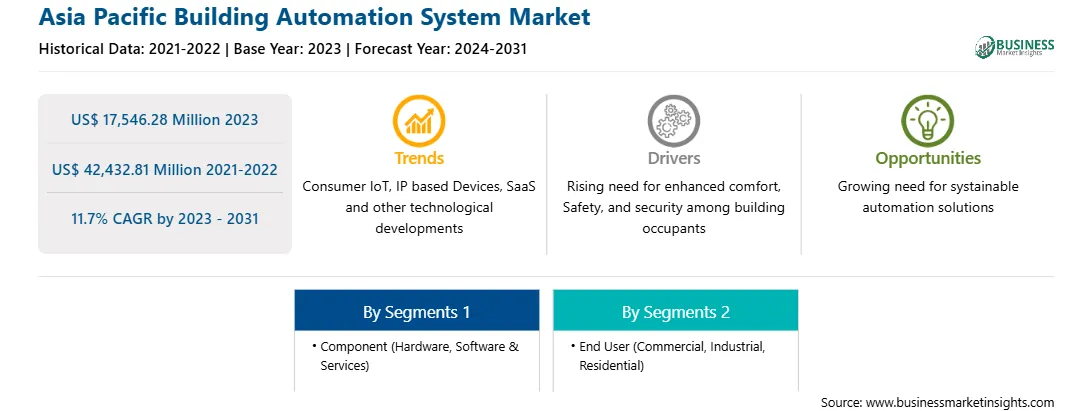

The Asia Pacific building automation system market was valued at US$ 17,546.28 million in 2023 and is expected to reach US$ 42,432.81 million by 2031; it is estimated to register a CAGR of 11.7% from 2023 to 2031.

Sustainable buildings aim to minimize energy consumption and carbon emissions. BAS can monitor, control, and optimize HVAC, lighting, and other systems based on occupancy and environmental conditions. With an increasing shift toward renewable energy sources, such as solar and wind, BAS can intelligently manage the integration and utilization of these sources within building operations, ensuring optimal energy use and substantial cost savings. BAS provides real-time data on energy usage and environmental metrics, facilitating informed decision-making for energy conservation strategies and compliance with sustainability standards and regulations. Sustainable buildings prioritize occupant comfort and health. BAS can maintain indoor air quality, regulate temperature, and optimize natural lighting, contributing to enhanced occupant satisfaction and productivity. Also, sustainable BAS solutions result in cost savings due to reduced energy expenses, lower maintenance needs, and prolonged equipment life, making them financially attractive for building owners and operators. The use of sustainable solutions aligns with global sustainability goals, improving energy efficiency, enhancing occupant comfort, and offering significant economic benefits for building owners and operators. Thus, the growing need for sustainable building automation solutions across industries is expected to create significant opportunities for the building automation market growth during the forecast period.

In August 2022, Johnson Controls, a renowned global leader in intelligent, sustainable, and health-focused buildings, collaborated with Microsoft Beijing Campus to continually renovate and enhance building operations. This strategic alliance has yielded remarkable results, including a 27.9% reduction in energy consumption and a 98% uptime for critical equipment. Consequently, the campus has received recognition for energy conservation and financial support from the Beijing Municipal Government and the Haidian District Government. This initiative aligns with China's commitment to peak carbon emissions by 2030 and achieve carbon neutrality by 2060, placing significant emphasis on the building sector to embrace the latest sustainable engineering technology. This partnership serves as a prime example of how AI and advanced building automation systems can significantly enhance energy efficiency and operational automation in large-scale building operations. Microsoft Beijing Campus also utilizes Johnson Controls Metasys Building Automation System (BAS) to monitor cooling and heating equipment, channeling significant data into OBEM for analysis. Such collaboration initiatives drive the Asia Pacific building automation system market.

Strategic insights for the Asia Pacific Building Automation System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Building Automation System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Building Automation System Strategic Insights

Asia Pacific Building Automation System Report Scope

Report Attribute

Details

Market size in 2023

US$ 17,546.28 Million

Market Size by 2031

US$ 42,432.81 Million

Global CAGR (2023 - 2031)

11.7%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Component

By End User

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Building Automation System Regional Insights

The Asia Pacific building automation system market is categorized into component, end user, and country.

Based on component, the Asia Pacific building automation system market is bifurcated into hardware and software & services. The hardware segment held a larger market share in 2023. Furthermore, the hardware segment is sub segmented into security & surveillance system, facility management systems, fire protection systems, and others.

In terms of end user, the Asia Pacific building automation system market is segmented into commercial, industrial, and residential. The commercial segment held the largest market share in 2023.

By country, the Asia Pacific building automation system market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific building automation system market share in 2023.

ABB Ltd; Mitsubishi Electric Corp; Bosch Sicherheitssysteme GmbH; Honeywell international Inc; Schneider Electric SE; Siemens AG; Johnson Controls International Plc; Carrier Global Corp; Lutron Electronics Co., Inc; and Trane Technologies Plc are some of the leading companies operating in the Asia Pacific building automation system market.

The Asia Pacific Building Automation System Market is valued at US$ 17,546.28 Million in 2023, it is projected to reach US$ 42,432.81 Million by 2031.

As per our report Asia Pacific Building Automation System Market, the market size is valued at US$ 17,546.28 Million in 2023, projecting it to reach US$ 42,432.81 Million by 2031. This translates to a CAGR of approximately 11.7% during the forecast period.

The Asia Pacific Building Automation System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Building Automation System Market report:

The Asia Pacific Building Automation System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Building Automation System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Building Automation System Market value chain can benefit from the information contained in a comprehensive market report.