Market Introduction

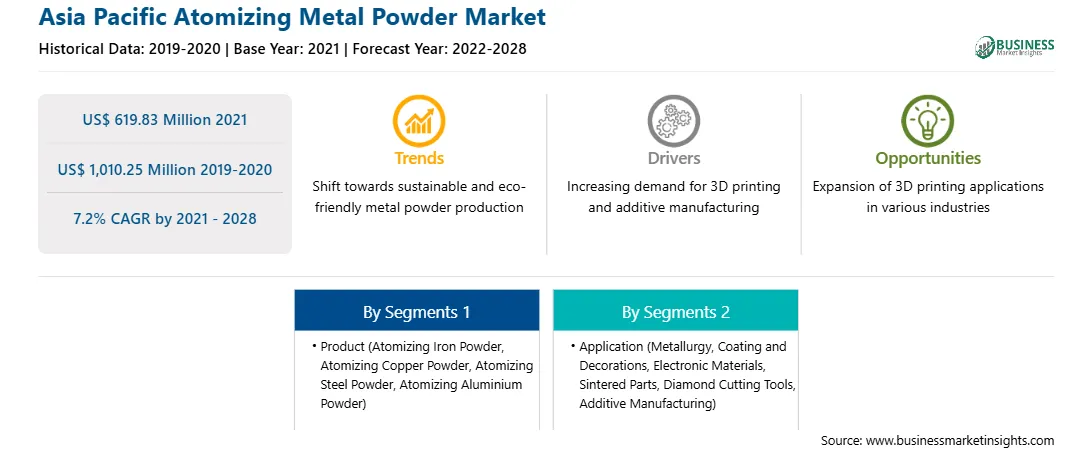

The atomizing metal powder market in APAC comprises several economies such as China, India, Japan, South Korea, Australia, and Rest of APAC. These countries are witnessing an upsurge due to growth in urbanization, increasing manufacturing industries coupled with growing industrialization which offers ample opportunities for key market players in the atomizing metal powder market. The APAC region encompasses an ample number of opportunities for the growth of atomizing metal powder. Rising foreign direct investments also lead to economic growth in the region. The growing number of atomizing metal powders uses in numerous applications including metallurgy, coating & decorations, electronic materials, sintered parts, diamond cutting tools, and others is anticipated to increase the atomizing metal powder demand in the APAC region. Furthermore, the increasing projects in the field of electrification coupled with the growth of the electronics industry in the APAC provide lucrative opportunities for the growth of the atomizing metal powder market. According to The Association of Southeast Asian Nations (ASEAN), the electronics industry accounts for 20 percent to 50 percent of the total value of exports of most countries in Asia. Malaysia has grown to become a primary global production hub with various electronic manufacturing services companies. Malaysia’s electronic and electric industry in recent years has grown to over 1,695 companies with a total investment of nearly US$ 35.5 billion and a workforce of over 600,000 people. Moreover, the rising automotive sales in the APAC (APAC) countries, including India and China, has been one of the most encouraging growth factors for the atomizing metal powder market in recent years.

In case of COVID-19, APAC is highly affected specially India. The governments of various APAC economies are taking possible steps to restrict the spread of the virus by announcing country-wide lockdown, which has a direct impact upon the growth of industrial sectors. This may impact the demand for atomizing metal powders. The various end-use sectors such as sintered parts, powder metallurgy, additive manufacturing, etc. have been hit hard by the pandemic, creating an impact on the consumption of atomizing metal powders in the region. The automotive industry is one of the major end-users of metal powders. China leads the automotive industry both in terms of production and consumption. In the automotive industry, consumer demand has declined dramatically. Moreover, the closure of manufacturing plants has declined the sales of metal powders. The growth of atomizing metal powder market has been severely affected by dwindling sales of vehicles amid the COVID-19 pandemic. The pandemic has also caused fluctuations in the prices of raw materials. However, as the logistics industry is resuming its operations, the production of metal powders in the region is increasing gradually. The growing electronics industry will further fuel the adoption of metal powders in post-pandemic times. The market is expected to witness an increase in investment by players to tap the prevailing opportunities as well as cater to expanding demand for atomizing metal powder in post-pandemic times.

Strategic insights for the Asia Pacific Atomizing Metal Powder provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Atomizing Metal Powder refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Atomizing Metal Powder Strategic Insights

Asia Pacific Atomizing Metal Powder Report Scope

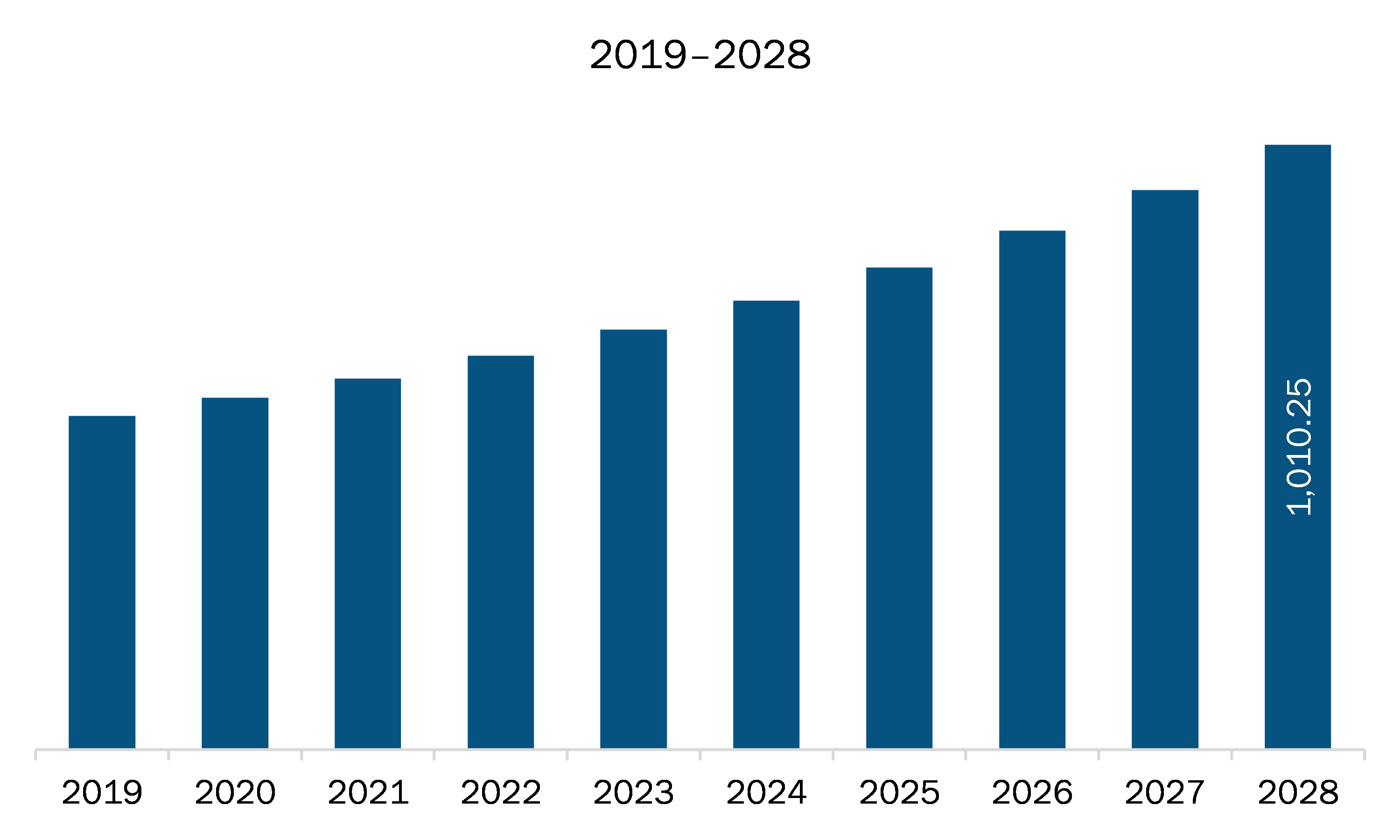

Report Attribute

Details

Market size in 2021

US$ 619.83 Million

Market Size by 2028

US$ 1,010.25 Million

Global CAGR (2021 - 2028)

7.2%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Product

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Atomizing Metal Powder Regional Insights

Market Overview and Dynamics

The APAC atomizing metal powder market is expected to grow from US$ 619.83 million in 2021 to US$ 1,010.25 million by 2028; it is estimated to grow at a CAGR of 7.2% from 2021 to 2028. The automobile industry is evolving due to the emerging new methods for vehicle components manufacturing. Conventional ways for producing vehicle parts are being reassessed due to the rising focus on e-mobility. The industry is adopting the changes to meet changing social needs, enhance vehicle performance, and reduce costs, in other words, to gain an edge in a competitive space. Many automakers address major issues, such as fuel consumption, carbon dioxide emissions, and energy diversification. The automotive industry is one of the most significant end-users of metal powders. There are three primary areas of application of metal powders in the industry, which comprise sintering, soldering, and additive manufacturing. Innovations in material development and pressing technique are directly responsible for expanding powder metal components in automobiles. Powder metallurgy has made a significant contribution to the technology used in automotive manufacturing. Powder metallurgy is a well-established green manufacturing technology to produce net-shape components. The ability to produce materials at a higher density and strength, the capability of producing increasingly complex parts, and the cost-effective manufacturing of auto components are a few advantages of powder metallurgy in the production of automotive parts. The potential to employ powder metallurgy to mass-produce reliable precision parts consistently at a low cost is highly appealing to the automotive sector. Moreover, environmental concerns are growing in the automotive industry. Technologies for reducing fuel consumption, such as lightweight technology and engine downsizing for environmentally friendly vehicles, have been rapidly developed. Powder metallurgy offers the ability to reduce part weight by adding lightning holes that reduce the part weight and lower overall material cost. Metal powder is widely used in the automotive industry as it helps reduce component weight by almost 50%. As light-weighting becomes vital to automotive manufacturers, the ability to customize material becomes advantageous. Metal powder manufacturers are benefiting from the growing demand for light-weighting metal parts in the automotive industry, which propels demand for atomizing metal powders across the APAC region.

Key Market Segments

In terms of product, the atomizing iron powder segment accounted for the largest share of the APAC atomizing metal powder market in 2020. In terms of application, the coating and decorations segment held a larger market share of the APAC atomizing metal powder market in 2020.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the APAC atomizing metal powder market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Advanced Technology & Materials Co., Ltd; GKN Sinter Metals Engineering GmbH; Höganäs AB; JFE GROUP; KOBE STEEL, LTD.; Kymera International; Makin Metal Powders (UK) Ltd; MITSUI MINING & SMELTING CO., LTD.; m-tec powder GmbH; Pometon S.p.A.; and Sandvik AB among others.

Reasons to buy report

APAC Atomizing Metal Powder Market Segmentation

APAC Atomizing Metal Powder Market - By Product

APAC Atomizing Metal Powder Market -

By Application

APAC Atomizing Metal Powder Market - By Country

APAC Atomizing Metal Powder Market - Company Profiles

The Asia Pacific Atomizing Metal Powder Market is valued at US$ 619.83 Million in 2021, it is projected to reach US$ 1,010.25 Million by 2028.

As per our report Asia Pacific Atomizing Metal Powder Market, the market size is valued at US$ 619.83 Million in 2021, projecting it to reach US$ 1,010.25 Million by 2028. This translates to a CAGR of approximately 7.2% during the forecast period.

The Asia Pacific Atomizing Metal Powder Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Atomizing Metal Powder Market report:

The Asia Pacific Atomizing Metal Powder Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Atomizing Metal Powder Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Atomizing Metal Powder Market value chain can benefit from the information contained in a comprehensive market report.