Incorporating automation in cell and gene therapy manufacturing would lead to a reduced risk of contamination, improved consistency, and decreased cost of production. Lonza Cocoon and the CliniMACS Prodigy system from Miltenyi are a few of the devices available in the market to enable automation. These products have been designed to enable the automation of most sequential unit operations for a CAR-T process within a single system. The rising demand for cell and gene therapies has shifted the production of cell and gene therapy products from a small-volume process to a large-volume process worldwide. In addition to the increasing research activities, the evolution of cell and gene therapy from an academic and clinical setting to mass production and commercialization has propelled the demand for automation in commercial manufacturing. In July 2020, Thermo Fisher Scientific Inc. and Lyell Immunopharma partnered to develop and manufacture processes to design effective cell therapies for cancer patients. Under this partnership, the companies aim to improve the capability of T-cells and support the development of an integrated current good manufacturing practice (cGMP) compliant platform (system and software), along with reagents, consumables, and instruments. Thus, automation is emerging as a new trend in the Asia Pacific cell and gene therapy manufacturing services market.

Asia Pacific region comprises of China, Japan, India, Australia, South Korea, and Rest of Asia Pacific countries. The Asia Pacific region is one of the leading regions in the field of cell and gene therapy, with several countries which are involved in the investing in research and development of these therapies. Japan is one of the leaders in the Asia Pacific region when it comes to cell and gene therapies. In 2014, Japan was the first country to approve a cell therapy product, a treatment for macular degeneration. Several other cell and gene therapies have been approved in the country since then, including the CAR-T for leukemia and lymphoma.

China is the first country to approve a gene therapy in 2003, since then cell and gene therapy development has advanced rapidly worldwide, and their therapeutic potential has soared. China's government has conducted several regulatory reforms to promote normative development of cell and gene therapies. According to a study published in Nature in 2021, China is home to more than 50% of all cell therapy trials across the world. Currently, China has nearly 400 ongoing CAR-T trials centered on hematology and oncology and solid tumors. Cell therapy in China is entering a new era with the approval of Fosun Kite's Yescarta and JW Therapeutics' Relma-cel in 2021 from the National Medical Products Administration (NMPA). Due to lower costs and larger patient populations, several multinational companies have moved to the region to take advantage of these factors.

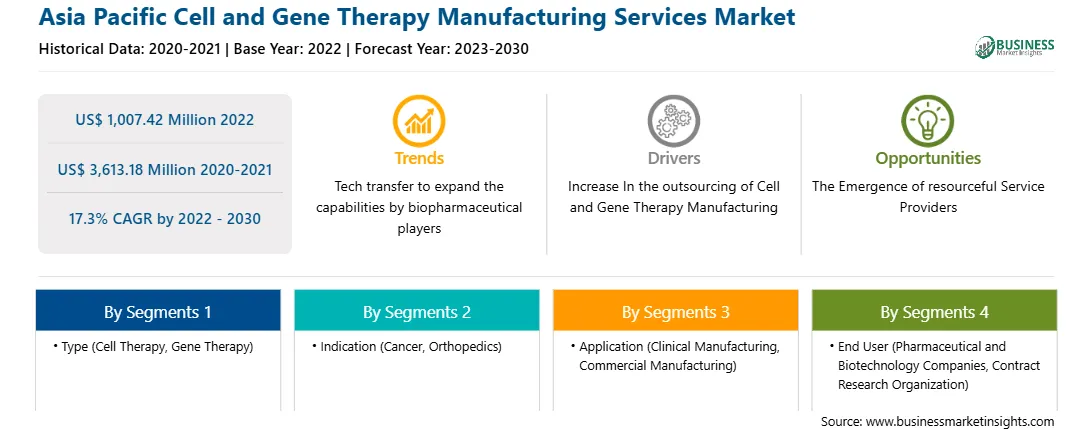

The Asia Pacific cell and gene therapy manufacturing services market is segmented into type, indication, application, end user, and country.

Based on type, the Asia Pacific cell and gene therapy manufacturing services market is bifurcated into cell therapy and gene therapy. In 2022, the cell therapy segment registered a larger share in the Asia Pacific cell and gene therapy manufacturing services market. The cell therapy segment is further segmented into autologous and allogenic. The gene therapy segment is further segmented into viral and non-viral vector.

Based on indication, the Asia Pacific cell and gene therapy manufacturing services market is segmented into cancer, orthopedics, and others. In 2022, the cancer segment registered the largest share in the Asia Pacific cell and gene therapy manufacturing services market.

Based on application, the Asia Pacific cell and gene therapy manufacturing services market is segmented into clinical manufacturing and commercial manufacturing. In 2022, the commercial manufacturing segment registered the largest share in the Asia Pacific cell and gene therapy manufacturing services market.

Based on end user, the Asia Pacific cell and gene therapy manufacturing services market is bifurcated into pharmaceutical and biotechnology companies and contract research organization (CROs). In 2022, the pharmaceutical and biotechnology companies segment registered a larger share in the Asia Pacific cell and gene therapy manufacturing services market.

Based on country, the Asia Pacific cell and gene therapy manufacturing services market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. In 2022, China registered the largest share in the Asia Pacific cell and gene therapy manufacturing services market.

Catalent Inc, Charles River Laboratories International Inc, FUJIFILM Holdings Corp, Lonza Group AG, Merck KgaA, Nikon Corp, Takara Bio Inc, Thermo Fisher Scientific Inc, and WuXi AppTec Co Ltd are some of the leading companies operating in the Asia Pacific cell and gene therapy manufacturing services market.

Strategic insights for the Asia Pacific Cell and Gene Therapy Manufacturing Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,007.42 Million |

| Market Size by 2030 | US$ 3,613.18 Million |

| Global CAGR (2022 - 2030) | 17.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Cell and Gene Therapy Manufacturing Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Catalent Inc

2. Charles River Laboratories International Inc

3. FUJIFILM Holdings Corp

4. Lonza Group AG

5. Merck KgaA

6. Nikon Corp

7. Takara Bio Inc

8. Thermo Fisher Scientific Inc

9. WuXi AppTec Co Ltd

The Asia Pacific Cell and Gene Therapy Manufacturing Services Market is valued at US$ 1,007.42 Million in 2022, it is projected to reach US$ 3,613.18 Million by 2030.

As per our report Asia Pacific Cell and Gene Therapy Manufacturing Services Market, the market size is valued at US$ 1,007.42 Million in 2022, projecting it to reach US$ 3,613.18 Million by 2030. This translates to a CAGR of approximately 17.3% during the forecast period.

The Asia Pacific Cell and Gene Therapy Manufacturing Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Cell and Gene Therapy Manufacturing Services Market report:

The Asia Pacific Cell and Gene Therapy Manufacturing Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Cell and Gene Therapy Manufacturing Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Cell and Gene Therapy Manufacturing Services Market value chain can benefit from the information contained in a comprehensive market report.