Based on country, the APAC automotive radar market is segmented into Australia, China, India, Japan, and South Korea. APAC is estimated to hold the largest market share throughout the forecast period. Moreover, the region is also anticipated to grow at the highest CAGR rate. The presence of vast automotive manufacturing industry in the region, particularly in China, is fueling the automotive radar market growth in the region. Moreover, rising awareness among the middle-class population regarding vehicle safety is another significant factor propelling radar systems' deployment in mid-range passenger cars. The demand for automotive radars in APAC is bolstered by the stringent government regulations on vehicle safety. Moreover, countries such as Japan and India manufacturers of the premium cars. Also, the automotive industry in APAC significantly invests in R&D on autonomous vehicles, which is bolstering the growth of the market. APAC countries are increasingly implementing intelligent transport systems (ITS) as they improve road safety, ensure smoother traffic, reduce environmental burdens, and stimulate regional economic activity. The advancements in transportation systems, along with the mounting importance of car safety, are propelling the adoption of advanced technologies such as automotive radar in vehicles. Also, high resolution radar systems coming into limelight is going to bolster the demand for automotive radar in the coming years, which is further anticipated to drive the APAC automotive radar market.

The APAC region constitutes the world’s two most populated countries as well as manufacturing hubs across India and China. The China region virtually imposed strict lockdown and social isolation, which almost halted the manufacturing and production of numerous automotive OEMs and OESs for several weeks resulting in shrinking market demand. Moreover, the country also isolated its import as well as the export of critical raw materials and components for numerous automotive vehicles impacting the supply chain of various end-user industries. Similarly, India also imposed a nationwide lockdown to mitigate the growing COVID-19 cases across the country. As a result, the subsequent lockdown and disruption of numerous industrial equipment across China and India have contributed significantly to negatively impacting the automotive radar market growth across the APAC region. The closure of several wholesalers, distributors, and sales representatives has also witnessed limited availability of automotive aftermarket products or their related components from other European and North American-based market players. After a prolonged lockdown, various countries have started easing the restrictions. For instance, the government of India started the unlock phase in which it allowed the manufacturing activities to resume. The COVID–19 pandemics will have a short-term impact on the APAC automotive radar market; however, the market will recover in the coming years.

Strategic insights for the Asia-Pacific Automotive Radar provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 1,722.3 Million |

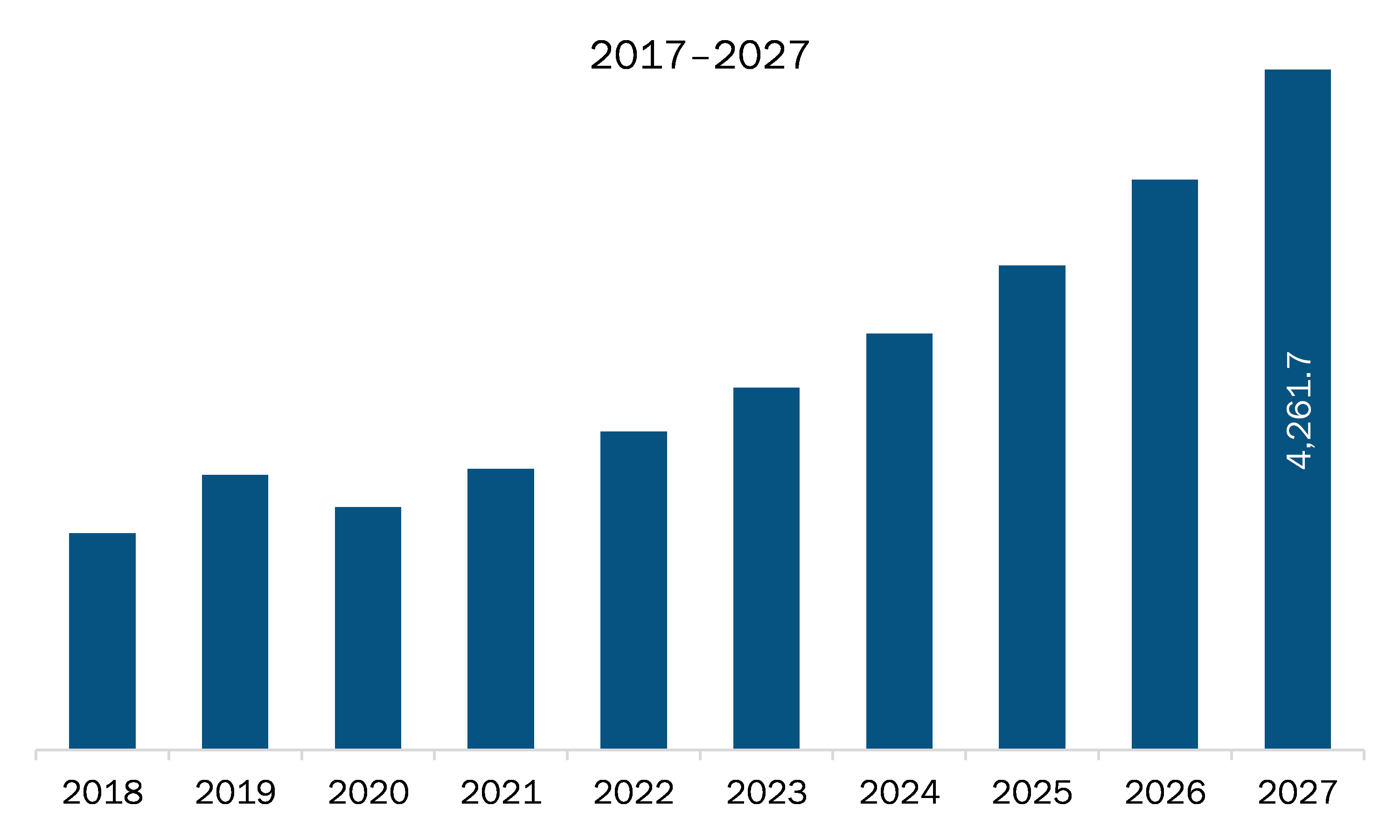

| Market Size by 2027 | US$ 4,261.7 Million |

| Global CAGR (2020 - 2027) | 15.9% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Range

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia-Pacific Automotive Radar refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The automotive RADAR market in APAC is expected to grow from US$ 1,722.3 million in 2019 to US$ 4,261.7 million by 2027; it is estimated to grow at a CAGR of 15.9% from 2020 to 2027. With the mounting number of level 2+ vehicles on road, the need for advanced and more accurate automotive radar sensors is increasing. This acts as a huge opportunity for OEMs offering basic-level radar sensors. For instance, Xilinx and Continental announced the first production-ready 4D imaging radar. Theoretically, 4D imaging radar uses echolocation (mechanism that is observed in dolphins, bats, and several humans) and the time-of-flight measurement principle to capture a space in 3D. Furthermore, these radar systems are designed fulfill the imaging requirements within the time scale of a fast-moving automobile or a zooming drone. Therefore, the fourth dimension enhances the overall accuracy in a self-driving system. The 4D imaging radar is operational in all types of whether/environment conditions, including fog, darkness, and heavy rains. Numerous companies are investing in R&D to introduce such advanced radar-based imaging technologies and gain a maximum share in the APAC automotive radar market.

Based on range, the short range radar segment is expected to lead the market throughout the forecast period. By frequency, 24 GHz is expected to dominate the market in 2019; however, the 77 GHz is anticipated to attain the highest market share by frequency by 2027. By Application, the adaptive cruise control segment is anticipated to dominate the market by 2027. The passenger cars segment is expected to hold over 70% of the market share based on vehicle type from 2019 to 2027.

A few major primary and secondary sources referred to for preparing this report on the automotive radar market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are APAC automotive radar market. Aptiv Plc; Continental AG; Denso Corporation; HELLA KGaA Hueck & Co.; Nidec Corporation; Robert Bosch GmbH; Tung Thih Electronic Co Ltd; Valeo; Veoneer Inc; ZF Friedrichshafen AG.

The Asia-Pacific Automotive Radar Market is valued at US$ 1,722.3 Million in 2019, it is projected to reach US$ 4,261.7 Million by 2027.

As per our report Asia-Pacific Automotive Radar Market, the market size is valued at US$ 1,722.3 Million in 2019, projecting it to reach US$ 4,261.7 Million by 2027. This translates to a CAGR of approximately 15.9% during the forecast period.

The Asia-Pacific Automotive Radar Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Automotive Radar Market report:

The Asia-Pacific Automotive Radar Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Automotive Radar Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Automotive Radar Market value chain can benefit from the information contained in a comprehensive market report.