Colorectal cancer is a malignant tumor that develops in colonic or rectal tissues. Colorectal cancer is increasingly affecting populations in Asian countries. According to the International Agency for Research on Cancer & GLOBOCAN, ~1 million new colorectal cancer cases were reported in Asia in 2020. Japan, China, Malaysia, Singapore, Korea, and Turkey reported higher prevalence rates compared to other countries in Asia Pacific. Surgery is the most common treatment for all stages of colon cancer. In ideal situations, if the cancer is diagnosed in the early stages, doctors can remove the tumor via surgical procedures. A colonoscopy is an important screening test for colorectal cancer diagnostics, and it has become a part of routine cancer screening. Thus, the rising prevalence of colorectal cancer drives the growth of the Asia Pacific colorectal cancer diagnostics market.

The Asia Pacific colorectal cancer diagnostics market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. Colorectal cancer (CRC) ranked third among China's most diagnosed cancers in 2022, according to a study titled “Colorectal Cancer Screening in China: Status, Challenges, and Prospects." As per GLOBOCAN, an estimated 555,477 newly diagnosed colorectal cancer cases and 286,162 colorectal cancer-related deaths occurred in China in 2020. With the aging population, socioeconomic developments, and lifestyle changes, the burden of colorectal cancer has increased in China in the past few decades, especially in urban and eastern regions. Numerous practices and studies have shown that early detection and treatment of CRC and its precancerous lesions through screening effectively reduces the mortality and incidence of CRC. Due to the large population and limited healthcare resources in China, a two-tier screening strategy has been adopted in most CRC screening programs. It is using a noninvasive or minimally invasive approach to select high-risk individuals and individuals who should undergo colonoscopy (the gold standard for CRC screening). Most guidelines in China recommend colonoscopy, flexible sigmoidoscopy, or faecal occult blood testing (mainly FIT) for people at average risk between the age of 50 and 75. Intestinal capsule endoscopy, computed tomography-colonography (CTC), and multi-target DNA have also been recommended in some guidelines or by consensus. In August 2022, Pillar Biosciences received approval from China's National Medical Products Administration to commercialize its OncoReveal Dx Colon Cancer Assay. This approval was important to oncologists across China, who needed a streamlined, efficient, and accurate way to identify the right therapy for their patients.

Due to rapid socioeconomic development, environmental problems, lifestyle changes, and urbanization, people in China face several obstacles in maintaining and improving their health. The Chinese government has announced the Healthy China 2030 Plan, emphasizing the strategic importance of health for China's growth. The growing investments in the health sector and an increasing prevalence of colon cancer are driving the growth of the Asia Pacific colorectal cancer diagnostics market in China.

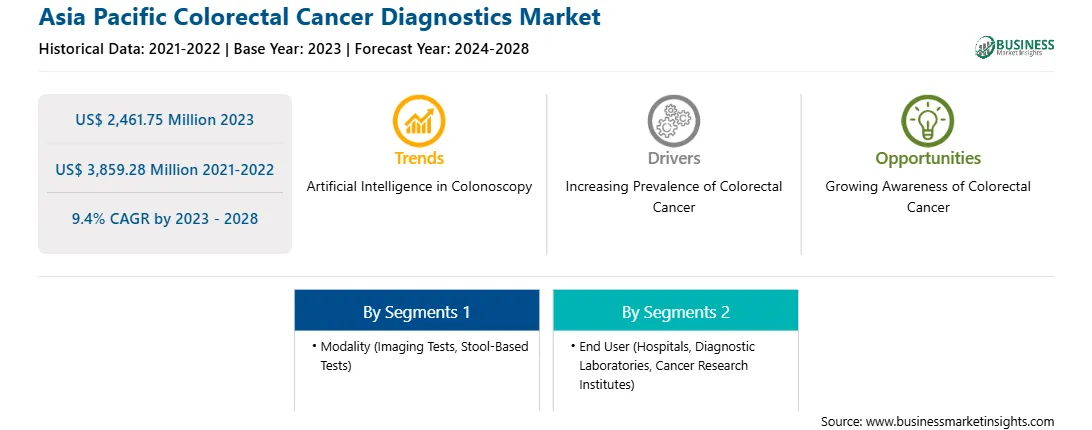

Strategic insights for the Asia Pacific Colorectal Cancer Diagnostics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Colorectal Cancer Diagnostics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Colorectal Cancer Diagnostics Strategic Insights

Asia Pacific Colorectal Cancer Diagnostics Report Scope

Report Attribute

Details

Market size in 2023

US$ 2,461.75 Million

Market Size by 2028

US$ 3,859.28 Million

Global CAGR (2023 - 2028)

9.4%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Modality

By End User

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Colorectal Cancer Diagnostics Regional Insights

Asia Pacific Colorectal Cancer Diagnostics Market Segmentation

The Asia Pacific colorectal cancer diagnostics market is segmented into modality, end user, and country.

Based on modality, the Asia Pacific colorectal cancer diagnostics market is bifurcated into imaging tests and stool-based tests. In 2023, the imaging tests segment held a larger share of the Asia Pacific colorectal cancer diagnostics market. The market for the imaging tests segment is further segmented into colonoscopy, CT colonography, flexible sigmoidoscopy, capsule endoscopy, and others. The market for the stool based tests segment is subsegmented into faecal immunochemical test (fit), guaiac-based faecal occult blood test (gFOBT), and stool DNA test.

Based on end user, the Asia Pacific colorectal cancer diagnostics market is segmented into hospitals, diagnostic laboratories, cancer research institutes, and others. In 2023, the hospitals segment held the largest share of the Asia Pacific colorectal cancer diagnostics market.

Based on country, the Asia Pacific colorectal cancer diagnostics market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. In 2023, China accounted for the largest share of the Asia Pacific colorectal cancer diagnostics market.

Medtronic Plc, Illumina Inc, Epigenomics AG, Clinical Genomics Technologies Pty Ltd, F. Hoffmann-La Roche Ltd, Quest Diagnostics Inc, Siemens Healthineers AG, Bruker Corp, and Eiken Chemical Co., Ltd. are the leading companies operating in the Asia Pacific colorectal cancer diagnostics market.

The Asia Pacific Colorectal Cancer Diagnostics Market is valued at US$ 2,461.75 Million in 2023, it is projected to reach US$ 3,859.28 Million by 2028.

As per our report Asia Pacific Colorectal Cancer Diagnostics Market, the market size is valued at US$ 2,461.75 Million in 2023, projecting it to reach US$ 3,859.28 Million by 2028. This translates to a CAGR of approximately 9.4% during the forecast period.

The Asia Pacific Colorectal Cancer Diagnostics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Colorectal Cancer Diagnostics Market report:

The Asia Pacific Colorectal Cancer Diagnostics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Colorectal Cancer Diagnostics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Colorectal Cancer Diagnostics Market value chain can benefit from the information contained in a comprehensive market report.