Cell therapy bioprocessing is a subfield of bioprocess engineering that bridges cell therapy and bioprocessing (i.e., biopharmaceutical manufacturing). Cell therapy is one of the fastest-growing areas of the life sciences. It entails delivering entire living cells to a patient to treat disease.

Thus, the growing approvals for cell therapies is expected to create a significant demand for cell therapy bioprocessing in the coming years, which is further anticipated to drive the cell therapy bioprocessing market.

COVID-19 has created an extraordinary emergency that is particularly affecting the supply chain. The supply chain disruptions, along with the enormous demand for effective therapies for the treatment of COVID 19 has put healthcare research industry in critical situation in Asia Pacific region. However, many of the market players now realized the importance of cell therapy in treatment of COVID 19 which is expected to raise demand for cell therapy bioprocessing during forecast period. China's short-term responses was similar to those of the United States and Europe. Most transactions remain largely unaffected, awareness of the need for better supply chain control. There have been no major supply changes, such as switching to domestic Chinese bioprocessing providers rather than Western bioprocessing providers. Indeed, significant public investments in pandemic-related vaccines and therapeutics are anticipated. The hope has also grown that trade imbalances between the United States and China will be easily bridged in favor of domestic health policy. The government is also attempting to implement anticipated economic reforms in order to make them more market driven. The pandemic is likely to be a catalyst in the spread of such trends.

Strategic insights for the Asia Pacific Cell Therapy Bioprocessing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

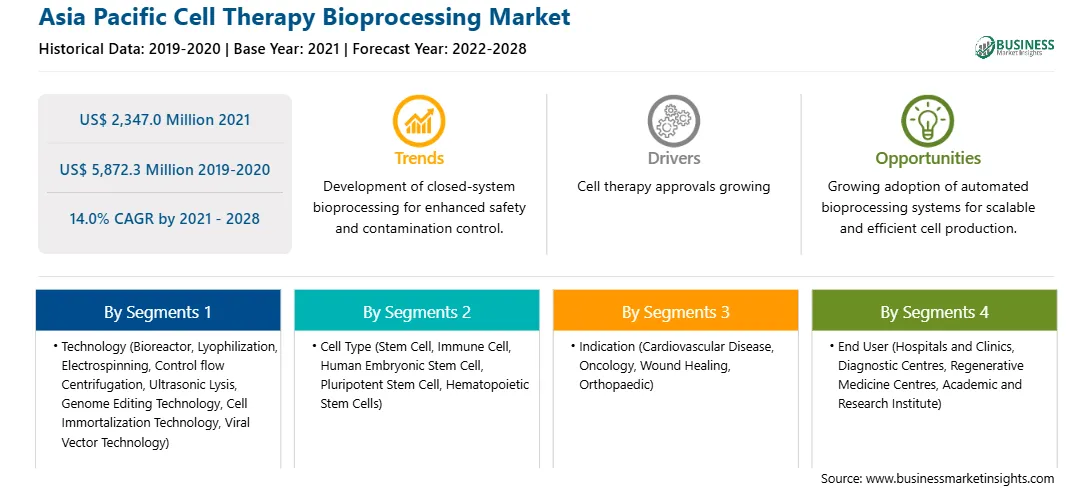

| Market size in 2021 | US$ 2,347.0 Million |

| Market Size by 2028 | US$ 5,872.3 Million |

| Global CAGR (2021 - 2028) | 14.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Cell Therapy Bioprocessing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Cell therapy bioprocessing market in Asia Pacific is expected to grow from US$ 2,347.0 million in 2021 to US$ 5,872.3 million by 2028; it is estimated to grow at a CAGR of 14.0% from 2021 to 2028. Cell therapies have shown positive results in treating various chronic diseases including rare genetic disorders by offering regenerative medicines and personalized medicines. Increasing need of treating chronic diseases have pushed the research and development activities resulting in growing cell therapy production and product approvals. Few instances are listed below for the cell therapies approvals that have contributed to the growth of the cell therapy bioprocessing market. In May 2019, the Food and Drug Administration (FDA) approved Zolgensma, manufactured by AveXis, Inc. A subsidiary of Novartis AG. Zolgensa is designed to treat spinal muscular atrophy in children below two years and is given by infusing one-time into the vein. Thus, growing product developments have resulted in various product approvals that reflects the increase in cell therapies. Therefore, it is expected that the growing approvals for cell therapies are enormously increasing the cell therapy bioprocessing, which, in turn is likely to drive the market’s growth over the coming years.

In terms of technology, the bioreactors segment accounted for the largest share of the Asia Pacific cell therapy bioprocessing market in 2020. In terms of cell type, the stem cell segment accounted for the largest share of the Asia Pacific cell therapy bioprocessing market in 2020. In terms of indication, the oncology segment accounted for the largest share of the Asia Pacific cell therapy bioprocessing market in 2020. In terms of end user, the academic and research institute segment held a larger market share of the cell therapy bioprocessing market in 2020.

A few major primary and secondary sources referred to for preparing this report on the Cell therapy bioprocessing market in Asia Pacific are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Fresenius Kabi Ag., Asahi Kasei Corporation, Sartorius Ag, Merck Kgaa, Thermo Fisher Scientific Inc., Corning Incorporated, Cytiva (Ge Healthcare), Lonza, Repligen, and Catalent Inc.

By Technology

By Cell Type

By Indication

By End User

By Country

The Asia Pacific Cell Therapy Bioprocessing Market is valued at US$ 2,347.0 Million in 2021, it is projected to reach US$ 5,872.3 Million by 2028.

As per our report Asia Pacific Cell Therapy Bioprocessing Market, the market size is valued at US$ 2,347.0 Million in 2021, projecting it to reach US$ 5,872.3 Million by 2028. This translates to a CAGR of approximately 14.0% during the forecast period.

The Asia Pacific Cell Therapy Bioprocessing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Cell Therapy Bioprocessing Market report:

The Asia Pacific Cell Therapy Bioprocessing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Cell Therapy Bioprocessing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Cell Therapy Bioprocessing Market value chain can benefit from the information contained in a comprehensive market report.