The expanding plastics industry is a primary driver of market expansion in the APAC. According to data from the manufacturers' association Plastics Europe, Asia generated 51% of the world's plastic in 2018. Plastic is widely used in these regions' supermarkets for various purposes, including packaged commodities and ready-to-eat meals, particularly in Japan. As a result, calcium carbonate, a well-known mineral filler used in the plastics sector, is in higher demand. Calcium carbonate is widely available worldwide, is compatible with a wide range of polymer resins, is easy to grind or reduces to specific particle size and is cost-effective. Infrastructure investment has been a crucial engine of economic development for APAC countries in recent years. Over the last ten years, the Asian construction industry has grown despite the region's poor economic performance. In 2012, Asia, for example, was the only continent to see continual development in the building industry. China has the largest building sector in Southeast Asia, followed by India, Japan, Malaysia, and Korea. China is home to the world's two tallest skyscrapers. In 2015, China is estimated to spend $2.28 trillion on construction in Southeast Asia, followed by Japan at $812 billion and India at $487 billion. International corporations continue to be attracted to commercial construction projects as a result of recent infrastructure improvements, enhanced transportation networks, and lower labour costs.

In case of COVID-19, APAC is highly affected specially India. The COVID-19 pandemic has been causing a significant economic loss in APAC. The consequence and impact are likely to worsen with the spread of the virus. The governments of various APAC countries-imposed lockdowns in early 2020 to restrict the spread of the virus, which, in turn, negatively impacted on calcium carbonate market. The region holds high revenue share in the global coatings industry. The pandemic has had a major impact on the paint and coatings industry mainly due to decrease in demand from the automotive industry. Further, the paper industry is one of the seriously hit industries in the wake of the COVID-19 pandemic. However, new application segments such as food packaging, hygiene paper products, and medical specialty papers are mitigating the impact of COVID-19 on the industry. Governments of various countries in Asia Pacific have realigned their operations and restructured their production facilities. They are encouraging significant investments in infrastructure and construction activities to stimulate their economic growth. As a result, the demand for infrastructure-related coatings is expected to increase in future after the gradual mellowing of impact of the pandemic. Asian Paints, a paint company in Asia, is promoting safe painting campaign to boost their sales. Such campaigns are anticipated to increase the demand for DIY paints and coatings, thereby leading to market growth. Such government and private initiatives would provide growth opportunities for calcium carbonate market players in the coming years.

Strategic insights for the Asia Pacific Calcium Carbonate provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 11,876.19 Million |

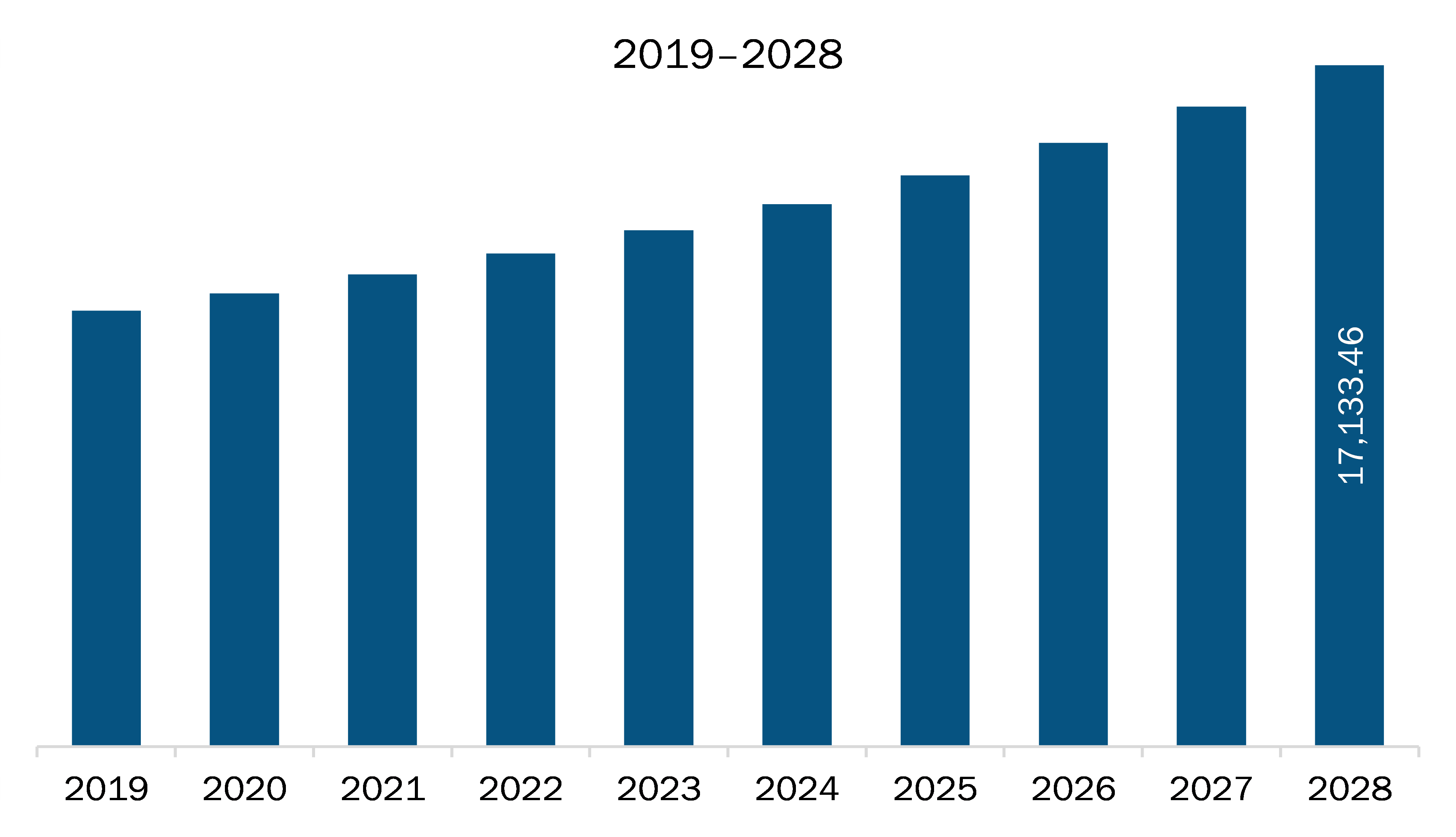

| Market Size by 2028 | US$ 17,133.46 Million |

| Global CAGR (2021 - 2028) | 5.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Calcium Carbonate refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC calcium carbonate market is expected to grow from US$ 11,876.19 million in 2021 to US$ 17,133.46 million by 2028; it is estimated to grow at a CAGR of 5.4% from 2021 to 2028. Surging demand from the paper industry will escalate the market growth. Calcium carbonate is available in two different forms for industrial applications: Ground Calcium Carbonate (GCC) and Precipitated Calcium Carbonate (PCC). The GCC has high whiteness, and it improves the durability of printed material. Both these types GCC and PCC are used as a paper filler which gives brightness about ~86–95% and ~90–97% respectively. They also improve the shine, porosity, printability, and opacity of the paper. PCC features more retention capacity than other paper fillers, enabling it for broader application scope in paper industry. Paper is mainly used in printing and writing media, newsprints, packaging, and paper board. In packaging applications, it is mainly used for making corrugated boxes, paperboard cartons, and paper bag. Being cost-effective, more efficient, and environmentally friendly, the demand for paper is increasing from packaging industry, which supports growth of the APAC calcium carbonate market. APAC region at present got a continuous demand for paper, indicating the uninterrupted need of calcium carbonate from the paper industry in the region. The growing e-commerce industry in countries such as India and China has led to an increase in demand for corrugated packaging material. In India, PCC acts as a suitable replacement for kaolin clay, as it is a cost-effective material option adding value and quality to the manufactured paper and paperboard materials. Thus, the continued demand for paper for different applications in various countries is boosting the APAC calcium carbonate market growth.

In terms of type, the ground calcium carbonate (GCC) segment accounted for the largest share of the APAC calcium carbonate market in 2020. In terms of application, the paper segment held a larger market share of the APAC calcium carbonate market in 2020.

A few major primary and secondary sources referred to for preparing this report on the APAC calcium carbonate market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are GCCP Resources Ltd; Imerys S.A.; J.M. Huber Corporation; LafargeHolcim; Minerals Technologies Inc.; OKUTAMA KOGYO CO.,LTD; Omya AG; and SCHAEFER KALK GmbH & Co. KG.

The Asia Pacific Calcium Carbonate Market is valued at US$ 11,876.19 Million in 2021, it is projected to reach US$ 17,133.46 Million by 2028.

As per our report Asia Pacific Calcium Carbonate Market, the market size is valued at US$ 11,876.19 Million in 2021, projecting it to reach US$ 17,133.46 Million by 2028. This translates to a CAGR of approximately 5.4% during the forecast period.

The Asia Pacific Calcium Carbonate Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Calcium Carbonate Market report:

The Asia Pacific Calcium Carbonate Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Calcium Carbonate Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Calcium Carbonate Market value chain can benefit from the information contained in a comprehensive market report.