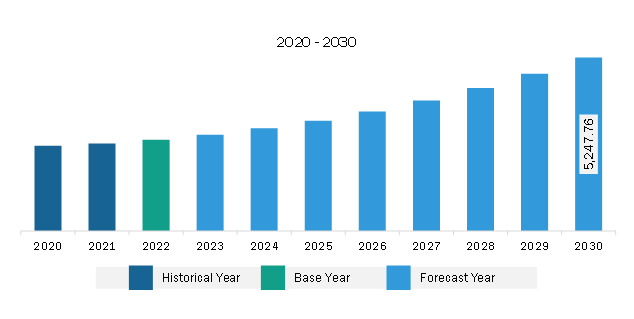

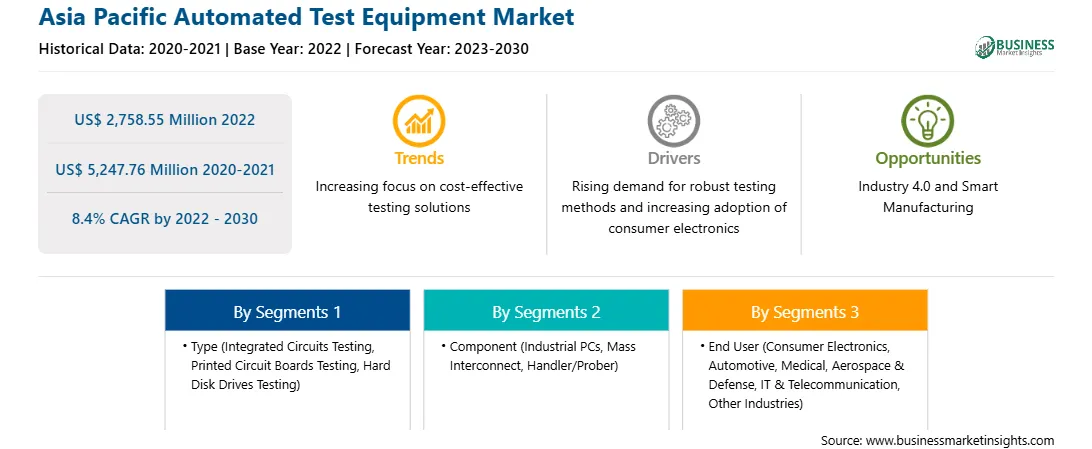

The Asia Pacific automated test equipment market was valued at US$ 2,758.55 million in 2022 and is expected to reach US$ 5,247.76 million by 2030; it is estimated to register a CAGR of 8.4% from 2022 to 2030.

Evolution of IoT and Connected Devices Boosts Asia Pacific Automated Test Equipment Market

The evolution of IoT enables devices to be connected over the Internet. For instance, according to Cisco Systems, Inc., nearly two-thirds or 66% of the global population will have Internet access, reaching 5.3 billion of total Internet users by the end of 2023. The rapid growth of data traffic over the Internet is attributed to the rising penetration of smartphones, smartwatches, and other consumer electronic devices that can be connected over the Internet, increasing the popularity of IoT.

Strong internet infrastructural deployments in advanced countries coupled with the development of advanced infrastructures such as 5G, fiber optic cables, and wireless connectivity are establishing new use cases, including Fixed Wireless Access, Critical IoT, and Massive IoT. Growing advancements in internet technology are driving businesses to harness the best out of the presented opportunity and maximize revenue generation streams. It is estimated that each individual will have close to a dozen devices that will be connected to the Internet by 2020. As per Ericsson's latest mobility report, the number of mobile subscriptions has reached 59 billion in the first quarter of 2023. The number of mobile broadband subscriptions is growing at 89% percent year-on-year, reaching a total of 65 million in the first quarter of 2023. The growing number of mobile subscriptions associated with inactive subscriptions, optimization of subscriptions for different types of calls, and multiple device ownership. A huge population from countries such as India and China are highly adopting smartphones and other consumer electronic devices, which is projected to create opportunities in the market. Additionally, significant initiatives taken by the government toward the digitalization of economies in developing countries such as India, and Japan are creating a larger number of data traffic over the Internet. Moreover, countries such as Singapore are also experiencing rapid growth in digitalization, resulting in a huge influx of data over the Internet.

Growing awareness related to the benefits provided by advanced technologies such as IoT, communications, and sensors is paving the way for the integration of sensors into the devices, creating opportunities for the automated test equipment market growth. Several industries, such as consumer electronics, automotive, healthcare, and aerospace & defense, are adopting automated testing equipment to automate and transform numerous business functions such as supply chain planning and logistics and manufacturing across industries for increasing profitability. The growth of automated test equipment in the various end user industries is anticipated to rise at a rapid rate in the coming years, with IoT gaining more prominence in the coming years.

Asia Pacific Automated Test Equipment Market Overview

Asia Pacific consists of many developing countries such as China, Japan, India, and South Korea, which have witnessed high growth in their manufacturing industries in recent years. Asia Pacific is on the verge of becoming a global manufacturing hub with the presence of diverse manufacturing industries, including electronics, automotive, and petrochemical production businesses. China is evolving into a high-skilled manufacturing hub, followed by other developing countries such as India, South Korea, Vietnam, and Taiwan. Governments of several Asia Pacific countries are offering tax rebates, funds, subsidies, etc., to attract manufacturing companies to set up plants in their respective countries. Initiatives such as Made in China 2025 and Make in India propel the growth of the manufacturing industry in the respective countries.

China is the largest producer of passenger cars in the world, followed by Japan, India, and South Korea. This would further propel the automated test equipment market growth in the country. Also, the consumer electronics manufacturing industry in Asia Pacific is leading globally. The presence of these industries is anticipated to influence the ATE market positively. On the other hand, China, which is the largest manufacturing hub, is experiencing a rise in the country's labor cost owing to the aging population of the country. As a result, manufacturing enterprises from developed countries are seeking to make investments in other Southeast Asian countries to take advantage of improving infrastructure, rising domestic consumption, and lower costs in these countries.

Additionally, many of the economies of Asia Pacific are embracing digitalization by adopting modern trends such as autonomous vehicles, smart cities, and IoT to become global powers. Asia Pacific presents strong business opportunities for investment in 5G technology amid the rapid-paced digital transformation in countries in this region, especially for investors seeking to avoid high operating costs in the US. 5G deployment trials have already commenced in Asian countries. According to the GSM Association, the adoption of 5G technology would cost over US$ 133 billion to the Asia Pacific economy by 2030. Countries such as South Korea, China, Japan, and India have already adopted 5G technology to transform their manufacturing facilities. Device compliance is another major factor that drives the deployment of 5G in Asia. Device manufacturers such as ZTE have unveiled 5G-ready smartphones, further defining Asia's leadership in 5G development. The percentage of 5G trials conducted in Asia Pacific accounts for nearly 50% of the global number. Over 30 operators in Asia Pacific are testing 5G, with 9 involved in field trials-including SK Telecom, KT, and LG Uplus in South Korea; China Mobile and China Unicom; and NTT Docomo in Japan. Such developments in 5G infrastructure are likely to create a demand for ATE in Asia Pacific in the coming years.

Asia Pacific Automated Test Equipment Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific Automated Test Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,758.55 Million |

| Market Size by 2030 | US$ 5,247.76 Million |

| Global CAGR (2022 - 2030) | 8.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Automated Test Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Advantest Corp

2. Anritsu Corp

3. Averna Technologies Inc

4. Chroma ATE Inc.

5. Exicon Co., Ltd

6. National Instruments Corp

7. SPEA S.p.A.

8. Teradyne Inc

9. Test Research, Inc.

The Asia Pacific Automated Test Equipment Market is valued at US$ 2,758.55 Million in 2022, it is projected to reach US$ 5,247.76 Million by 2030.

As per our report Asia Pacific Automated Test Equipment Market, the market size is valued at US$ 2,758.55 Million in 2022, projecting it to reach US$ 5,247.76 Million by 2030. This translates to a CAGR of approximately 8.4% during the forecast period.

The Asia Pacific Automated Test Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Automated Test Equipment Market report:

The Asia Pacific Automated Test Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Automated Test Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Automated Test Equipment Market value chain can benefit from the information contained in a comprehensive market report.