Presence of emerging economies and rise in adoption of advanced as well as sophisticated technologies are contributing to the overall growth of APAC. China, Japan, Australia, India, and South Korea are major contributors to the development of the market in this region. To implement technologically advanced class D audio amplifier solutions across different industries, including electronics in the country, rapid technological developments, digitalization of economies, and adequate government supports for setting manufacturing industries are contributing to the smooth evolution of these economies from the developing stage to the developed stage. To attract more foreign investments in the manufacturing sector, the government of India has introduced “Make in India” initiatives. As a part of this initiative, it is encouraging international companies to bring their manufacture operations to India by incentivizing dedicated investments into manufacturing. Similarly, the government of China has launched “Made in China 2025,” a national strategic plan to develop its manufacturing sector, which is likely to propel the growth of class D audio amplifier market growth in the region. Furthermore, the growth of manufacturing operations, healthcare infrastructure, and technological advancements are propelling the global class D audio amplifier market in APAC countries. Asia Pacific is expected to register the highest CAGR in the market during the forecast period.

In case of COVID-19, India got the highest no. of cases in APAC region. Rapidly growing urbanization and industrialization in these countries is presenting ample growth opportunities to the class D audio amplifier market players. However, the COVID-19 outbreak has brought the entire manufacturing sector to a halt by causing major supply chain disruptions. The trade war between the US and China has had a negative effect on trade of raw materials as well as on the demand for class D audio amplifiers. The COVID-19 pandemic has taken a toll on the consumer electronics industry. Hypermarkets, supermarkets, and showrooms of major brands have been shuttered around the world, impacting consumer electronics sales. Nonetheless, many businesses in APAC have adopted remote working to continue their operations amid lockdown scenarios. The practice of working from home (WFH) has triggered the demand for computers, laptops, and peripherals. Sales of headphones and Bluetooth earphones have increased, as these devices are necessary to attend webinars and online meetings more effectively. The need for distant connectivity has resulted in a multifold growth in sales of networking devices and connection hardware solutions. The supply chain for consumer electronics is largely based in China, as prominent consumer electronics device OEMs, as well as component OEMs, have production facilities in the country. However, the shutdown of manufacturing facilities in China in the first half of 2020 significantly affected the consumer electronics ecosystem. However, the impact on the supply side of the market is currently minimal due to the resumption of manufacturing in China. With the shift in consumer spending on non-essential items, sales of products such as television sets, air conditioners, and refrigerators have decreased significantly.

Strategic insights for the Asia Pacific Class D Audio Amplifier provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

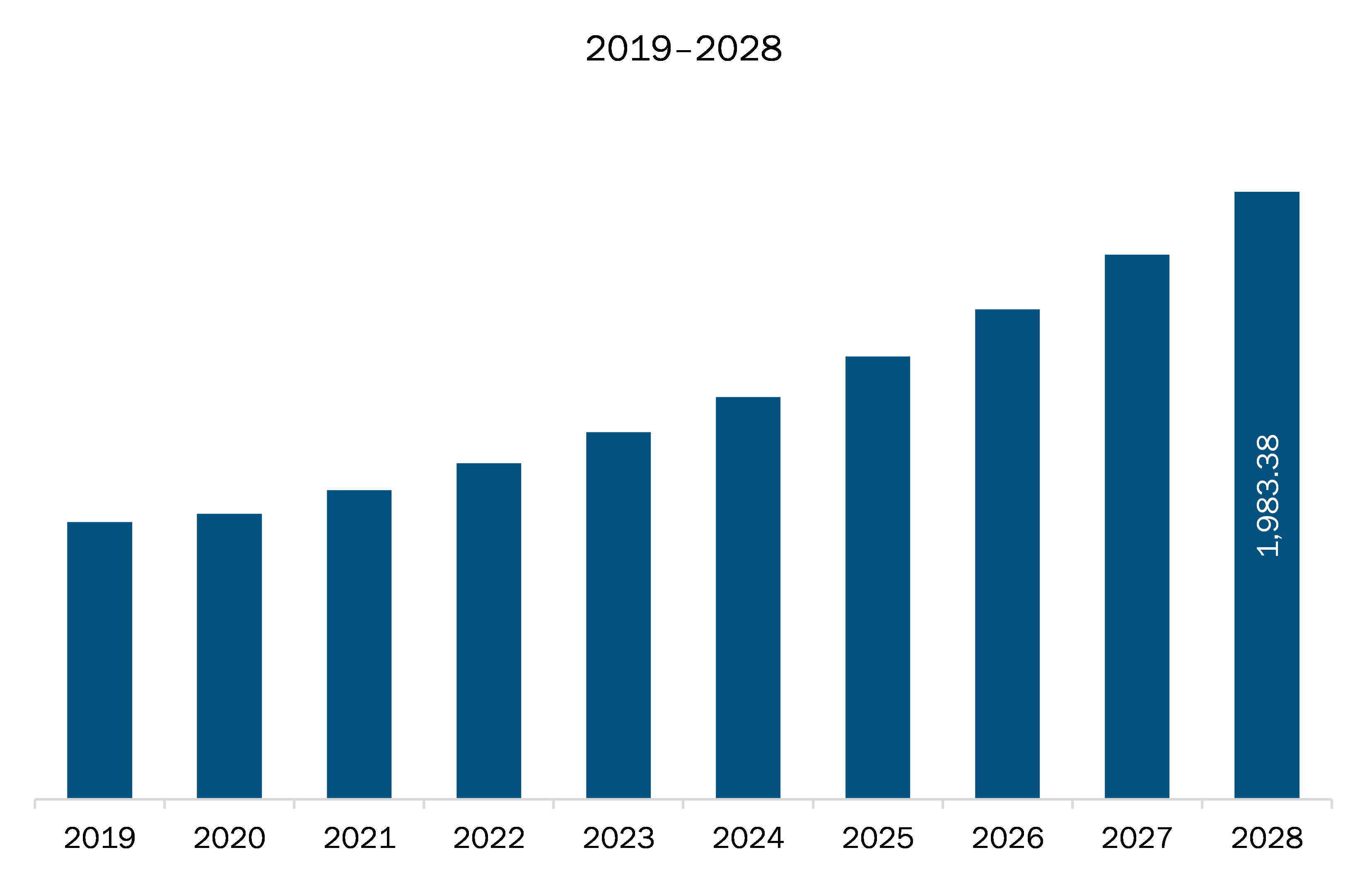

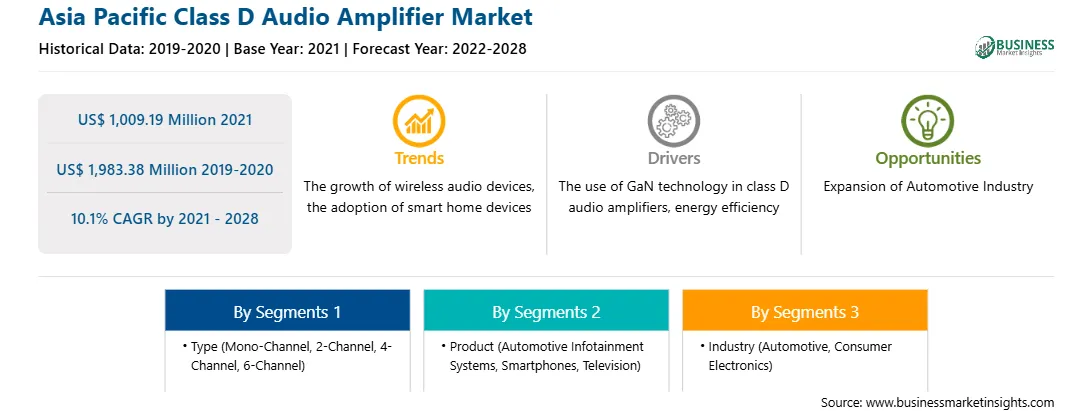

| Market size in 2021 | US$ 1,009.19 Million |

| Market Size by 2028 | US$ 1,983.38 Million |

| Global CAGR (2021 - 2028) | 10.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Class D Audio Amplifier refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC class D audio amplifier market is expected to grow from US$ 1,009.19 million in 2021 to US$ 1,983.38 million by 2028; it is estimated to grow at a CAGR of 10.1% from 2021 to 2028. Developing countries across APAC region are characterized by positive economic outlook, increasing middle class population, and rising disposable incomes. These factors are driving the sales of passenger cars in these countries. Developing economies have been witnessing steady growth in the post-recession era, which has reflected in rise in disposable income. In the countries such as China and Japan, where consumers have high disposable incomes at their disposal, high value and volume of car sales is driven by the preference for advanced features and technologies integrated in the vehicles. Luxury cars and autonomous cars, enhanced with high-end infotainment systems and technologies, are driving car sales in the region. Hence, car manufacturers are focusing on the integration of sophisticated in-vehicle infotainment systems to provide differentiated services to their customers. Despite a downturn in automotive sales in 2020 due to the COVID-19 pandemic, the overall growth outlook is estimated to be positive during the forecast period, i.e., during 2021–2028. Further, irrespective of variations in the percentage of car ownership across developing markets, the number of passenger cars per household saw a steady increase in the past decade. Further, sales of these cars are expected to increase in coming years due to growing adoption of private vehicles to avoid social contact in public transports to avoid exposure to SARS-CoV-2. Thus, surge in the adoption of in-vehicle infotainment systems in cars is bolstering the demand for class D audio amplifiers across APAC region.

In terms of type, the mono-channel segment accounted for the largest share of the APAC class D audio amplifier market in 2020. In terms of product, the others segment held a larger market share of the APAC class D audio amplifier market in 2020. Further, the consumer electronics segment held a larger share of the APAC class D audio amplifier market based on industry in 2020.

A few major primary and secondary sources referred to for preparing this report on the APAC class D audio amplifier market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Analog Devices, Inc; ICEpower a/s; INFINEON TECHNOLOGIES AG; Maxim Integrated; NXP Semiconductors N.V.; ON Semiconductor Corporation; Qualcomm Technologies, Inc.; Silicon Laboratories, Inc.; STMicroelectronics N.V.; and Texas Instruments Incorporated.

The Asia Pacific Class D Audio Amplifier Market is valued at US$ 1,009.19 Million in 2021, it is projected to reach US$ 1,983.38 Million by 2028.

As per our report Asia Pacific Class D Audio Amplifier Market, the market size is valued at US$ 1,009.19 Million in 2021, projecting it to reach US$ 1,983.38 Million by 2028. This translates to a CAGR of approximately 10.1% during the forecast period.

The Asia Pacific Class D Audio Amplifier Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Class D Audio Amplifier Market report:

The Asia Pacific Class D Audio Amplifier Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Class D Audio Amplifier Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Class D Audio Amplifier Market value chain can benefit from the information contained in a comprehensive market report.