Increased demand from automotive and aerospace industries is the major factor driving the growth of the Asia Pacific broaching machines market. Broaching machines are used to perform several operations in the automotive, aerospace & defense, and metal industries, among other heavy industries. It is employed in the manufacturing of automotive and industrial components, and subassembly parts such as gears, shafts, and splines. Broaching is one of the most effective and efficient metal removal techniques available for heavy industries. It is suitable for large-volume applications with close-fitting tolerance, which are typically seen in the automotive and aerospace industries. Broaching machines exhibit exceptional repeatability and deliver better part finish than other metal removal methods.

The rising defense expenditure across India, China, and other developing countries fuels the demand for various broaching machines. The policies favoring FDIs in these countries encourage several international private companies to invest in manufacturing capabilities in these countries to produce military equipment for the domestic defense forces. In 2021, the Government of China has spent around ~US$ 293 billion for the procurement of military equipment and solutions. Further, passenger car sales are growing across India and China, which is boosting the automotive sector in these countries, thereby leading to a huge demand for broaching machines. For instance, in 2021, total new vehicle sales in the China accounted to 26.3 million, a rise of approximately 3.8% over earlier year.

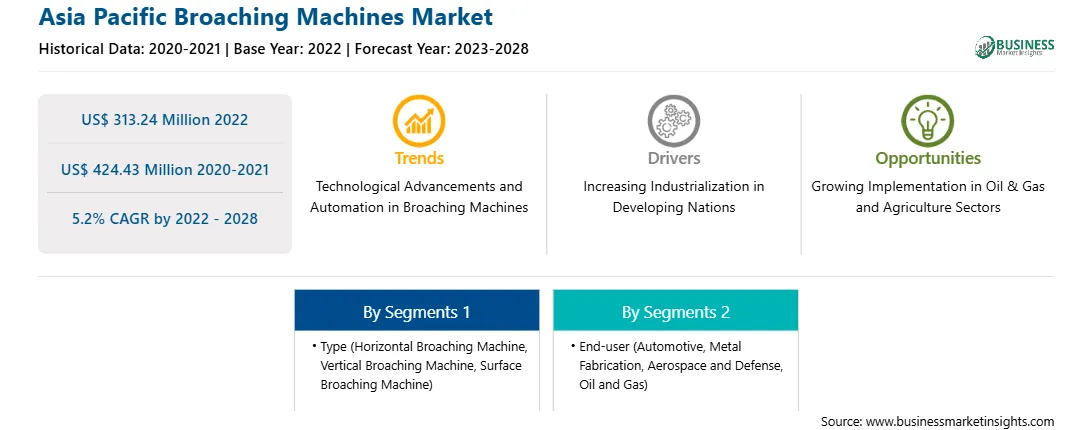

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Asia Pacific broaching machines market. The Asia Pacific broaching machines market is expected to grow at a good CAGR during the forecast period.

Strategic insights for the Asia Pacific Broaching Machines provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 313.24 Million |

| Market Size by 2028 | US$ 424.43 Million |

| Global CAGR (2022 - 2028) | 5.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Broaching Machines refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific broaching machines market is segmented into type, end-user, and country. Based on type, the broaching machines market is segmented into horizontal broaching machine, vertical broaching machine, surface broaching machine, others. The horizontal broaching machine segment holds the largest market share in 2022. Based on the end user, the broaching machines market is bifurcated into automotive, metal fabrication, aerospace and defense, oil and gas, others. Automotive segment holds the largest market share in 2022. Based on country, the Asia Pacific broaching machines market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China holds the largest market share in 2022.

Nachi-Fujikoshi Corp. Suntech Landriani Machine Tools Pvt. Ltd., The Ohio Broach & Machine Co., and Yeoshe Hydarulics Technology Co. Ltd. are among the leading companies in the Asia Pacific broaching machines market.

The Asia Pacific Broaching Machines Market is valued at US$ 313.24 Million in 2022, it is projected to reach US$ 424.43 Million by 2028.

As per our report Asia Pacific Broaching Machines Market, the market size is valued at US$ 313.24 Million in 2022, projecting it to reach US$ 424.43 Million by 2028. This translates to a CAGR of approximately 5.2% during the forecast period.

The Asia Pacific Broaching Machines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Broaching Machines Market report:

The Asia Pacific Broaching Machines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Broaching Machines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Broaching Machines Market value chain can benefit from the information contained in a comprehensive market report.