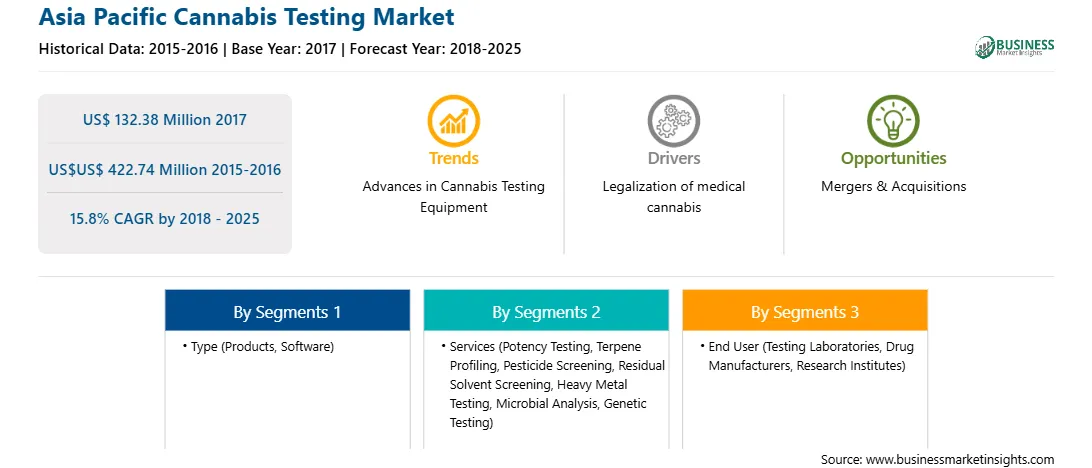

The Asia Pacific cannabis testing market is expected to grow at highest rate during the forecast period owing to growing adoption of LIMS, and cannabis legalization for medical and recreational purpose in Asia Pacific region.

The growing advanced technology provide the best solutions to meet the current requirements and enables the system to be readily adapted based on the needs. The modern LIMS (Laboratory Information Management Systems) system are used to automatically registers and archives the results of laboratory work, to support people management & equipment and materials administration. Advancements including, macro level challenges to increase innovation, manage risk, improve governance, comply with regulatory requirements, and deliver quantifiable operational results, help pathology laboratories to meet the evolving demands of the modern pathology services in the region. The increasing adoption of LIMS technique helps to improve the transparency to lab work status, reducing the costs & improved efficiency, providing flexibility to accommodate new requirements and also help to improve quality & compliance. Penetration of information technology and increasing demand for data management and standardization is helping in growing the number of LIMS vendors in the market. The increasing demand for the LIMS in Asian market and R&D spends in the counties like China and India is growing that proportionally upsurge the market growth in the region.

Thus, due to the above advancements, the cannabis testing market is expected to grow at a rapid pace during the forecast period.

The Asia Pacific region projects a great demand for cannabis testing market. This is because the medical use of cannabis to heal patients of various disease for example chronic neuropathic pain, and any spinal injury. It also helps to deal with anorexia in HIV AIDS which is a major challenge in this region. In December 2018, Thailand was the first country in Southeast Asia to legalize cannabis. There has been significant rise in investments in cannabis testing labs and recent law changes which have led to acceptance of marijuana and cannabis.

Thus, due to growing legalization of cannabis, the cannabis testing market is expected to grow at rapid pace.

In 2017, the product segment held a largest market share of 73.7% of the cannabis testing market, by type. This segment is also expected to dominate the market in 2025 owing diverse portfolio of cannabis testing products to the healthcare industry for innovations in the technologies. Moreover, the same segment is also expected to witness the highest CAGR in the market accounting to 16.1% in 2018 to 2015 owing to increasing analytical services and medicinal cannabis services in testing cannabis.

The Asia Pacific cannabis testing market on the basis of service is segmented into potency testing, microbial analysis, residual solvent screening, heavy metal testing, pesticide screening, terpene profiling, and genetic testing. The potency testing segment is anticipated to grow at a CAGR of 16.9% during the forecast period. Depending on the state in which testing occurs, a sample’s THC and CBD levels, along with its tetrahydrocannabinolic and cannabidolic acids are required. Other labs may opt to test samples for their CBC and CBG as well. Testing for potency involves gas or liquid chromatography for a range of matrices.

The testing laboratory segment held a largest market share of 49.2% of the cannabis testing market, by end user. This segment is also expected to dominate the market in 2025 owing to increasing number of diagnostic testing performed in the reference labs for the numerous diseases.

Strategic acquisition and product launches were observed as the most adopted strategy in Asia Pacific cannabis testing industry. Few of the recent product launch and product approval are listed below:

2016: Agilent Technologies, Inc. introduced Agilent 5110 ICP-OES that allow scientists to perform faster, more precise ICP-OES analysis.

2017: SCIEX launched the X-Series Quadrupole Time of Flight (QTOF) mass spectrometry (MS) platform, X500B QTOF System.

2018: Restek and Separation Science entered into a collaboration to develop a multi-speaker eSeminar focused on testing methods and associated topics for medicinal cannabis labs.

• Asia Pacific

Strategic insights for the Asia Pacific Cannabis Testing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 132.38 Million |

| Market Size by 2025 | US$US$ 422.74 Million |

| Global CAGR (2018 - 2025) | 15.8% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Cannabis Testing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The List of Companies

1. Agilent Technologies

2. PerkinElmer, Inc.

3. Shimadzu Corporation

4. SCIEX

5. Merck KGaA

6. Restek Corporation

7. Waters

8. CannaSafe Analytics

9. Accelerated Technology Laboratories, Inc.

10. Digipath Labs

The Asia Pacific Cannabis Testing Market is valued at US$ 132.38 Million in 2017, it is projected to reach US$US$ 422.74 Million by 2025.

As per our report Asia Pacific Cannabis Testing Market, the market size is valued at US$ 132.38 Million in 2017, projecting it to reach US$US$ 422.74 Million by 2025. This translates to a CAGR of approximately 15.8% during the forecast period.

The Asia Pacific Cannabis Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Cannabis Testing Market report:

The Asia Pacific Cannabis Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Cannabis Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Cannabis Testing Market value chain can benefit from the information contained in a comprehensive market report.