The rapid development of 3D printing implies fast penetration 3D printing techniques into the healthcare system, especially for treating fractures. In rehabilitation tool manufacturing, 3D printing technology is applied to orthopedic cast fabrication to create patient-specific features with an appropriate fit and a ventilated structure. The novel casting technology heals the fracture effectively without casting complications. The 3D-printed cast is customized and lightweight.

Patient-specific and 3D-printed casts develop proper fit according to the shape of the injured arm. Thus, the risk of stress concentration can be reduced since large contact areas are created. 3D printing makes the fabrication process simpler and in shorter period, especially in a customized design. On that account, the application of 3D printing in biomedical engineering is growing and promising to be practiced in the future. Also, the customizable hand cast made by using 3D printing technique is reliable and provides comfort and satisfaction to the patients. 3D printing is an evolving technology that has a potential application in treating pediatric forearm fractures. These factors can lead to better patient compliance. The 3D-printed cast proved to be superior in terms of satisfaction, comfort, and perceived function as compared to the fiberglass. Thus, the above-mentioned factors would create significant opportunities for the Asia Pacific clinic casting and splinting products market in the coming years.

The Asia Pacific clinic casting and splinting products market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. Rising cases of fractures due to accidents in countries such as India, China, Indonesia, and Australia, increase in geriatric population who are susceptible to fractures and sprains, and increase in prevalence of musculoskeletal disorders. Distal radius fracture (DRF) is one of the most common fall-related fractures of the upper extremities. According to Bioscientifica Ltd, in China, the age-adjusted overall incidence of DRF varies between 100 and 300 per 100,000 person-years. As osteoporosis occurrence is high in the geriatric population, the incidence of DRF also increases in this population. According to the 2020 census, people aged above 65 years accounted for 13.5% of the total population of China. As per World Bank Group data, in 2022, ~14% of the total population of China is aged above 65 years. A rise in the geriatric population in China increases the incidence of DRF in this population. Splinters and casts are used to immobilize the distal radius for treatment. Hence, an increase in cases of DRF in China is fueling the growth of the Asia Pacific clinic casting and splinting products market in China.

Strategic insights for the Asia Pacific Clinic Casting and Splinting Products provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Clinic Casting and Splinting Products refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Clinic Casting and Splinting Products Strategic Insights

Asia Pacific Clinic Casting and Splinting Products Report Scope

Report Attribute

Details

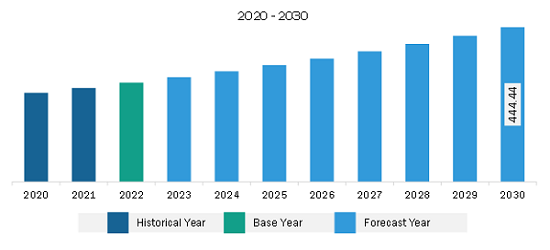

Market size in 2022

US$ 284.43 Million

Market Size by 2030

US$ 444.44 Million

Global CAGR (2022 - 2030)

5.7%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Product

By Application

By Material

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Clinic Casting and Splinting Products Regional Insights

Asia Pacific Clinic Casting and Splinting Products Market Segmentation

The Asia Pacific clinic casting and splinting products market is segmented into product, application, material, and country.

Based on product, the Asia Pacific clinic casting and splinting products market is segmented into casting and splinting. The casting segment held a larger share of the Asia Pacific clinic casting and splinting products market in 2022. The casting is sub-segmented into casts, tapes, cutters, and casting accessories. The splinting segment is further segmented into splints and splinting accessories.

Based on application, the Asia Pacific clinic casting and splinting products market is segmented into acute fractures or sprains, tendon and ligament injuries, and others. The acute fractures segment held the largest share of the Asia Pacific clinic casting and splinting products market in 2022.

Based on material, the Asia Pacific clinic casting and splinting products market is segmented into Plaster of Paris, fiberglass, and others. The Plaster of Paris segment held the largest share of the Asia Pacific clinic casting and splinting products market in 2022.

Based on country, the Asia Pacific clinic casting and splinting products market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific clinic casting and splinting products market in 2022.

3M Co, DeRoyal Industries Inc, Enovis Corp, Essity AB, Ossur hf, Performance Health Holding Inc, Prime Medical Inc, and Zimmer Biomet Holdings Inc are some of the leading companies operating in the Asia Pacific clinic casting and splinting products market.

The Asia Pacific Clinic Casting and Splinting Products Market is valued at US$ 284.43 Million in 2022, it is projected to reach US$ 444.44 Million by 2030.

As per our report Asia Pacific Clinic Casting and Splinting Products Market, the market size is valued at US$ 284.43 Million in 2022, projecting it to reach US$ 444.44 Million by 2030. This translates to a CAGR of approximately 5.7% during the forecast period.

The Asia Pacific Clinic Casting and Splinting Products Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Clinic Casting and Splinting Products Market report:

The Asia Pacific Clinic Casting and Splinting Products Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Clinic Casting and Splinting Products Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Clinic Casting and Splinting Products Market value chain can benefit from the information contained in a comprehensive market report.