The APAC's autonomous navigation market comprises China, India, Japan, Australia, South Korea, and the Rest of APAC. The economy of the region is performing well owing to numerous technological and infrastructural developments in several industries. Countries in APAC are increasingly investing in military UAV technology due to territorial disputes, economic growth, and long-required military modernizations. According to the Stockholm International Peace Research Institute, over the last decade, the region witnessed an increase of 52% in military spending that accounted for ~US$ 392 billion in 2018. This represents over one-fifth of the defence budget worldwide, and is anticipated to grow further The autonomous navigation system has become an important aspect to ensure the safe navigation of autonomous mobile robots used in outdoor environments, such as unmanned ground vehicles (UGVs) and delivery robots. It is highly critical for autonomous mobile robots to precisely understand the route and identify the obstacles during movement. Thus, introduction of new products with incorporated autonomous navigation system is expected to drive the growth of the market in APAC. Also, AI optimization for increasing navigation efficiency is driving the APAC autonomous navigation market.

Furthermore, COVID-19 is having a negative impact over the APAC region. APAC region is characterized by the presence of a large number of developing countries, positive economic outlook, high industrial presence, and huge population. The high growth rate of urbanization and industrialization in developing countries of Asia Pacific region is anticipated to offer ample growth opportunities to the market players operating in the autonomous navigation market. Logistics is amongst the prominent industries in Asian economy due to rising e-commerce, however COVID-19 has impacted the supply chain of many industries. However, due to government’s measures to reduce the effects coronavirus outbreak by announcing lockdowns, travel and trade bans has disturbed the performance of supply chain to some extent. Disturbed logistics industry has witnessed minimal adoption of advanced technologies during the time of lockdown. It is expected that with business getting resumed, the adoption of autonomous technologies and systems such as autonomous navigation will increase to increase efficiency with minimal human intervention. All these measures are expected to have a negative impact on the demand of autonomous navigation in this region especially in 2020 and 2021.

Strategic insights for the Asia Pacific Autonomous Navigation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

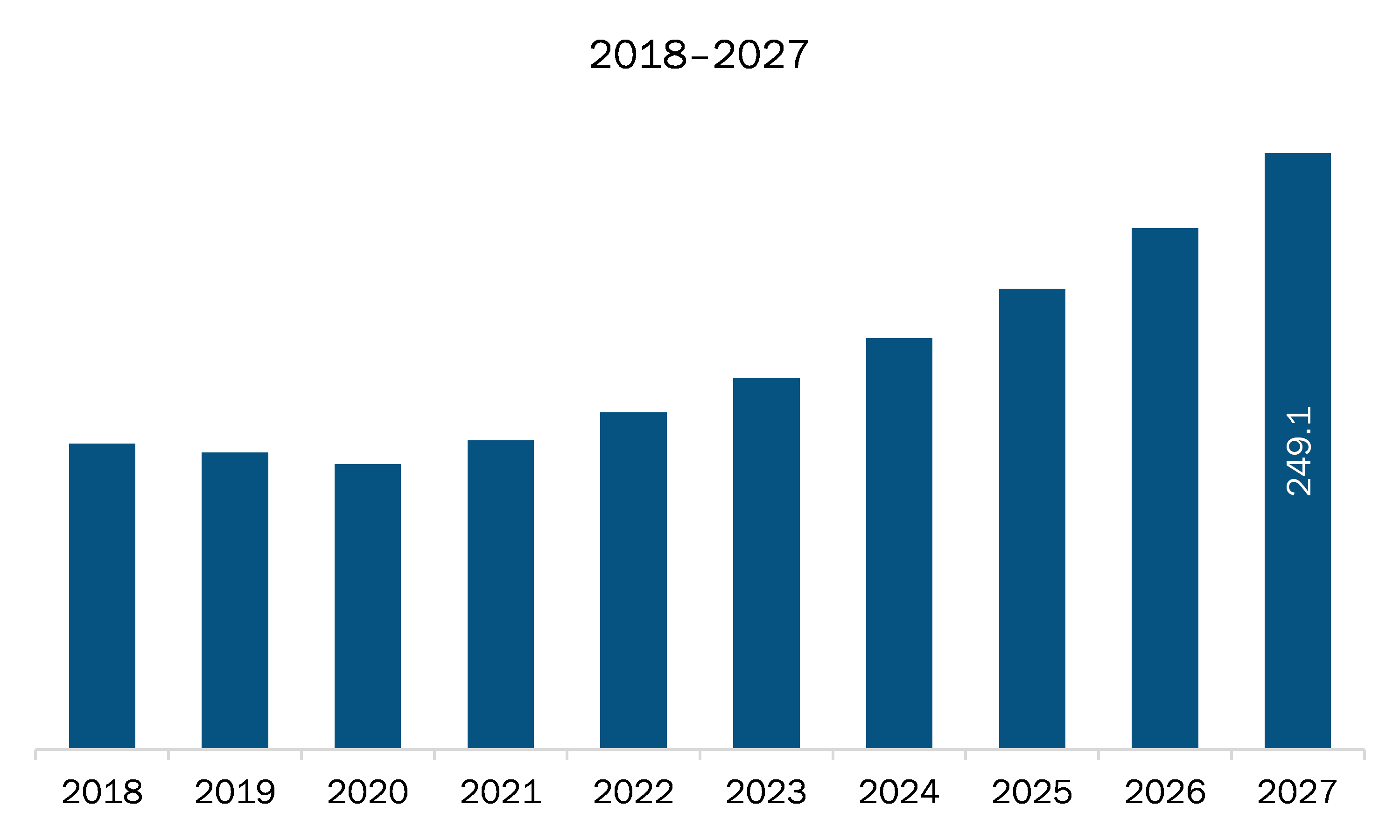

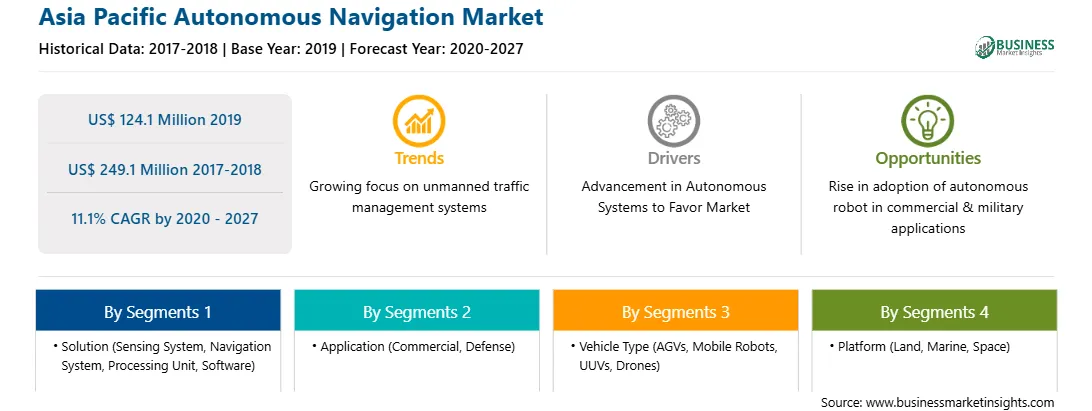

| Market size in 2019 | US$ 124.1 Million |

| Market Size by 2027 | US$ 249.1 Million |

| Global CAGR (2020 - 2027) | 11.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Solution

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Autonomous Navigation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The autonomous navigation market in APAC is expected to grow from US$ 124.1 million in 2019 to US$ 249.1 million by 2027; it is estimated to grow at a CAGR of 11.1% from 2020 to 2027. With growing industrial economies, the industries are integrating advanced technologies in their business process to optimize productivity. With a growing young and aging working population in industries, the need to incorporate autonomous technologies in the industrial sector is rising, intending to provide products on time. Therefore, industries such as logistics are inclined toward automation to develop automated guided vehicles (AVGs) for time management, accuracy, and productivity. With advancements in robotic technologies, the industrial sector, including logistics, is deploying automation to boost production quality with a better time management aspect.

In terms of solution, the sensing system segment accounted for the largest share of the APAC autonomous navigation market in 2019. In terms of application, the commercial segment held a larger market share of the APAC autonomous navigation market in 2019. Further, AGVs segment held a larger share of the market based on vehicle type in 2019. Also, on the basis of platform, land segment held largest market share in 2019.

A few major primary and secondary sources referred to for preparing this report on the autonomous navigation market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Brain Corporation; Collins Aerospace, a Raytheon Technologies Corporation Company; FURUNO ELECTRIC CO., LTD.; Kollmorgen; KONGSBERG; Trimble Inc.; YUJIN ROBOT Co., Ltd.

Some of the leading companies are:

The Asia Pacific Autonomous Navigation Market is valued at US$ 124.1 Million in 2019, it is projected to reach US$ 249.1 Million by 2027.

As per our report Asia Pacific Autonomous Navigation Market, the market size is valued at US$ 124.1 Million in 2019, projecting it to reach US$ 249.1 Million by 2027. This translates to a CAGR of approximately 11.1% during the forecast period.

The Asia Pacific Autonomous Navigation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Autonomous Navigation Market report:

The Asia Pacific Autonomous Navigation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Autonomous Navigation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Autonomous Navigation Market value chain can benefit from the information contained in a comprehensive market report.