Bovine tuberculosis (bTB) is a chronic infectious disease that primarily affects cattle and is later transmitted to other animals and humans. The World Organization for Animal Health (WOAH) has listed bTB as one of the diseases that must be detected and reported as earliest as possible. As per the data shared by Thermo Fisher Scientific in May 2023, bTB affects more than 50 million cattle worldwide, incurring annual economic losses of ~US$ 3 billion.

The prevalence of bTB differs in different geographic areas. However, its prevalence reaches beyond bTB 50% in some parts of Asia. Despite the ongoing technological and infrastructural developments, many countries fail to effectively diagnose bTB due to the complexity of the disease and the lack of universal strategies for its diagnosis. This scenario provides opportunities for bovine diagnostics market players to enhance awareness in Asia and launch new products that suit the socioeconomic conditions in these countries.

The Asia Pacific bovine diagnostics market in Asia Pacific is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. According to an article published in BMC Journals in 2023, bTB is a major endemic in China that results in major losses in dairy cattle production. In its Medium and Long-Term National Plan for Prevention and Control of Animal Diseases (2012–2020), the Ministry of Agriculture and Rural Affairs in China has classified the bTB of dairy cattle as one of the 16 infectious diseases that should be controlled and eliminated, as the disease also affects human welfare in addition to the livestock industry. A milk-based test is performed for diseases such as bovine brucellosis, Mycoplasma bovis (M. bovis) disease, paratuberculosis, and bovine leukosis. The collection and testing of milk samples do not have much impact on dairy cows, which also results in greater cooperation from dairy workers. The National Dairy Herd Improvement (DHI) Program of China also emphasizes on the collection of milk samples from lactating cows monthly, followed by testing them to assess breeding suitability and milk quality. It also recommends evaluating the milk samples to detect mastitis in the early stages using a CombiFoss FT + milk composition and a somatic cell analyzer. China implements its current bTB control strategy through test-and-slaughter policies, which are based on surveillance programs at the national and local levels, as well as on farms. Mycobacterium bovis culture is the “gold standard” for diagnosing bTB. However, the identification of M. bovis by culturing it is insensitive, cumbersome, and time-consuming, and it requires high-level biosafety laboratory facilities because of the persistent infection, slow growth, and potentially dangerous characteristics of the pathogen. Currently, the tuberculin skin test is the recommended and conventional test performed on animals at farms in China for detecting bTB, while the blood interferon-gamma in vitro release test is an alternative laboratory diagnostic test available. Thus, increasing bTB disease and support by government for diagnosis boosts the growth of bovine diagnostics market growth in China.

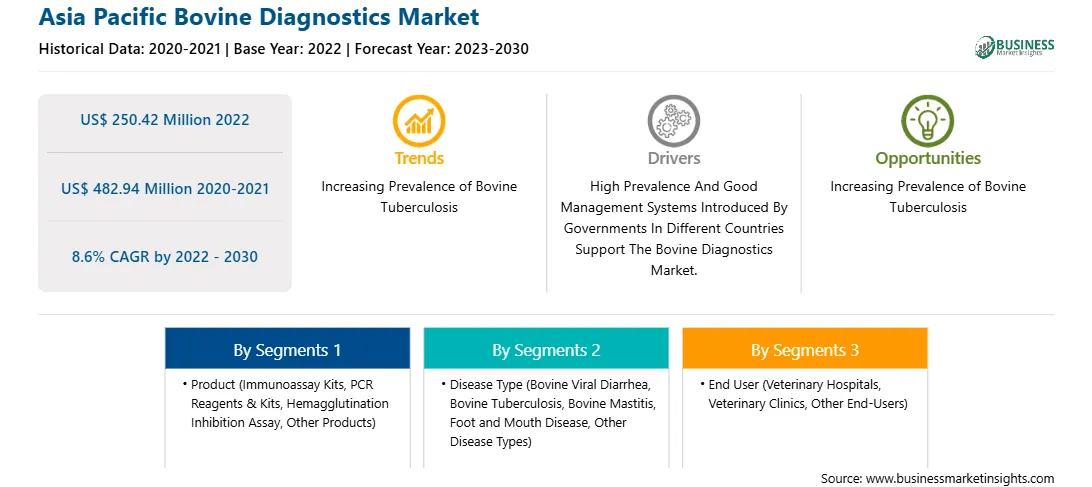

The Asia Pacific bovine diagnostics market is segmented into product, disease type, end user, and country.

Based on product, the Asia Pacific bovine diagnostics market is segmented into immunoassay kits, PCR reagents & kits, hemagglutination inhibition (HI) assay, and other products. The immunoassay kits segment held the largest share of the Asia Pacific bovine diagnostics market in 2022.

Based on disease type, the Asia Pacific bovine diagnostics market is segmented into bovine viral diarrhea (BVD), bovine tuberculosis (TB), bovine mastitis, foot and mouth disease (FMD), and other disease types. The bovine mastitis segment held the largest share of the Asia Pacific bovine diagnostics market in 2022.

Based on end user, the Asia Pacific bovine diagnostics market is segmented into veterinary hospitals, veterinary clinics, and other end-users. The veterinary hospitals segment held the largest share of the Asia Pacific bovine diagnostics market in 2022.

Based on country, the Asia Pacific bovine diagnostics market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific bovine diagnostics market in 2022.

bioMerieux SA, Bionote Inc, Idexx Laboratories Inc, Innovative Diagnostics SAS, Neogen Corp, Ring Biotechnology Co Ltd, Shenzhen Bioeasy Biotechnology Co Ltd, and Thermo Fisher Scientific Inc are some of the leading companies operating in the Asia Pacific bovine diagnostics market.

Strategic insights for the Asia Pacific Bovine Diagnostics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 250.42 Million |

| Market Size by 2030 | US$ 482.94 Million |

| Global CAGR (2022 - 2030) | 8.6% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Bovine Diagnostics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific Bovine Diagnostics Market is valued at US$ 250.42 Million in 2022, it is projected to reach US$ 482.94 Million by 2030.

As per our report Asia Pacific Bovine Diagnostics Market, the market size is valued at US$ 250.42 Million in 2022, projecting it to reach US$ 482.94 Million by 2030. This translates to a CAGR of approximately 8.6% during the forecast period.

The Asia Pacific Bovine Diagnostics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Bovine Diagnostics Market report:

The Asia Pacific Bovine Diagnostics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Bovine Diagnostics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Bovine Diagnostics Market value chain can benefit from the information contained in a comprehensive market report.