. Hence, the presence of a strong automotive sector and the increasing number of car manufacturers drive the growth of the commercial vehicle transmission oil pump and transmission system market in Asia Pacific.

Due to the increasing number of COVID-19 confirmed cases in India and other countries across Asia Pacific, the region is greatly affected by the COVID-19 pandemic. The region homes the largest population across the world, which is imposing greater risk to a large number of individuals. Further, China is a world leader in many global brands. According to the Organization for Economic Co-operation and Development (OECD), the pandemic affected major economies of the region, such as China, India, South Korea, and Vietnam, and these countries experienced a decline in industrial growth during the first two quarters of 2020. In 2020, the COVID-19 outbreak functioned as a major drag on the automotive parts and components business, as supply chains were disrupted by trade restrictions and consumption fell because of government-imposed lockdowns across the world. India witnessed a decline in the automobile sector in terms of demand due to subsequent lockdowns to control the spread of the novel coronavirus virus. The disruption in the supply chain and the closing of manufacturing industries hampered the sales of automobiles and their components. However, with the introduction of the COVID-19 vaccine in the region, the impact on the supply chain side of the market is currently minimal due to the resumption of automobile companies’ operations in various countries of Asia Pacific. The region is set to lead the post-pandemic growth in the commercial vehicle transmission oil pump and transmission system market.

Strategic insights for the Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

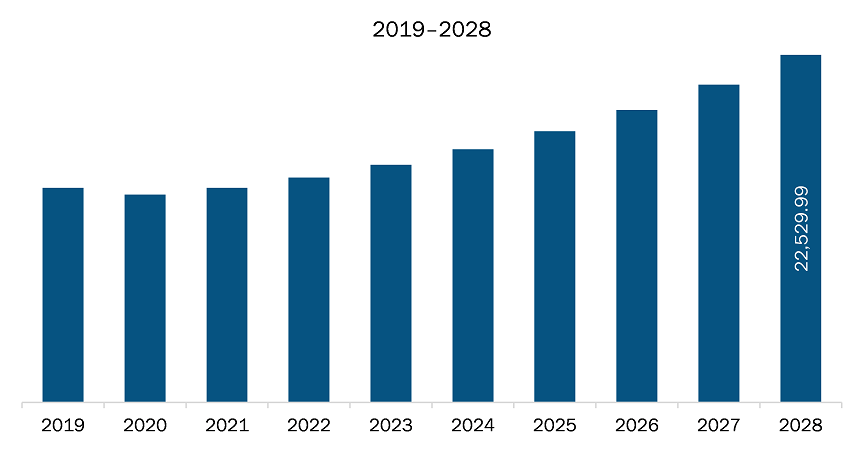

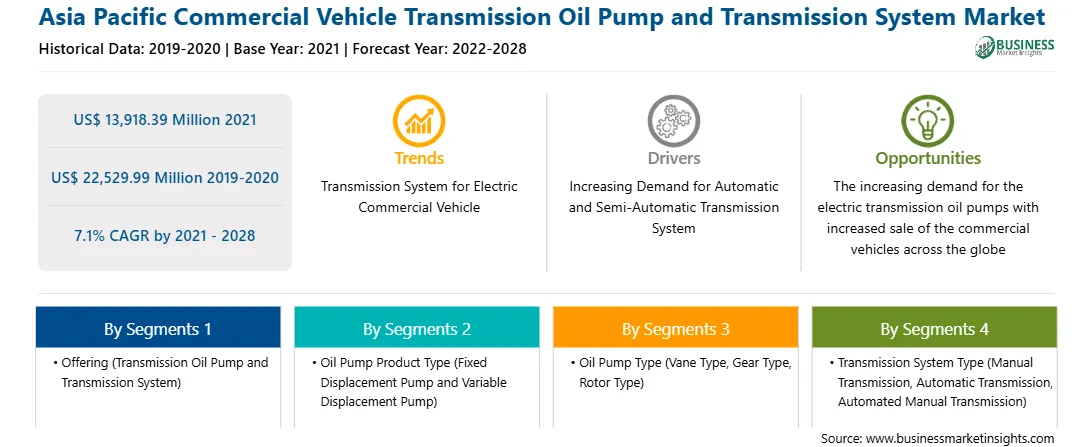

| Market size in 2021 | US$ 13,918.39 Million |

| Market Size by 2028 | US$ 22,529.99 Million |

| Global CAGR (2021 - 2028) | 7.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The commercial vehicle transmission oil pump and transmission system market in Asia Pacific is expected to grow from US$ 13,918.39 million in 2021 to US$ 22,529.99 million by 2028; it is estimated to grow at a CAGR of 7.1% from 2021 to 2028. Transmission system ensures a smooth and comfortable drive by transferring the maximum amount of power from an engine to the wheels via gearbox. The majority of low- and mid-range vehicles now use semi-automatic and automatic transmission systems. The mobility and fuel efficiency of a car can be considerably influenced by an automated transmission system, depending on the electrical technology utilized in the transmission and the design of the transmission system. Automatic gearboxes or dual pedal technology is available in various configurations, such as Automatic Transmission (AT), Automated-Manual Transmission (AMT), Continuously Variable Transmission (CVT), Dual-Clutch Transmission (DCT), Direct Shift Gearbox (DSG), and Tiptronic Transmission. The shift from manual to automatic transmissions is driven by an increased desire for comfort and safety. Automatic gearboxes are comfortable, safe, environment friendly, and cost effective. They also provide a superior driving experience. A driver does not need to handle the clutch with an automatic transmission, which is quite convenient, especially in urban stop-and-go traffic. Autonomous parking assistants, for example, make daily living accessible and are a precursor to utterly automated driving. Furthermore, automotive component makers are working hard to deliver cost-effective alternatives without sacrificing vehicle performance. To address the rising demand for transmission systems across the automotive sector, they adopt various business expansion methods. For instance, Aisin Seiki Co., Ltd. is concentrating its development and manufacturing skills on Toyota Motor Corp.'s manual transmission products under the Aisin AI brand. Thus, the high adoption rate of semi-automatic and automatic transmission systems in commercial vehicles is a significant factor driving the growth of the commercial vehicle transmission oil pump and transmission systems market.

In terms of offering, transmission system segment held a larger market share of the commercial vehicle transmission oil pump and transmission system market in 2020. Based on oil pump product type, fixed displacement pump segment held a larger market share in 2020. Based on oil pump type, gear type segment held a larger market share in 2020. Based on transmission system type, manual transmission segment held a larger market share in 2020. Based on vehicle type, HCV (Class VII to Class VIII) segment held a larger market share in 2020. Similarly Based on powertrain type, internal combustion engine segment held the largest share in the market.

A few major primary and secondary sources referred to for preparing this report on the commercial vehicle transmission oil pump and transmission system market in Asia Pacific are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Allison Transmission Holding INC; Daimler AG; Eaton Group; Mack Trucks; Scania; Sinotruk (Hong Kong) Limited; Shaanxi Fast Auto Drive Co. Ltd.; Volvo AG; Voith GmbH & Co. KGaA; ZF Friedrichshafen AG; Hyundai Transys; Mahle GmbH; Concentric AB; Scherzinger Pumpen GmbH & Co. KG; SHW AG; BorgWarner Inc.; SLPT; Vitesco Technologies; Qijiang Gear Transmission Co., Ltd; Fuxin Del Auto Parts Co., Ltd.; and Zhejiang Wanliyang Co., Ltd among others.

The Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market is valued at US$ 13,918.39 Million in 2021, it is projected to reach US$ 22,529.99 Million by 2028.

As per our report Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market, the market size is valued at US$ 13,918.39 Million in 2021, projecting it to reach US$ 22,529.99 Million by 2028. This translates to a CAGR of approximately 7.1% during the forecast period.

The Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market report:

The Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Commercial Vehicle Transmission Oil Pump and Transmission System Market value chain can benefit from the information contained in a comprehensive market report.