Increasing Organic and Inorganic Strategies by Key Players Fuel Asia Pacific Butterfly Needles Market Growth

The key market players are adopting various organic and inorganic strategies, including mergers and acquisitions, expansions, and new product launches, to stay competitive in the market. In January 2022, ICU Medical Inc. acquired Smiths Medical from Smiths Group plc. The Smiths Medical business includes syringes, ambulatory infusion devices, and vascular access and vital care products. The company offers Saf-T Wing butterfly needle, a single-use needle for drawing blood from venous. ICU Medical has become a leading infusion therapy company with a larger footprint after adding the Smiths product line to its portfolio. Similarly, in June 2020, Becton Dickinson Benelux NV launched BD Vacutainer UltraTouch Push Button Blood Collection Set with Pre-Attached Holder. A pre-attached holder prevents accidental needlestick injury due to the nonpatient (tube-side) needle and helps ensure compliance with OSHA's single-use holder requirements. Thus, many organic and inorganic strategies in the butterfly needles market enables healthcare professionals to provide improved services. These strategies help key players to meet the rising demand for butterfly needles that can efficiently manage patients suffering from chronic disease conditions, thereby driving the Asia Pacific butterfly needles market growth.

Asia Pacific Butterfly Needles Market Overview

The Asia Pacific butterfly needles market is segmented into China, India, Japan, South Korea, Australia, and the Rest of Asia Pacific. China dominated the market in 2022. Healthcare providers often recommend a blood test to discover any underlying diseases such as cardiovascular diseases, diabetes, cancer, and HIV/AIDs. According to an article titled "Cardiovascular Health and Diseases in China" by the National Center for Biotechnology Information (NCBI), Cardiovascular disease (CVD) accounted for ~47% and 44% of all deaths in rural and urban areas, respectively, in 2019. Two out of every five deaths occur due to CVD, and it is estimated that over 330 million patients suffer from CVD in China. According to the same source, the number of patients suffering from various diseases includes stroke (~13 million), heart failure (~11 million), coronary heart disease (~9 million), pulmonary heart disease (~5 million), rheumatic heart disease (~4.87 million), atrial fibrillation (~2.5 million), lower extremity artery disease (~2 million), congenital heart disease (~45.30 million), and hypertension (~245.00 million). According to United Nations Program on HIV/AIDS (UNAIDS), in 2018, ~1.25 million people were affected by HIV in China. Furthermore, according to World Health Organization (WHO), China has a high rate of diabetes, as more than 10% of the total population in China is suffering from diabetes. Also, as per WHO, by 2040, an estimated 402 million people (28% of the total population) will be aged 60 years and above. Thus, China is facing the pressures of an aging population and the constant rise in the prevalence of metabolic risk factors. As a result, the CVD and diabetes burden will continue to increase, setting new requirements for the development and application of butterfly needless for blood testing in China. Further, the growing presence of local key players in the butterfly needles market in the country is boosting the market in China. Manufacturers are focusing on expanding their strategic global presence and specialized expertise with exclusive technological capabilities, leading to the expansion of needle sets and butterfly needles availability in China. Hence, the rising prevalence of diabetes and cardiovascular diseases, the increasing geriatric population, and the expansion of regional players are expected to propel the growth of the butterfly needles market in China.

Strategic insights for the Asia Pacific Butterfly Needles provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Butterfly Needles refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Butterfly Needles Strategic Insights

Asia Pacific Butterfly Needles Report Scope

Report Attribute

Details

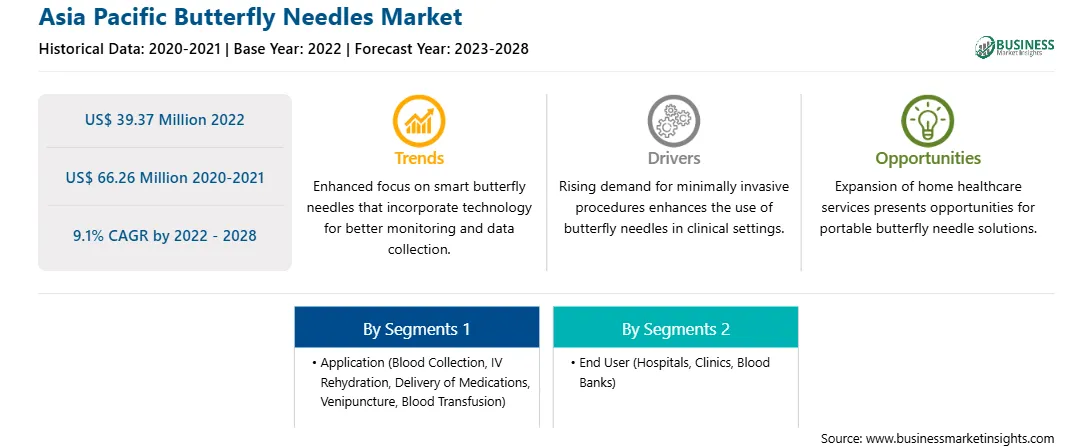

Market size in 2022

US$ 39.37 Million

Market Size by 2028

US$ 66.26 Million

Global CAGR (2022 - 2028)

9.1%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Application

By End User

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Butterfly Needles Regional Insights

Asia Pacific Butterfly Needles Market Segmentation

The Asia Pacific butterfly needles market is segmented based on application, end user, and country.

Based on application, the Asia Pacific butterfly needles market is segmented into blood collection, IV rehydration, delivery of medications, venipuncture, and blood transfusion. The blood collection segment held the largest Asia Pacific butterfly needles market share in 2022.

Based on end user, the Asia Pacific butterfly needles market is segmented into hospitals, clinics, blood banks, and others. The hospitals segment held the largest Asia Pacific butterfly needles market share in 2022.

Based on country, the Asia Pacific butterfly needles market has been categorized into China, India, Japan, South Korea, Australia, and the Rest of Asia Pacific. Our regional analysis states that China dominated the Asia Pacific butterfly needles market in 2022.

B. Braun SE, Becton Dickinson and Co, Cardinal Health Inc, ICU Medical Inc, Medline Industries Inc, Nipro Corp, SB-Kawasumi Laboratories Inc, Terumo Corp, and Vogt Medical Vertrieb GmbH are the leading companies operating in the Asia Pacific butterfly needles market.

The Asia Pacific Butterfly Needles Market is valued at US$ 39.37 Million in 2022, it is projected to reach US$ 66.26 Million by 2028.

As per our report Asia Pacific Butterfly Needles Market, the market size is valued at US$ 39.37 Million in 2022, projecting it to reach US$ 66.26 Million by 2028. This translates to a CAGR of approximately 9.1% during the forecast period.

The Asia Pacific Butterfly Needles Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Butterfly Needles Market report:

The Asia Pacific Butterfly Needles Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Butterfly Needles Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Butterfly Needles Market value chain can benefit from the information contained in a comprehensive market report.