In the last two decades, autonomous driving has progressed from science fiction to a plausible prospect due to significant advancements in the radar technology and computer capability. Further, the portable technology has flourished to the point that ultralight electronics can make judgments based on self-improving algorithms, enabling engineers to emulate human decision-making in the design of autonomous vehicles. Furthermore, the next generation of completely autonomous cars would necessitate extremely intelligent systems that will be significantly more sophisticated than the existing embedded systems. These automobiles would require the functioning of multiple complicated artificial intelligence (AI) software and systems for navigation, road and vehicular awareness, traffic patterns, pedestrian awareness, and danger awareness and assessment systems, among others, on their computing systems. The process of addressing these computational and intelligence needs is likely to give rise to a new generation of embedded processors in the future, which would prove as a significant opportunity for the automotive embedded systems market players during the forecast period.

The COVID-19 epidemic has been a headache for Asian automakers. The widespread suspension strategy of Asian carmakers threatens to stifle metal and petrochemicals demand from the industry. Furthermore, in terms of automotive production, China is the biggest car market, and Wuhan, which is a center of an outbreak, which is also called as a “motor city”. The city is home to auto plants such as Peugeot Group, Honda, General Motors, Nissan, and Renault. For instance, Honda alone in Wuhan accounts for ~50% of total production in China. Also, Hubei Province, a Capital of Wuhan, was the 4th largest car producer in China in 2019. The SARS-CoV-2 pandemic has interrupted business operations of various manufacturing businesses, including automotive. As a result, the COVID-19 has impacted the region's automotive sector, but ongoing vaccine campaigns are bringing back on the right path, which is a good indication of the gradual progress of embedded system manufacturers.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the APAC automotive embedded system market. The APAC automotive embedded system market is expected to grow at a good CAGR during the forecast period.

Strategic insights for the Asia Pacific Automotive Embedded System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

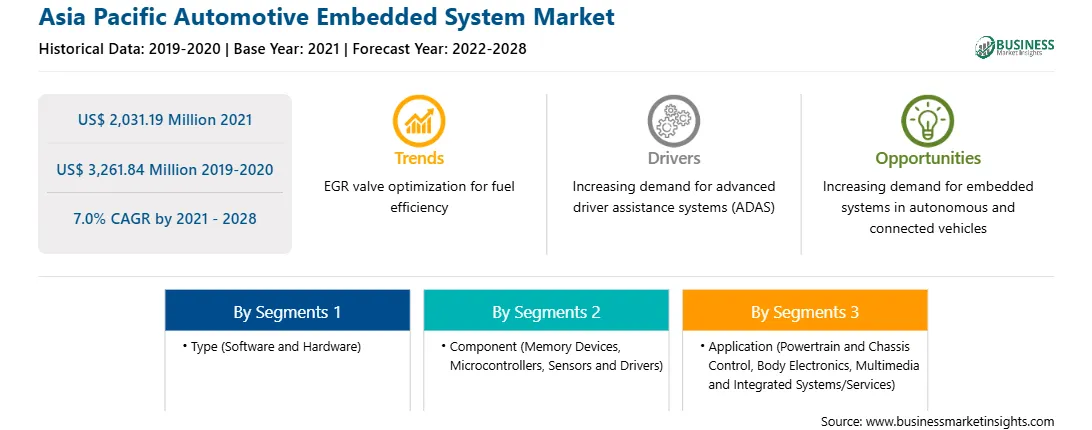

| Market size in 2021 | US$ 2,031.19 Million |

| Market Size by 2028 | US$ 3,261.84 Million |

| Global CAGR (2021 - 2028) | 7.0% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Automotive Embedded System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific Automotive Embedded System Market is valued at US$ 2,031.19 Million in 2021, it is projected to reach US$ 3,261.84 Million by 2028.

As per our report Asia Pacific Automotive Embedded System Market, the market size is valued at US$ 2,031.19 Million in 2021, projecting it to reach US$ 3,261.84 Million by 2028. This translates to a CAGR of approximately 7.0% during the forecast period.

The Asia Pacific Automotive Embedded System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Automotive Embedded System Market report:

The Asia Pacific Automotive Embedded System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Automotive Embedded System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Automotive Embedded System Market value chain can benefit from the information contained in a comprehensive market report.