Governments, private companies, and industry players have substantially invested in the development of EVs and innovative features of EVs to decrease the reliability on fossil fuel vehicles. To meet the diverse needs of EV users, manufacturers such as WAI, Leoni, and Green Cell have introduced a range of EV charging cables. These cables adhere to different charging standards and specific power transmission requirements, making them compatible with vehicles of Audi, BMW, Tesla, and other well-known brands. Manufacturers have obtained TUV certification for their cables, ensuring safety and quality standard compliance. Extension cables have also been introduced, extending existing charging cables and enhancing convenience for EV owners. These new features introduced in high voltage cables help reduce charging time and minimize power losses during transmission.

Additionally, new features such as liquid-cooled solutions and improved durability have increased the performance and reliability of the cables. As the world transitions toward a greener and sustainable future, governments across the world recognize the importance of promoting EV adoption and reducing emissions. They are investing in expanding alternatives to conventional automotive options. With anticipated technological advancements, policy changes, and market dynamics further shaping the industry. Therefore, there will be a rising demand for high voltage cables with innovative features ensuring safer and higher performance in the coming years.

Asia Pacific is witnessing rapid economic growth and an increase in the disposable incomes of middle-class consumers, which are the prominent factors responsible for the surge in demand for electric vehicles. Several Asia Pacific countries, including China, witnessed a rise in EV adoption, while others are in the preliminary stages of the transition. In developing countries, many barriers, such as high acquisition costs, the need for new safety and technical standards, and costs for developing charging infrastructure, are hampering the adoption of EVs. Asia Pacific experienced one of the leading global e-mobility revolutions, which created huge opportunities for market players to reduce air pollution and raise the quality of public transport in the region. Governments of various countries in Asia Pacific are taking various initiatives on electric mobility. In August 2022, The Economic and Social Commission of Asia and Pacific (ESCAP) launched an initiative on electric mobility to promote the growth of electric mobility in public transport to reduce vehicle emissions and dependence on fossil fuels for transport operations.

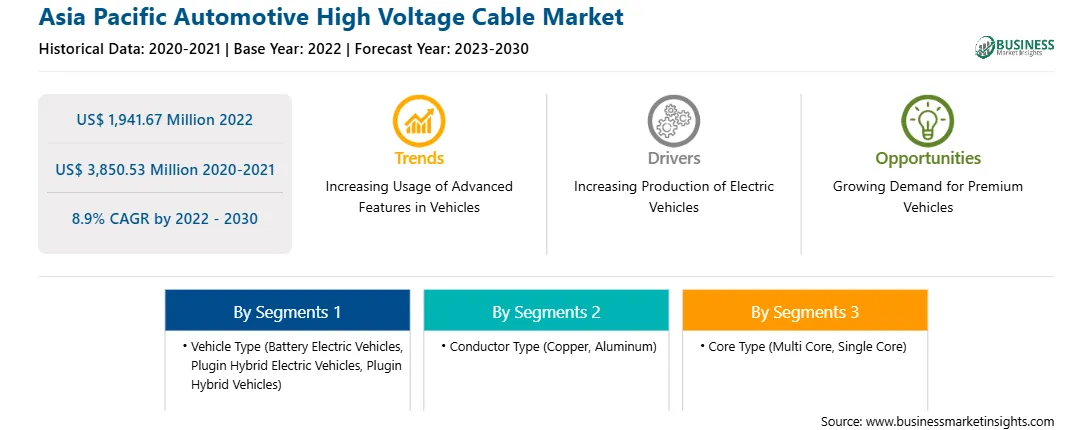

The Asia Pacific automotive high voltage cable market is segmented into vehicle type, conductor type, core type, and country.

Based on vehicle type, the Asia Pacific automotive high voltage cable market is segmented into battery electric vehicles (BEV), plugin hybrid electric vehicles (PHEV), plugin hybrid vehicles (PHV). The battery electric vehicles (BEV) segment held the largest market share in 2022.

Based on conductor type, the Asia Pacific automotive high voltage cable market is bifurcated into copper and aluminum. The copper segment held a larger market share in 2022.

Based on core type, the Asia Pacific automotive high voltage cable market is segmented into multi core and single core. The multi core segment held a larger market share in 2022.

Based on country, the Asia Pacific automotive high voltage cable market is segmented into China, Japan, South Korea, India, and the Rest of Asia Pacific. China dominated the Asia Pacific automotive high voltage cable market in 2022.

ACOME Co, Coroplast Fritz Muller GmbH & Co KG, Huber+Suhner AG, JYFT, LEONI AG, Prysmian SpA, Shanghai KMCable Group Co Ltd, and Sumitomo Electric Industries Ltd are some of the leading companies operating in the Asia Pacific automotive high voltage cable market.

Strategic insights for the Asia Pacific Automotive High Voltage Cable provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,941.67 Million |

| Market Size by 2030 | US$ 3,850.53 Million |

| Global CAGR (2022 - 2030) | 8.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Automotive High Voltage Cable refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific Automotive High Voltage Cable Market is valued at US$ 1,941.67 Million in 2022, it is projected to reach US$ 3,850.53 Million by 2030.

As per our report Asia Pacific Automotive High Voltage Cable Market, the market size is valued at US$ 1,941.67 Million in 2022, projecting it to reach US$ 3,850.53 Million by 2030. This translates to a CAGR of approximately 8.9% during the forecast period.

The Asia Pacific Automotive High Voltage Cable Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Automotive High Voltage Cable Market report:

The Asia Pacific Automotive High Voltage Cable Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Automotive High Voltage Cable Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Automotive High Voltage Cable Market value chain can benefit from the information contained in a comprehensive market report.