Asia Pacific is marked by several of vigorously growing economies with huge population size, particularly India and China. Increased population reflects in a high demand for effective and safe mobility solutions. A few of the world's most valuable vehicle manufacturers, such as Toyota, Honda, Tata, and Hyundai, are concentrated in this region. Notably, the automotive sector, including motor vehicles and components manufacturers, generates enormous revenue through the sales of passenger cars and commercial vehicles in the region; moreover, the high production capabilities of automotive manufacturers support this sales performance. Additionally, several manufacturers of automotive ECUs are investing heavily in the research and development to adapt to the pace of the evolving market. For instance, Vitesco Technologies, a spin-off from Continental AG, has expanded its R&D capacities in China through a new research and development center in Tianjin, China, aiming to develop and test electrified drive systems. The vision behind the expansion is to create a solid base of hybrid and electrified drive technologies for the region. Burgeoning sales of premium cars and surging sales of SUV are the major factor driving the growth of the APAC automotive ECU market.

In case of COVID-19, APAC is highly affected specially India. The containment measures imposed by governments in APAC have hindered the growth of the automotive and electronics sectors. China is a manufacturing hub and is among the countries that were hit by SARS-CoV-2 in early stages, which has ultimately impacted the production of automotive and electronics equipment. Further, interruptions in supply chains and logistics have adversely affected the procurement rate of various automotive and electronics equipment, including hardware components of automotive ECUs. India, South Korea, Japan, Vietnam, etc., have witnessed a sharp decline in the production of ICE and electric vehicles. APAC is an also a global manufacturing hub with countries such as China, Japan, South Korea, and India leading the global manufacturing sector. The ongoing COVID-19 is anticipated to cause huge disruptions in the growth of various industries in the region. China is the largest raw material supplier for various industries in the world. Thus, a disturbed supply of raw materials and components from China and other Asian countries is limiting the growth of the automotive ECU market.

Strategic insights for the Asia Pacific Automotive ECU provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

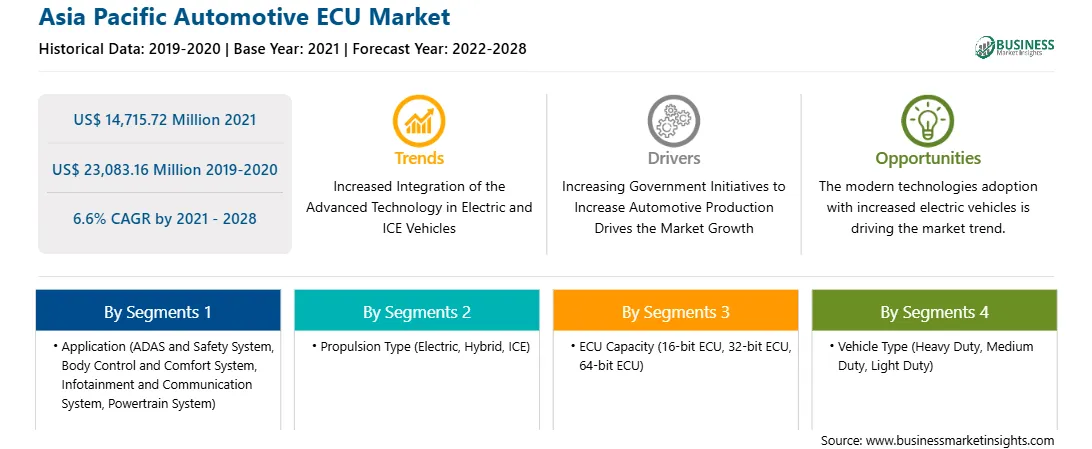

| Market size in 2021 | US$ 14,715.72 Million |

| Market Size by 2028 | US$ 23,083.16 Million |

| Global CAGR (2021 - 2028) | 6.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Automotive ECU refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC automotive ECU market is expected to grow from US$ 14,715.72 million in 2021 to US$ 23,083.16 million by 2028; it is estimated to grow at a CAGR of 6.6% from 2021 to 2028. The adoption of buses and trucks, specifically for logistics and public transportation purposes, is on the rise across the region. The growing population in urban areas demands expanded public transportation with improvements in existing transportation infrastructure, proving to be insufficient. The OEMs across the region are now focusing on reducing the global carbon footprint by encouraging the use of electric vehicles. With the growing mobility on demand, passenger car and taxi manufacturers are focusing more on deploying greener technologies in these vehicles. This drives them to the field of electrification of vehicles, specifically passenger cars. Several countries across the region are highly focused on building green transportation. Several countries across the region are likely to continue to enhance public transportation facilities and information systems to support the adoption of the same. The governments across different countries are offering tax rebates and incentives to boost the adoption of electric vehicles such as e-trucks and e-buses in their public transport to reduce CO2 emissions. Electric vehicle models available in the automotive market are the BYD K9, Mercedes Benz electric truck, and Tata Starbus Hybrid e-buses, among others. Recently, a few of commercial vehicle manufacturers have announced electric buses, whereas several OEMs have announced plans to migrate full-size trucks or pickup trucks to battery EV platforms. These factors are expected to create enormous opportunities for the implementation of new technologies such as automotive ECU in the coming years across APAC region.

In terms of application, the ADAS and Safety System segment accounted for the largest share of the APAC automotive ECU market in 2020. In terms of propulsion type, the ICE segment held a larger market share of the APAC automotive ECU market in 2020. In terms of ECU capacity, the 32-bit ECU segment held a larger market share of the APAC automotive ECU market in 2020. Further, the light duty segment held a larger share of the APAC automotive ECU market based on vehicle type in 2020.

A few major primary and secondary sources referred to for preparing this report on the APAC automotive ECU market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Aptiv PLC; Continental AG; Denso Corporation; Hitachi, Ltd.; Mitsubishi Electric Corporation; Pektron; Robert Bosch GmbH; TRANSTRON Inc.; Veoneer Inc; and ZF Friedrichshafen AG among others.

The Asia Pacific Automotive ECU Market is valued at US$ 14,715.72 Million in 2021, it is projected to reach US$ 23,083.16 Million by 2028.

As per our report Asia Pacific Automotive ECU Market, the market size is valued at US$ 14,715.72 Million in 2021, projecting it to reach US$ 23,083.16 Million by 2028. This translates to a CAGR of approximately 6.6% during the forecast period.

The Asia Pacific Automotive ECU Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Automotive ECU Market report:

The Asia Pacific Automotive ECU Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Automotive ECU Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Automotive ECU Market value chain can benefit from the information contained in a comprehensive market report.