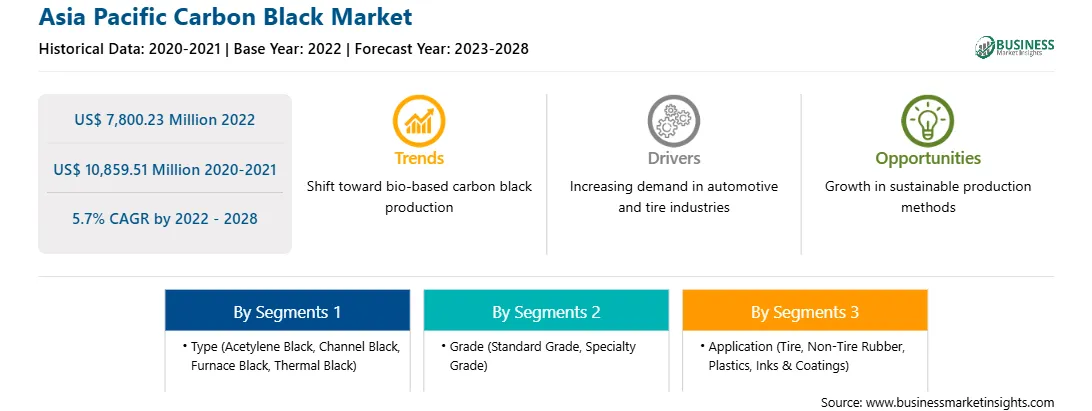

The Asia Pacific carbon black market is expected to grow from US$ 7,800.23 million in 2022 to US$ 10,859.51 million by 2028. It is estimated to grow at a CAGR of 5.7% from 2022 to 2028.

Rising Need for Green Alternatives with Shift Toward Sustainability is Driving Asia Pacific Carbon Black Market

The green economy can promote economic development and improve people's lives while promoting environmental and social well-being. An important part of the green economy is promoting sustainable technological developments and adoption. Recovered/green carbon black is emerging as an alternative to virgin carbon black produced from the combustion of crude oil. The carbon black recovered from recycled tires contributes to a significant decrease in CO2 emissions and emphasizes reusing products to minimize waste generation.

Companies are heading toward adopting an eco-friendly and sustainable production approach by investing in better R&D activities to optimize resource consumption. Enviro has developed a proprietary tire pyrolysis technology that can recover carbon black, oil, steel, and gas from end-of-life tires. Further, in November 2019, as a part of its long-term partnership with DeltaEnergy Group, LLC, Bridgestone Americas Inc. (Bridgestone) announced that it would be using recycled carbon black tires on a large scale in the tire market for the first time. The large-scale commercialization of the patented recovered carbon black product DE Black, recycled by DeltaEnergy Group from end-of-life tires, marks an important milestone in the journey of Bridgestone Group toward its long-term environmental vision of 100% material sustainability and 50% CO2 emission reduction by 2050. Compared to virgin carbon black, DeltaEnergy Group's materials extraction process produces 81% less CO2 per ton. Therefore, a shift toward sustainability and a rise in the need for green alternatives are expected to offer lucrative opportunities for the carbon black market players over the coming years.

Asia Pacific Carbon Black Market Overview

High disposable income of people in Asia Pacific is surging the demand for commercial and passenger vehicles, bolstering the need for automotive tires. Additionally, increasing investments by leading automotive OEMs and rising EV manufacturing capabilities in Asia Pacific are propelling the demand for conventional and electric vehicles in the region. The growth of the tire industry in Asia Pacific is attributed to the growing automotive industry in the region. China has been the largest global producer and consumer of tires since 2005. According to data from the China Rubber Industry Association Tire Branch, the 38 key member companies produced a total of 529.22 million tires in 2021, an increase of 11.28% as compared to 2020. India is another lucrative market for carbon black in Asia Pacific. Carbon black is widely used for tire manufacturing in the country. Thus, with the growing automotive tire industry, the demand for carbon black is also increasing across the region.

Asia Pacific Carbon Black Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the Asia Pacific Carbon Black provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Carbon Black refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Carbon Black Strategic Insights

Asia Pacific Carbon Black Report Scope

Report Attribute

Details

Market size in 2022

US$ 7,800.23 Million

Market Size by 2028

US$ 10,859.51 Million

Global CAGR (2022 - 2028)

5.7%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Grade

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Carbon Black Regional Insights

Asia Pacific Carbon Black Market Segmentation

The Asia Pacific carbon black market is segmented into type, grade, application, and country.

Based on type, the Asia Pacific carbon black market is sub segmented into acetylene black, channel black, furnace black, thermal black, and others. The furnace black segment held the largest market share in 2022.

Based on grade, the Asia Pacific carbon black market is segmented into standard grade and specialty grade. The standard grade segment held the larger market share in 2022.

Based on application, the Asia Pacific carbon black market is segmented into tire, non-tire rubber, plastics, inks & coatings, and others. The tire segment held the largest market share in 2022.

Based on country, the Asia Pacific carbon black market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the market in 2022.

Klean Industries Inc; Imerys SA; Tokai Carbon Co Ltd; Orion Engineered Carbons SA; Cabot Corp; and China Synthetic Rubber Corp are the leading companies operating in the Asia Pacific carbon black market.

The Asia Pacific Carbon Black Market is valued at US$ 7,800.23 Million in 2022, it is projected to reach US$ 10,859.51 Million by 2028.

As per our report Asia Pacific Carbon Black Market, the market size is valued at US$ 7,800.23 Million in 2022, projecting it to reach US$ 10,859.51 Million by 2028. This translates to a CAGR of approximately 5.7% during the forecast period.

The Asia Pacific Carbon Black Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Carbon Black Market report:

The Asia Pacific Carbon Black Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Carbon Black Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Carbon Black Market value chain can benefit from the information contained in a comprehensive market report.