Market Introduction

The Asia Pacific commercial aircraft maintenance tooling market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Owing to a continuous rise in demand, the manufacturers of advanced vibration meters are focused on the development of robust vibration analyzers. MTI Instruments has developed a turbine vibration analyzer/balancing system named PBS-4100R+ that is suitable for jet engines. The system is used by several aircraft manufacturers and MRO facilities operating in the commercial aviation sector. MIT Instruments has developed PBS-4100+ for ground usage. The two analyzers mentioned earlier are compatible with engines from Pratt & Whitney, GE, Honeywell, and Rolls-Royce. Similarly, ACES Systems offers Viper II, a portable vibration analyzer, for the vibration analysis of engines offered by leading commercial aircraft jet engine manufacturers. The ability to deliver quick and accurate data is one of the critical benefits of the Viper II analyzer, which makes it an attractive choice in the commercial aircraft MRO industry. The availability of several commercial aircraft vibration analyzers/meters enables the MRO providers to procure the desired product easily. This factor is helping the commercial aircraft maintenance tooling market to propel over the years. The rising inclination towards the adoption of advanced vibration meters by the MRO service providers and airline operators with in-house MRO facilities is driving the commercial aircraft maintenance tooling market through 2028.

According to the International Air Transport Association’s (IATA) report published in June, Asia Pacific airlines faced the worst challenges. The Q4 of 2020 had been turbulent for the Asia Pacific aviation industry as Southeast Asia recorded exorbitant number of COVID-19 cases that forced lockdowns, hampering travel plans. Due to the massive spread of more contagious strains of the COVID-19, several nations such as Singapore, Thailand, Malaysia, and Vietnam have reimposed strict movement restrictions. This has severely affected the Southeast Asian airlines, and the future of some airlines is uncertain, which is subsequently hampering the adoption of new maintenance tools.

Strategic insights for the Asia Pacific Commercial Aircraft Tooling provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Commercial Aircraft Tooling refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Commercial Aircraft Tooling Strategic Insights

Asia Pacific Commercial Aircraft Tooling Report Scope

Report Attribute

Details

Market size in 2021

US$ 302.34 Million

Market Size by 2028

US$ 459.50 Million

Global CAGR (2021 - 2028)

6.2%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Tool Type

By Users

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Commercial Aircraft Tooling Regional Insights

Market Overview and Dynamics

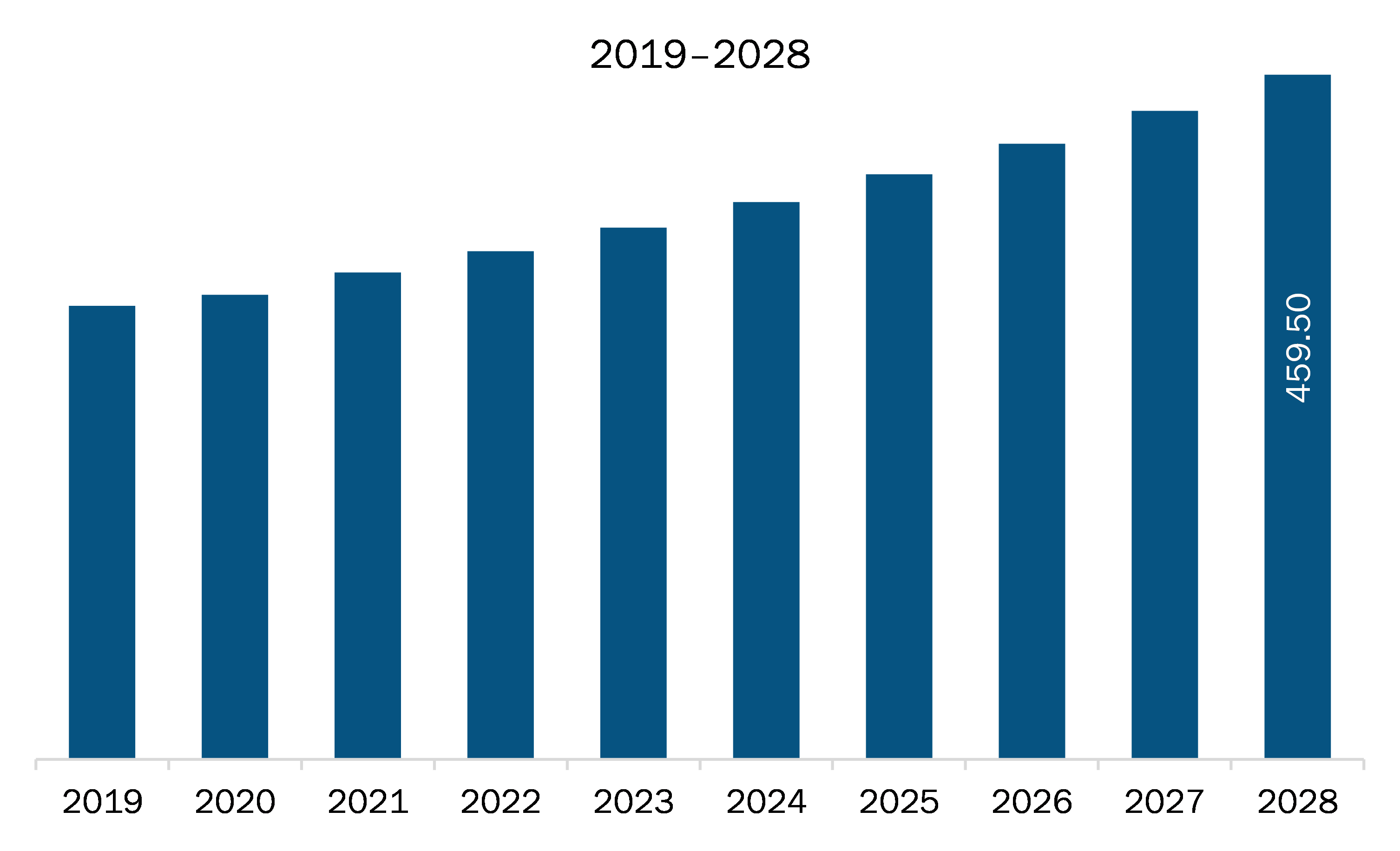

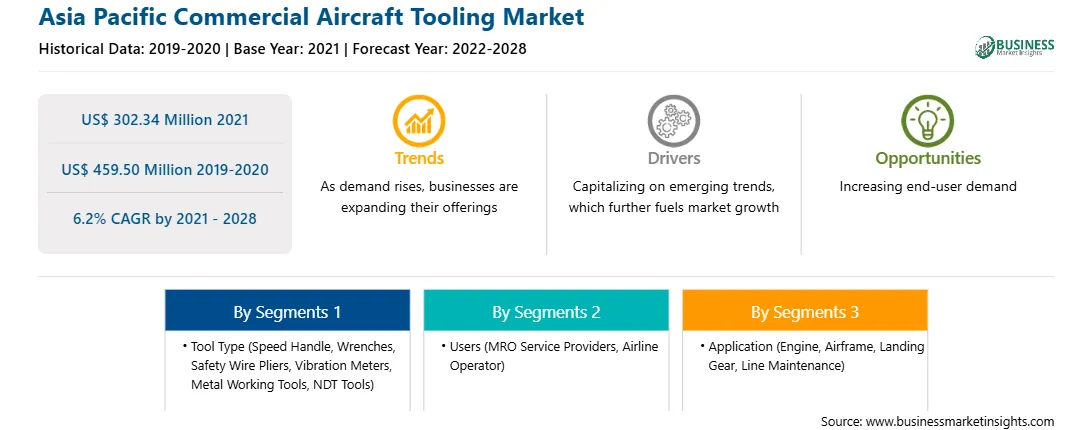

The commercial aircraft maintenance tooling market in Asia Pacific is expected to grow from US$ 302.34 million in 2021 to US$ 459.50 million by 2028; it is estimated to grow at a CAGR of 6.2% from 2021 to 2028. The commercial aviation sector has maintained a strong fleet size over the years, with Airbus and Boeing are the two most notable aircraft manufacturers in terms of delivery statistics. The commercial aviation industry has witnessed tremendous growth in the past few years with the emergence of new low-cost carriers (LCCs) and fleet expansion strategies adopted by the full-service carriers (FSCs). Further, commercial aviation is foreseen to surge in the coming years owing to the mounting number of air travel passengers and aircraft procurement. According to Boeing Commercial Market Outlook (CMO) 2019–2039, the total number of existing aircraft fleet in 2019 accounted for 25,900, and it is expected to reach 48,400 by 2039. Nonetheless, as the aviation industry reopened in the Q3 of 2020, the aircraft manufacturers have begun witnessing a rise in demand for their aircraft models. With the projected rise in aircraft volumes, the demand for various types of maintenance tools, including wrenches, vibration tools, NDT tools, calibration tools, metalworking tools, and speed handles, would also increase in the coming years.

Key Market Segments

Based on tool type, the speed handle segment accounted for the largest share of the Asia Pacific commercial aircraft maintenance tooling market in 2020. Based on users, the MRO service providers segment accounted for the largest share of the Asia Pacific commercial aircraft maintenance tooling market in 2020. Based on application, the airframe segment accounted for the largest share of the Asia Pacific commercial aircraft maintenance tooling market in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the Asia Pacific commercial aircraft maintenance tooling market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include HYDRO SYSTEMS KG; Red Box Aviation.; Stanley Black & Decker, Inc.; Shanghai kaviation Techology Co., Ltd.; STAHLWILLE Eduard Wille GmbH & Co. KG; Field International Group Limited; Henchman Products; Dedienne Aerospace; Tronair Inc. and Snap-On Incorporated.

Reasons to buy report

Asia Pacific Commercial Aircraft Maintenance Tooling Market Segmentation

Asia Pacific Commercial Aircraft Maintenance Tooling Market – By Country

Asia Pacific Commercial Aircraft Maintenance Tooling Market – Company Profiles

The Asia Pacific Commercial Aircraft Tooling Market is valued at US$ 302.34 Million in 2021, it is projected to reach US$ 459.50 Million by 2028.

As per our report Asia Pacific Commercial Aircraft Tooling Market, the market size is valued at US$ 302.34 Million in 2021, projecting it to reach US$ 459.50 Million by 2028. This translates to a CAGR of approximately 6.2% during the forecast period.

The Asia Pacific Commercial Aircraft Tooling Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Commercial Aircraft Tooling Market report:

The Asia Pacific Commercial Aircraft Tooling Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Commercial Aircraft Tooling Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Commercial Aircraft Tooling Market value chain can benefit from the information contained in a comprehensive market report.