The development of greener chlorine production methods is a significant step toward addressing environmental concerns and promoting sustainability in the chemical industry. Traditionally, chlorine has been produced through the chlor-alkali process, which involves the electrolysis of brine (sodium chloride solution). While effective, this process involves mercury and uses vast amounts of electrical energy, which could leave a considerable amount of carbon footprint. Researchers and industry players have been actively working on greener chlorine production in response to these challenging methods. Membrane cell and solid oxide technologies show promise in reducing energy consumption and greenhouse gas emissions during chlorine production. These technologies improve the overall efficiency of the electrolysis process, leading to lower energy requirements and reduced environmental impact.

Moreover, advancements in catalysts are contributing to greener chlorine production. Efficient catalysts can enhance the selectivity and performance of the electrolysis process, leading to higher yields of chlorine with reduced energy consumption. Researchers are continuously working to identify and optimize catalyst materials to make chlorine production sustainable. Manufacturers of chlorine, such as Covestro AG and Nobiuse, use sustainable manufacturing practices to produce chlorine. Covestro AG uses oxygen depolarized cathode to manufacture chlorine, which requires up to 25% less electricity than conventional processes. Using electricity generated from renewable sources such as solar, wind, or hydropower can significantly reduce the carbon footprint associated with chlorine production. Renewable energy-driven electrolysis minimizes greenhouse gas emissions and reduces dependence on fossil fuels, making the entire chlorine production process environmentally friendly. Thus, the development of greener chlorine production methods is driven by the commitment to environmental sustainability and the desire to reduce the environmental footprint of chemical processes. These efforts aim to improve chlorine production's environmental profile and contribute to the broader goal of transitioning toward a sustainable and circular economy. As these greener methods continue to advance and gain traction, they have the potential to reshape the chlorine industry and foster a sustainable future for chemical production. All these factors will drive the Asia Pacific chlorine market growth during the forecast period.

Australia, China, India, Japan, and South Korea are the key contributors to the Chlorine Market in Asia Pacific. With an increasing population and a shift of people from rural to urban areas, there is a rising need for construction materials, particularly PVC and its derivatives. Chlorine is a fundamental raw material in PVC production used to manufacture pipes, fittings, cables, and other building products. Growth of the construction industry to accommodate the urban population’s demands is expected to intensify the demand for chlorine-based materials, thereby contributing to the market expansion. The robust manufacturing sector in Asia Pacific also drives the demand for chlorine. The region has become a global manufacturing hub, with industries spanning chemicals, textiles, plastics, and electronics. According to a report published by BASF SE, chemical production in Asia Pacific expanded by 4.2% in 2021. Chlorine is a crucial element in various industrial processes, such as the production of chemicals, solvents, and intermediates for pharmaceuticals. The rising manufacturing activities across the region to meet domestic and international demands are anticipated to fuel the demand for chlorine, an essential raw material.

Strategic insights for the Asia Pacific Chlorine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Chlorine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Chlorine Strategic Insights

Asia Pacific Chlorine Report Scope

Report Attribute

Details

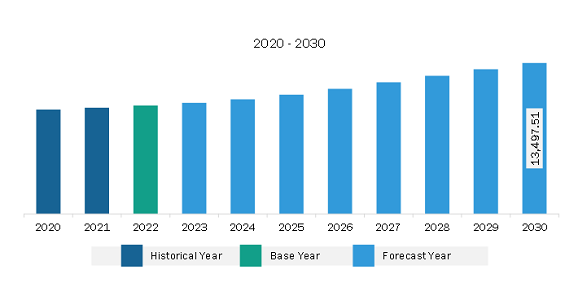

Market size in 2023

US$ 9,937.69 Million

Market Size by 2030

US$ 13,497.51 Million

Global CAGR (2023 - 2030)

4.5%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Application

By End-Use Industry

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Chlorine Regional Insights

Asia Pacific Chlorine Market Segmentation

The Asia Pacific chlorine market is segmented into application, end-use industry, and country.

Based on application, the Asia Pacific chlorine market is segmented into ethylene dichloride/polyvinylchloride production, chloromethanes, isocyanates and oxygenates, solvents, and others. The ethylene dichloride/polyvinylchloride production segment held the largest share of the Asia Pacific chlorine market in 2023.

Based on end-use industry, the Asia Pacific chlorine market is segmented into water treatment, chemicals, pulp and paper, plastics, pharmaceuticals, and others. The plastics segment held the largest share of the Asia Pacific chlorine market in 2023.

Based on country, the Asia Pacific chlorine market has been categorized into the Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific chlorine market in 2023.

Aditya Birla Chemicals India Ltd, BASF SE, Ercros SA, Hanwha Solutions Corp, INEOS Group Holdings SA, Occidental Petroleum Corp, Olin Corp, Tata Chemicals Ltd, and Sumitomo Chemical Co Ltd are the leading companies operating in the Asia Pacific chlorine market.

The Asia Pacific Chlorine Market is valued at US$ 9,937.69 Million in 2023, it is projected to reach US$ 13,497.51 Million by 2030.

As per our report Asia Pacific Chlorine Market, the market size is valued at US$ 9,937.69 Million in 2023, projecting it to reach US$ 13,497.51 Million by 2030. This translates to a CAGR of approximately 4.5% during the forecast period.

The Asia Pacific Chlorine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Chlorine Market report:

The Asia Pacific Chlorine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Chlorine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Chlorine Market value chain can benefit from the information contained in a comprehensive market report.