The growth of the market is due to the rising prevalence of asthma and the opportunities with commercialization of biologics are propelling the asthma drugs market growth. However, the unmet medical needs are hampering market growth.

Many asthma patients observed that identifying and avoiding triggers, taking a daily inhaled or oral controller drug, and utilizing a quick-relief inhaler when symptoms arise are enough to keep their asthma under control. However, these drugs are insufficient to treat asthma for some people. Several novel drugs, namely "biologics," have recently been licensed for the treatment of moderate-to-severe asthma. Biologics are different from other medications as it targets a specific antibody, molecule, or cell involved in asthma. As a result, biologics are called precision or personalized therapy.

A biologic is a drug derived from the cells of a live organism, such as bacteria or mice, tailored to target specific molecules in humans. Antibodies, inflammatory chemicals, and cell receptors are the targets for asthma biologics. By targeting these molecules, biologics attempt to disrupt the processes that contribute to inflammation, which causes asthma symptoms.

Biologics are given to patients who continue to experience symptoms despite taking normal daily controller drugs. Symptoms of poorly controlled asthma include recurrent hospital admissions, emergency room visits, or the need for oral steroids for exacerbations; waking up at night with difficulty breathing; requiring a fast-acting reliever medication, such as albuterol, several times a day or week; and requiring a fast-acting reliever medication, such as albuterol, several times a day or week. Before prescribing a biologic, clinicians ensure that the patient is taking all of their other controller medications as prescribed, avoiding any potential triggers, and treating any other medical illnesses that can be exacerbating their asthma.

The main advantage of biologics has been a reduction in many asthma exacerbations, including ER visits, hospitalizations, and the need for oral steroids. Reduced asthma symptoms, lower dosages of other controller medications, and fewer missed school and workdays are other advantages of biologics. Biologics improve asthmatic patients' quality of life. A few biologics have been reported to help people with severe asthma improve their lung function.

Currently, five biologics for asthma are approved—omalizumab, mepolizumab, reslizumab, benralizumab, and dupilumab. Omalizumab is an antibody that targets IgE allergy antibodies. Mepolizumab, reslizumab, and benralizumab target eosinophils, a type of cell that plays a role in allergic inflammation. Dupilumab is a monoclonal antibody that targets a receptor for two molecules that cause allergic inflammation. A doctor will obtain screening tests, such as blood work or environmental allergen skin prick testing, to determine which biologic can be the best possible way to treat asthma. Omalizumab is approved for patients aged six years old or older. All biologics, except for reslizumab, are approved for individuals aged 12 years old. Adults aged 18 and over are allowed to use reslizumab.

Biologics have been proved in trials to be quite safe and have a few side effects. Further, biologics are more expensive than other controller drugs, but the price is likely to drop due to increased demand, the introduction of new biologics, and large-scale manufacturing.

Strategic insights for the Asia Pacific Asthma Drugs provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3,783.73 Million |

| Market Size by 2028 | US$ 5,806.55 Million |

| Global CAGR (2021 - 2028) | 6.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Medication

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Asthma Drugs refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

ASIA PACIFIC ASTHMA DRUGS MARKET SEGMENTATION

The Asia Pacific asthma drugs market, by medication, is segmented into quick relief medications and long-term control medications. Based on route of administration, the market is segmented into inhaled, prefilled syringe/vials, and others. Based on distribution channel, the Asia Pacific asthma drugs market is segmented into online pharmacies, hospital pharmacies, and retail pharmacies. By country, the market is segmented into the India, China, Japan, Australia, South Korea and Rest of Asia Pacific.

AstraZeneca; TEVA PHARMACEUTICAL INDUSTRIES LTD;

Boehringer Ingelheim International GmbH, GlaxoSmithKline plc., Merck & Co., Inc., Koninklijke Philips N.V., Sanofi,

Pfizer Inc. (Arena Pharmaceutical GmbH), Novartis AG and Abbott are among the leading companies operating in the Asia Pacific asthma drugs market.

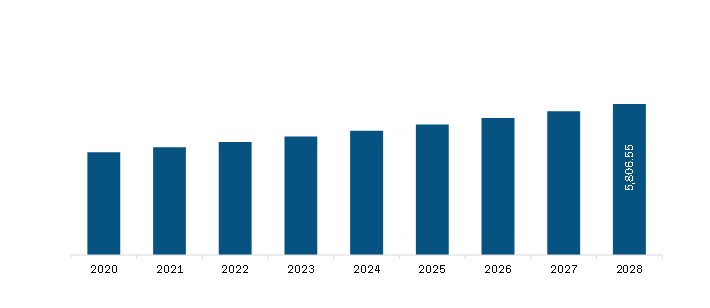

The Asia Pacific Asthma Drugs Market is valued at US$ 3,783.73 Million in 2021, it is projected to reach US$ 5,806.55 Million by 2028.

As per our report Asia Pacific Asthma Drugs Market, the market size is valued at US$ 3,783.73 Million in 2021, projecting it to reach US$ 5,806.55 Million by 2028. This translates to a CAGR of approximately 6.3% during the forecast period.

The Asia Pacific Asthma Drugs Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Asthma Drugs Market report:

The Asia Pacific Asthma Drugs Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Asthma Drugs Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Asthma Drugs Market value chain can benefit from the information contained in a comprehensive market report.