The huge population in the region has led to high demand for residential and commercial construction activities. APAC comprises several developing economies such as China and India, as well as many Southeast Asian countries, which generate robust demands for infrastructure projects. The rising population of these countries is the main driver for the region's construction industry. Further, governments of various economies are taking several measures to attract private investments in construction and infrastructure development. For instance, the 2011–2020 Economic Transformation Program (ETP) by the Malaysian government attracts huge FDIs in the country's infrastructure and construction activities. Therefore, the increasing construction sector across the region demands the application of carbide tools in the specific cutting tools for the foundation and piloting machines. Furthermore, government initiatives, rapid technological developments, and digitalization of economies are among other factors propelling the region's overall economic growth, which is driving it from a developing phase to a developed phase. Moreover, the increase in demand for high-speed cutting tools in the manufacturing industries has also been adding to the growth in revenue of the carbide tools market. Due to the carbide tools, the manufacturing industries are highly inclined to use them in varied applications. Surging demand for enhanced carbide cutting tools and growing demand in various industries are the major factor driving the growth of the APAC carbide tools market.

In case of COVID-19, APAC is highly affected specially India. China and India are the most prominent manufacturing hub in the region and have an enhanced focus on industrialization. The growth of the manufacturing industry has been hampered due to lockdown but soon expected to recover the development by enhancing the production capabilities in the second half of the year 2021. The demand for advanced electronics such as a healthcare machines has risen significantly. Also, companies in the Asian region have restructured their capabilities by adopting various strategies such as automation, partnership, and acquisition. The lockdown has been having a severe impact on the automotive sector across the region. China is responsible for more than 80% of the global auto supply chain. Hubei, for example, is one of China's four main car production centers, with over 100 automotive suppliers. Hubei's automotive plants were closed until March 11 and are now slowly reopening. However, China has been able to stabilize its spread of COVID-19, and industries are up and running. This embarks a positive sign towards the stabilization of the carbide tools market.

Strategic insights for the Asia-Pacific Carbide Tools provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

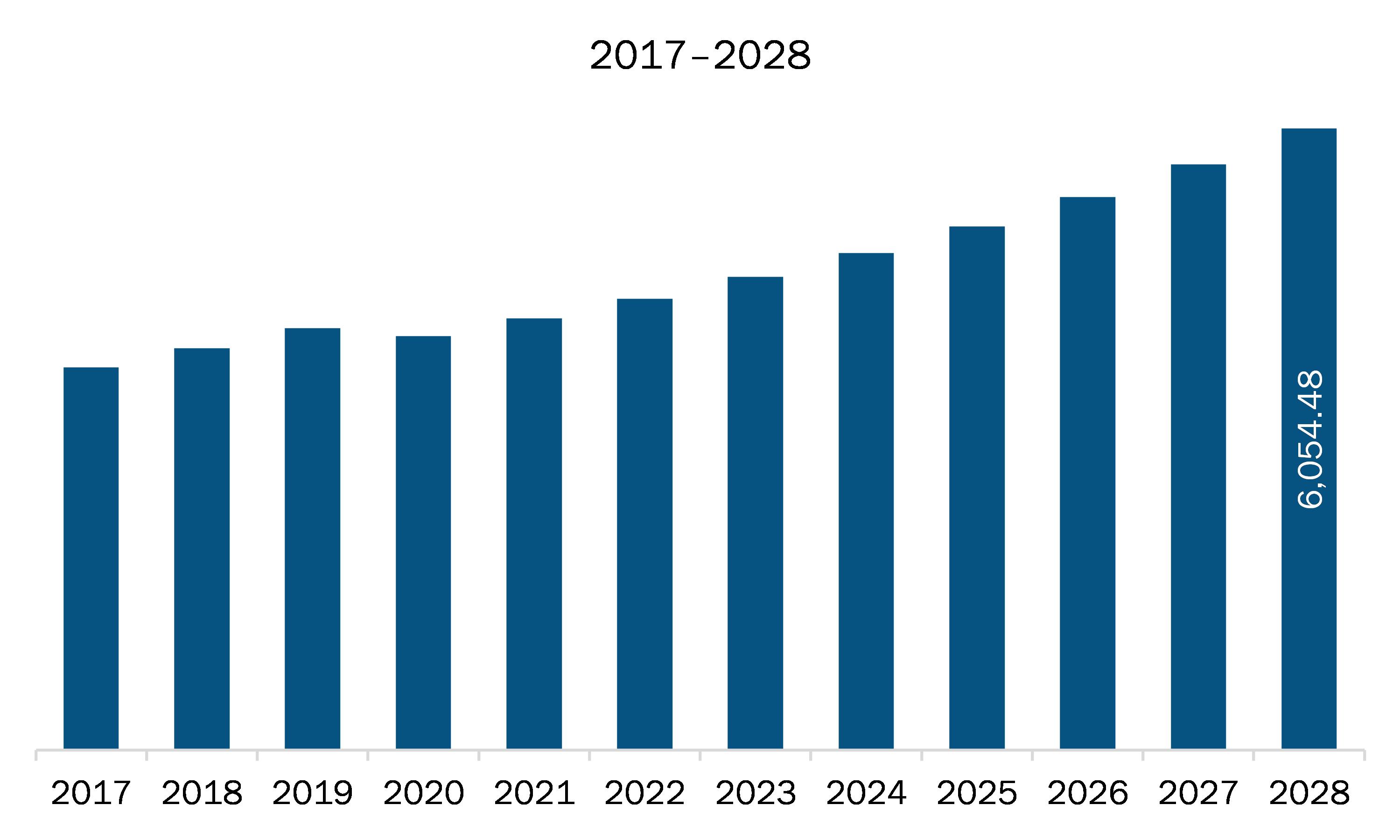

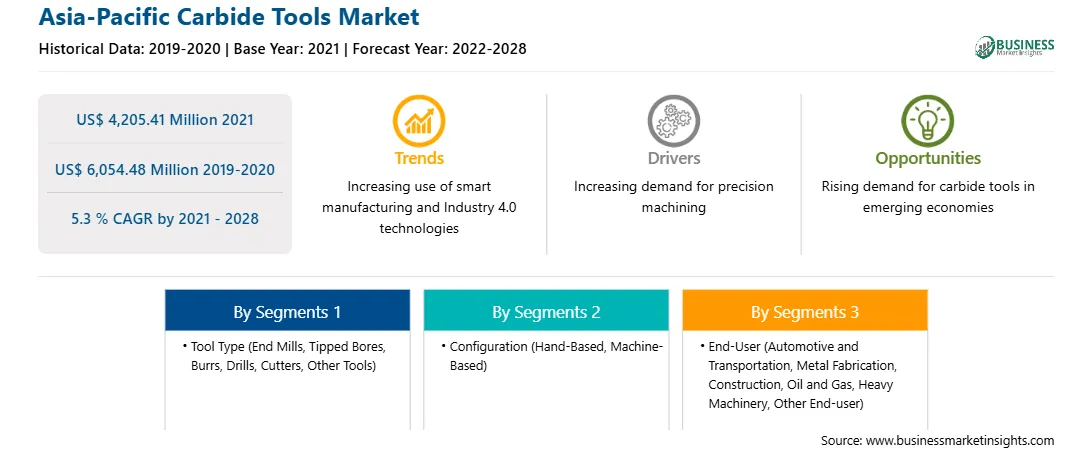

| Market size in 2021 | US$ 4,205.41 Million |

| Market Size by 2028 | US$ 6,054.48 Million |

| Global CAGR (2021 - 2028) | 5.3 % |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Tool Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia-Pacific Carbide Tools refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC carbide tools market is expected to grow from US$ 4,205.41 million in 2021 to US$ 6,054.48 million by 2028; it is estimated to grow at a CAGR of 5.3 % from 2021 to 2028. Refined performance of carbide tools than their counterparts is expected to surge the APAC carbide tools market. Carbide tools retain their cutting-edge hardness at high machining temperatures generated by high cutting speeds and feeds that reduce machining cycle time. These tools confer improved surface finish and hold size with better quality for prolonged periods. Along with this, carbide tools last longer due to the carbide chip forming surface resists wear as the chip flows over the tools. This reduces the need for costly changes with increased scrap and rework. Further, carbide tools are used when machining highly abrasive materials. The carbide is also known as tungsten carbide as it comprises half part tungsten and half part carbide. The substance features stiffness thrice that of steel and is commonly used on other types of wood-cutting tools as well. Carbide-tipped wood cutting tools higher cutting speed than standard steel-based woodworking tools. Thus, the better performance capabilities of carbide tools than their counterparts are propelling the growth of the APAC carbide tools market.

In terms of tool type, the end mills segment accounted for the largest share of the APAC carbide tools market in 2020. In terms of configuration, the machine-based segment held a larger market share of the APAC carbide tools market in 2020. Further, the automotive and transportation segment held a larger share of the APAC carbide tools market based on end-user in 2020.

A few major primary and secondary sources referred to for preparing this report on the APAC carbide tools market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are CERATIZIT S.A.; DIMAR GROUP; KYOCERA Precision Tools; Makita Corporation; MITSUBISHI MATERIALS Corporation; Sandvik Coromant; Xinrui Industry Co., Ltd.; and YG-1 Co., Ltd.

The Asia-Pacific Carbide Tools Market is valued at US$ 4,205.41 Million in 2021, it is projected to reach US$ 6,054.48 Million by 2028.

As per our report Asia-Pacific Carbide Tools Market, the market size is valued at US$ 4,205.41 Million in 2021, projecting it to reach US$ 6,054.48 Million by 2028. This translates to a CAGR of approximately 5.3 % during the forecast period.

The Asia-Pacific Carbide Tools Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Carbide Tools Market report:

The Asia-Pacific Carbide Tools Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Carbide Tools Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Carbide Tools Market value chain can benefit from the information contained in a comprehensive market report.