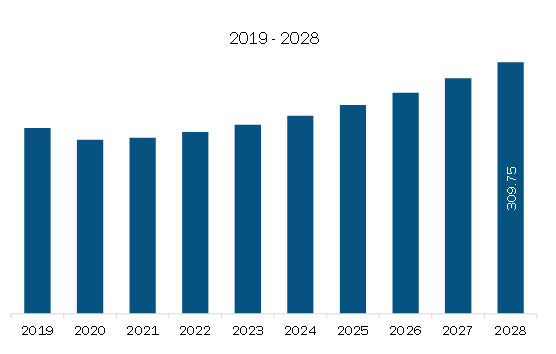

The Asia Pacific bucket elevator market is expected to grow from US$ 421.58 million in 2022 to US$ 666.49 million by 2028. It is estimated to grow at a CAGR of 7.9% from 2022 to 2028.

Surging Need for Food Grains and Seeds is Driving the Asia Pacific Bucket Elevator Market

As per the Food and Agriculture Organization (FAO), a rise in the global population triggers the demand for different food grains such as soybean, corn, coffee, and wheat. The National Bureau of Statistics, China, stated that corn and soybean production in China, for the year 2022–2023 stood at 277.2 million MT and 20.3 million MT, respectively, recording an increase of 2% and 24%, respectively, from the previous year. In November 2021, the Government of India, through its GOVERNMENT E-MARKETPLACE (GEM) portal, floated a tender for the supply, installation, and commissioning of a 4 tph vertical bucket elevator, for feeding seed pre-cleaner, in a seed processing plant (wheat). The grain and seed processing plants prefer different bucket designs and customizable elevators. Market players have been taking initiatives to grab these opportunities by introducing new products. In December 2022, Ryson International, Inc launched a new range of bulk bucket elevators. The elevators were made available in C and Z configurations, and three different bucket sizes with capacities of 300, 700, and 1,800 cubic feet an hour. The company also offered powder-coated, or stainless-steel finished buckets for extending the range of applications. Per the company, the new offerings are built-to-order, customizable, and relatively easy to install.

Asia Pacific Bucket Elevator Market Overview

Based on geography, the Asia Pacific bucket elevator market is segmented into Australia, China, India, Japan, South Korea, and the rest of Asia Pacific. China, India, and other Southeast Asian countries are the significantly contributing to the Asia Pacific bucket elevator market share. The presence of highly developing countries such as China and India are positively impacting growth of several industries—mining, food, agriculture, and construction. The government bodies across this region are investing heavily in infrastructural development. Additionally, several global manufacturing companies are investing in the region to set up their production facilities thereby influencing the growth of the construction industry across the region. Some of the major construction projects undertaken in Asia Pacific are mentioned below:

Additionally, the Asia Pacific countries such as South Korea, China, India, Vietnam, and Singapore are witnessing a rise in investment in the construction of new airports. For instance, the Chinese government announced its intension to build a total of 400 airports across the country by 2035. These factors are expected to influence the growth of the construction industry across the region, thereby contributing to the growing demand for bucket elevators. China, India, Japan, Thailand, Vietnam, Bangladesh, and Myanmar are among the major countries focused on agriculture in Asia Pacific. The rising focus of the government bodies to promote their agricultural capabilities is further propelling the demand for bucket elevators from the agricultural sector for application such as loading and unloading grains or seeds from warehouses. Thus, rising agricultural activities across the above-mentioned Asia Pacific countries is influencing the demand for bucket elevators, thereby contributing to its market growth.

Asia Pacific Bucket Elevator Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the Asia Pacific Bucket Elevator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Bucket Elevator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Bucket Elevator Strategic Insights

Asia Pacific Bucket Elevator Report Scope

Report Attribute

Details

Market size in 2022

US$ 421.58 Million

Market Size by 2028

US$ 666.49 Million

Global CAGR (2022 - 2028)

7.9%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Capacity

By Industry

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Bucket Elevator Regional Insights

Asia Pacific Bucket Elevator Market Segmentation

The Asia Pacific bucket elevator market is segmented into type, capacity, industry, and country.

Based on type, the Asia Pacific bucket elevator market is segmented into centrifugal discharge elevators, continuous discharge elevators, positive discharge elevators. In 2022, the centrifugal discharge elevators segment registered a largest share in the Asia Pacific bucket elevator market.

Based on capacity, the Asia Pacific bucket elevator market is segmented as upto 350 cubic feet per hour, 351–830 cubic feet per hour, 2001 – 2800 cubic feet per hour, 831 – 2000 cubic feet per hour, above 2801 cubic feet per hour. In 2022, the 350 cubic feet per hour segment registered a largest share in the Asia Pacific bucket elevator market.

Based on industry, the Asia Pacific bucket elevator market is segmented into construction, agriculture, mining, fertilizers & chemicals, energy and utilities, paper and pulp, others. In 2022, the construction segment registered a largest share in the Asia Pacific bucket elevator market.

Based on country, the Asia Pacific bucket elevator market is segmented into China, Japan, India, South Korea, Australia, and the Rest of APAC. In 2022, China segment registered a largest share in the Asia Pacific bucket elevator market.

AGCO Corp; BEUMER Group GmbH & Co KG; Ryson International Inc; Satake Corp; and Skandia Elevator AB are the leading companies operating in the Asia Pacific bucket elevator market.

The Asia Pacific Bucket Elevator Market is valued at US$ 421.58 Million in 2022, it is projected to reach US$ 666.49 Million by 2028.

As per our report Asia Pacific Bucket Elevator Market, the market size is valued at US$ 421.58 Million in 2022, projecting it to reach US$ 666.49 Million by 2028. This translates to a CAGR of approximately 7.9% during the forecast period.

The Asia Pacific Bucket Elevator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Bucket Elevator Market report:

The Asia Pacific Bucket Elevator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Bucket Elevator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Bucket Elevator Market value chain can benefit from the information contained in a comprehensive market report.