The APAC region has enormous growth potential with the presence of fast-growing countries such as China and India and developed nations such as Japan and Australia. The region has vast manufacturing sector, along with industries such as electronics, food & beverage, automobiles, and healthcare industries. Further, governments of developing countries have been introducing policies such as Make in India and Made in China 2025 to promote the establishment of manufacturing plants to make themselves self-sufficient and capable of exporting surplus goods. However, China, the world's largest manufacturing center, is witnessing an increase in labor costs due to the country's ageing population. This has piqued the interest of manufacturers in investing in Southeast Asian countries. Additionally, the presence of a strong automotive sector and rise in number of passenger car and commercial vehicle manufacturers are among the major factors driving the growth of the broaching tools market in APAC. Development in the economies of China and India and large disposable income of population in countries such as South Korea and Japan, have accelerated the growth of the automotive sector in APAC. For instance, India produced 3,394,446 vehicles in 2020. In the same year, China was the largest vehicle producing country across the world with the production of 25,225,242 units of passenger cars and commercial vehicles. Thus, the above-mentioned are factors are contributing to the growth of the broaching tool market in APAC.

In case of COVID-19, APAC is highly affected specially India. The outbreak has created significant disruptions in primary industries such as manufacturing, healthcare, energy & power, electronics & semiconductor, aerospace & defense, and construction. A significant decline in the growth of mentioned industrial activities is impacting the performance of the APAC broaching tools market. APAC is characterized by the presence of several developing countries, positive economic outlook, and huge industrial sector, in addition to the largest share of global population. These factors make APAC a major region for the growth of the broaching tools market. The lockdown of various plants and factories in many economies in the region is affecting the global supply chains and negatively impacting the manufacturing processes, delivery schedules, and product and service sales. APAC is a global manufacturing hub with countries such as China, Japan, and South Korea leading the global manufacturing sector. Disruptions in supply chains and manufacturing activities have led to the discontinuation of the production of new broaching tools, which is hindering the market growth. Meanwhile, the recent onset of the second wave of COVID-19 in India is expected further hamper the performance of the broaching tool manufacturers in the coming quarters of 2021.

Strategic insights for the Asia-Pacific Broaching Tools provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

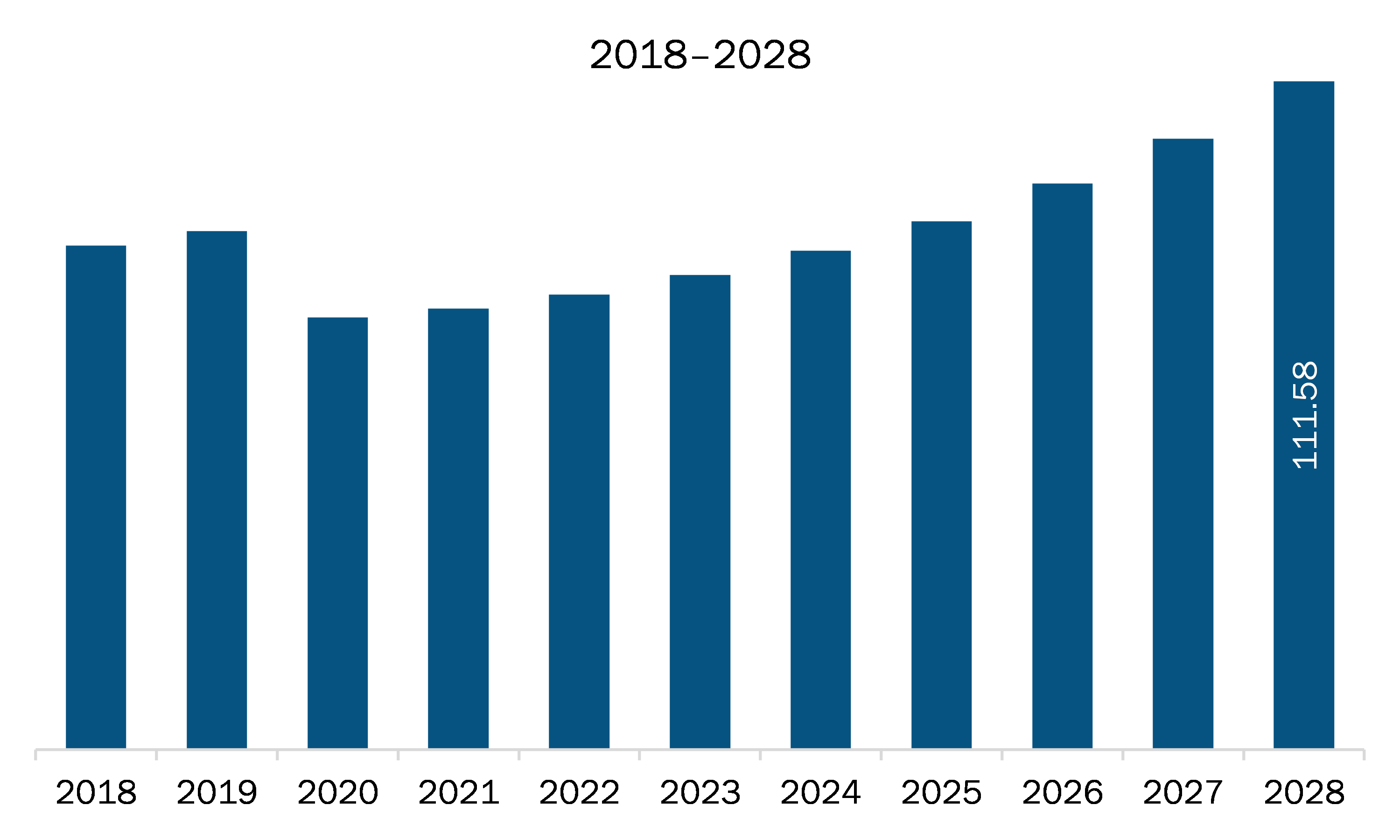

| Market size in 2021 | US$ 73.64 Million |

| Market Size by 2028 | US$ 111.58 Million |

| Global CAGR (2021 - 2028) | 6.1% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia-Pacific Broaching Tools refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC broaching tools market is expected to grow from US$ 73.64 million in 2021 to US$ 111.58 million by 2028; it is estimated to grow at a CAGR of 6.1% from 2021 to 2028. Owing to the economic growth, the manufacturing sector has gained significant traction over the last two decades, especially in emerging economies of APAC region. Broaching tools are widely used for producing various industrial components and sub-assembly parts. The rising demand for high speed and accurate finishing process from the end-use sectors such as automotive, aerospace & defense, and construction is encouraging broaching tools manufacturers to introduce advanced tools in the market. The manufacturing sector is one of APAC’s key economic growth drivers. Factors such as low labor cost, increasing young population, and government benefits in form subsidiaries and tax incentives attract organizations to set up larger manufacturing bases in APAC region. Further, government initiatives such as Made in China 2025 and make in India are propelling the growth of the manufacturing sector in APAC region. Also, the growing disposable income among the masses is leading to increasing adoption of the modern lifestyle in APAC, which is fueling the demand for consumer electronics and automobiles, thus bolstering the manufacturing sector. Therefore, the growing manufacturing sector is anticipated to drive the growth of the APAC broaching tools market.

In terms of type, the internal broaches segment accounted for the largest share of the APAC broaching tools market in 2020. In terms of end user, the automotive segment held a larger market share of the APAC broaching tools market in 2020.

A few major primary and secondary sources referred to for preparing this report on the APAC broaching tools market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are American Broach & Machine Company; Blohm Jung Gmbh; Ekin S. Coop; Mitsubishi Heavy Industries Machine Tool Co., Ltd.; and Nachi-Fujikoshi Corp.

The Asia-Pacific Broaching Tools Market is valued at US$ 73.64 Million in 2021, it is projected to reach US$ 111.58 Million by 2028.

As per our report Asia-Pacific Broaching Tools Market, the market size is valued at US$ 73.64 Million in 2021, projecting it to reach US$ 111.58 Million by 2028. This translates to a CAGR of approximately 6.1% during the forecast period.

The Asia-Pacific Broaching Tools Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Broaching Tools Market report:

The Asia-Pacific Broaching Tools Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Broaching Tools Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Broaching Tools Market value chain can benefit from the information contained in a comprehensive market report.