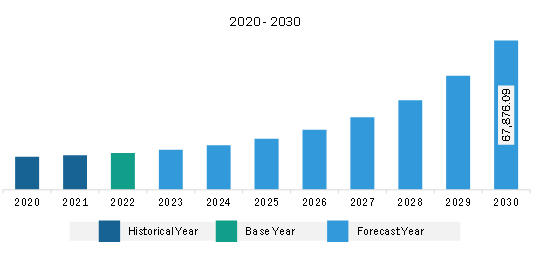

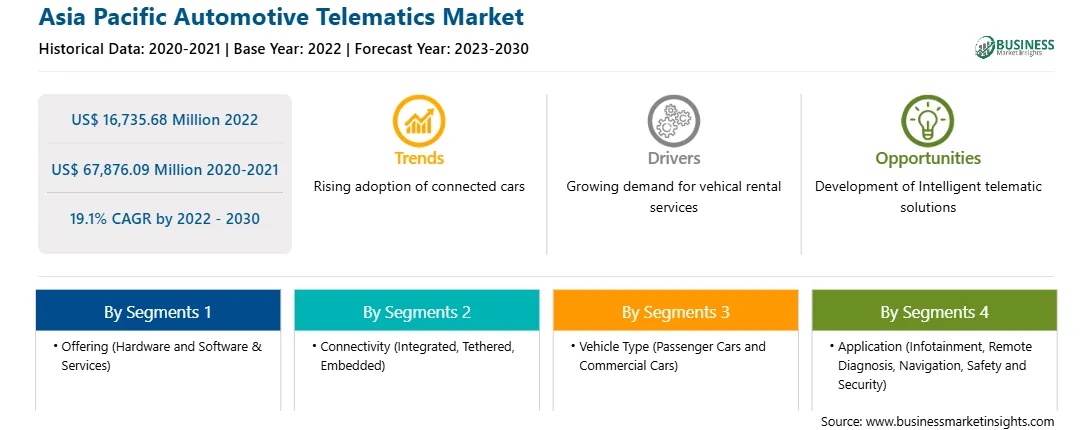

The Asia Pacific automotive telematics market was valued at US$ 16,735.68 million in 2022 and is expected to reach US$ 67,876.09 million by 2030; it is estimated to register a CAGR of 19.1% from 2022 to 2030.

Mounting Adoption of IoT and AI in Fleet Management Boosts Asia Pacific Automotive Telematics Market

IoT-enabled telematic devices optimize customer services and enhance vehicle maintenance management. With an IoT-integrated automotive telematics platform, communication and data retrieval become easy via smartphone applications and help in condition monitoring of the vehicle. Several companies are adopting the Sixt, and mobility service providers have adopted IoT-enabled automotive telematics systems via applications to optimize business operations. With this, app, customers connected more than 280,000 vehicles and connected with around 1.5 million drivers across 110 countries globally. The rising adoption of IoT and connected cars is a major trend in the Asia Pacific automotive telematics market. Several leading players are partnering with IoT solutions providers to enhance automotive capabilities. For instance, Aeris IoT and Sify solution provider integrated their IoT solutions for connected cars that minimize idle time and offer real-time vehicle tracking. Aeris IoT solutions providers have integrated the IoT Network, and the company has optimized more than 600 carriers across 190 countries. Further, Axon Telematics, a supplier of telematics solutions, partnered with Aeris to deploy an automotive telematics product to manage the real-time vehicle location. Axon deployed its product that collects drivers' behavior data to help insurers determine the vehicle's real-time location and provides a self-activation and self-installation system for vehicle policyholders. The logistics and transportation industry is implementing IoT for real-time vehicle location tracking. The growing adoption of smart tracking and environment monitoring (STEM) devices among consumers and transportation companies drives the growth of the Asia Pacific automotive telematics market. IoT-enabled devices track real-time GPS locations and help manage ambient temperature, pressure, humidity, goods mishandling, and several other parameters. It assures the smooth handling of goods throughout the transportation supply chain. Further, rising advancements in telematics gateways helped transportation and logistics companies optimize routing for better efficiency, monitoring the fleet's health, and improving the overall safety of the drivers.

Asia Pacific Automotive Telematics Market Overview

Asia Pacific is home to one of the most dynamic and rapidly evolving automotive industries worldwide. As the world's largest and most populous region, it encompasses a diverse landscape of automotive manufacturers, from established giants to emerging players. Within this automotive sector, the connected vehicle industry is gaining significant traction and reshaping how people interact with their vehicles and the transportation ecosystem. Leading automakers across the region, including Toyota, Hyundai, and BYD, are investing heavily in integrating advanced connectivity features into their vehicles. For instance, Toyota Corporation invested US$ 600 million in China's mobility technology company, DiDi Global. These companies are installing telematics solutions to track the vehicle's location and improve fuel efficiency. BYD and Toyota Corporations are offering fully connected vehicles for their premium vehicle models. These vehicles consist of several features including infotainment systems, GPS tracking, and other automotive telematics components.

Major countries such as China and India are actively promoting electric mobility, providing incentives for electric vehicle adoption, and supporting the development of charging infrastructure.

The robust digital infrastructure in the region, including the deployment of 5G networks, further accelerates the growth of the Asia Pacific automotive telematics market. With high-speed, low-latency connectivity, vehicles can access real-time data, receive over-the-air updates, and communicate seamlessly with other vehicles and infrastructure.

The region has a strong automotive sector, supported by the growing automotive manufacturing industry in countries such as India, China, and South Korea. Countries such as India, China, South Korea, and Japan are among the leading vehicle manufacturing countries worldwide. An increase in the number of car manufacturers and the presence of a strong automotive sector drive the Asia Pacific automotive telematics market in the region. In APAC, China is the largest market owing to its leading automotive sector. Also, the rise in automotive sales propels the demand for automotive telematics. Growing adoption of advanced technologies and increasing demand for using unpowered trailers and caravans accelerate the Asia Pacific automotive telematics market growth.

Asia Pacific Automotive Telematics Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific Automotive Telematics provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 16,735.68 Million |

| Market Size by 2030 | US$ 67,876.09 Million |

| Global CAGR (2022 - 2030) | 19.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Automotive Telematics refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Verizon Communications Inc

2. Geotab Inc.

3. Omnitracs LLC

4. Samsara Inc

5. Motive Technologies Inc

6. ORBCOMM Inc

7. Trimble Inc

8. Valeo SE

9. TomTom NV

10. Denso Corp

11. Luxoft Switzerland AG

12. Harman International Industries Inc

The Asia Pacific Automotive Telematics Market is valued at US$ 16,735.68 Million in 2022, it is projected to reach US$ 67,876.09 Million by 2030.

As per our report Asia Pacific Automotive Telematics Market, the market size is valued at US$ 16,735.68 Million in 2022, projecting it to reach US$ 67,876.09 Million by 2030. This translates to a CAGR of approximately 19.1% during the forecast period.

The Asia Pacific Automotive Telematics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Automotive Telematics Market report:

The Asia Pacific Automotive Telematics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Automotive Telematics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Automotive Telematics Market value chain can benefit from the information contained in a comprehensive market report.