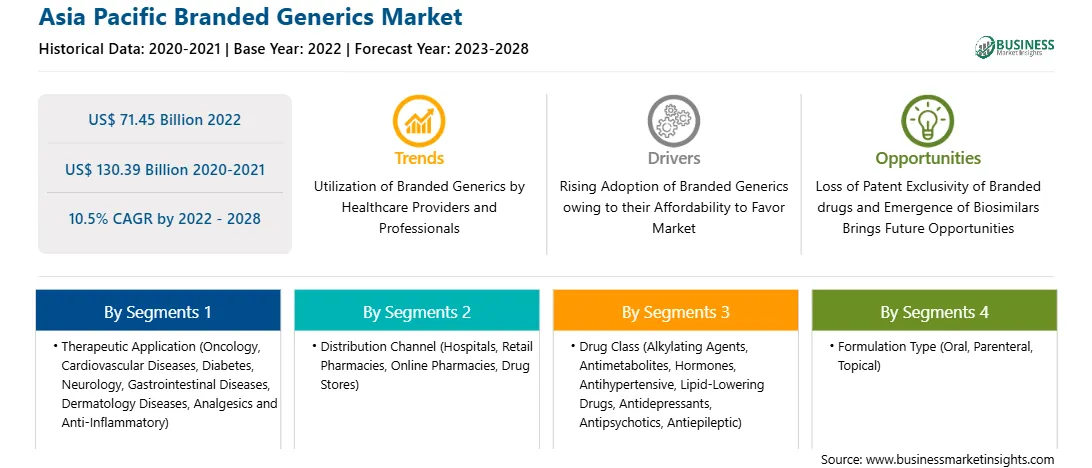

The branded generics market in Asia Pacific is expected to grow from US$ 71.45 billion in 2022 to US$ 130.39 billion by 2028; it is estimated to grow at a CAGR of 10.5% from 2022 to 2028.

A Scientific Electronic Library Online (SciELO) report states that promoting branded generics constitutes a core instrument for countries' national pharmaceutical policies, ultimately reducing drug expenditure with expanding healthcare access. In November 2008, the Department of Pharmaceuticals, Ministry of Chemicals & Fertilizers, Government of India launched Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP) to make quality generic medicines available at affordable prices. Under the scheme, dedicated outlets known as Janaushadhi Kendras offered generic medicines at affordable prices. As of 2021, 8,012 Janaushadhi Kendras were functional across the country. Moreover, a Food and Drug Administration (FDA) report states that if the FDA approves most branded generics, it can drop the costs of medicines. Generally, multiple generic drugs for the same product create competition in the market. For example, a single generic competitor results in price reductions of up to 30%, while five competing generics are associated with a price drop of nearly 85%.

The WHO estimates that about 65% of the Indian population lacks regular access to essential medicines despite India being one of the largest manufacturers and suppliers of generic drugs. The price of generic drugs procured by the government in bulk is less than the price paid for a branded drug by an individual consumer. It can be lowered to 2% of the retail price of a branded drug. Therefore, the provision related to free drugs acts as one of the most important interventions responsible for mitigating the burden on healthcare costs. One of the targets of the proposed Sustainability Development Goals of Indian Government is to achieve universal healthcare coverage, including financial risk protection; access to quality essential health care services; and access to safe, effective, quality, and affordable essential medicines. Therefore, the rise in government initiatives for promoting branded generics drives the growth of the Asia Pacific branded generics market.

By introducing new features and technologies, vendors in the Asia Pacific branded generics market can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the market at a good CAGR during the forecast period.

Asia Pacific Branded Generics

Market Revenue and Forecast to 2028 (US$ Billion)

Strategic insights for the Asia Pacific Branded Generics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Branded Generics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Branded Generics Strategic Insights

Asia Pacific Branded Generics Report Scope

Report Attribute

Details

Market size in 2022

US$ 71.45 Billion

Market Size by 2028

US$ 130.39 Billion

Global CAGR (2022 - 2028)

10.5%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Therapeutic Application

By Distribution Channel

By Drug Class

By Formulation Type

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Branded Generics Regional Insights

Asia Pacific Branded Generics Market Segmentation

Asia Pacific branded generics market is segmented into therapeutic application, distribution channel, drug class, formulation type and country. The therapeutic application segment of the Asia Pacific branded generics market is segmented into oncology, cardiovascular diseases, diabetes, neurology, gastrointestinal diseases, dermatology diseases, and analgesics and anti-inflammatory. In 2022, the others segment held the largest share of the market, by therapeutic application. The Asia Pacific branded generics market, by distribution channel is hospital pharmacies, retail pharmacies, online pharmacies, and drug stores. The retail pharmacies segment is likely to hold the largest share of the market in 2022. The Asia Pacific branded generics market, by drug class is segmented into alkylating agents, antimetabolites, hormones, anti-hypertensive, lipid lowering drugs, anti-depressants, anti-psychotics, anti-epileptic, and others. The others segment is likely to hold the largest share of the market in 2022. The Asia Pacific branded generics market, based on formulation type is segmented into oral, parenteral, topical, and other. In 2022, the oral segment held the largest share of the market, by formulation type. Based on country, the Asia Pacific branded generics market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China held the largest market share in 2022.

Aspen Holdings, AstraZeneca, Bausch Health (Valeant Pharmaceuticals), Dr. Reddy's Laboratories Inc., GlaxoSmithKline plc, Hetero, Lupin, Mylan N.V., Par Pharmaceuticals, Sandoz International Gmbh, Sanofi, and Teva Pharmaceutical Industries Ltd. are among the leading companies in the branded generics market operating in this region.

The Asia Pacific Branded Generics Market is valued at US$ 71.45 Billion in 2022, it is projected to reach US$ 130.39 Billion by 2028.

As per our report Asia Pacific Branded Generics Market, the market size is valued at US$ 71.45 Billion in 2022, projecting it to reach US$ 130.39 Billion by 2028. This translates to a CAGR of approximately 10.5% during the forecast period.

The Asia Pacific Branded Generics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Branded Generics Market report:

The Asia Pacific Branded Generics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Branded Generics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Branded Generics Market value chain can benefit from the information contained in a comprehensive market report.