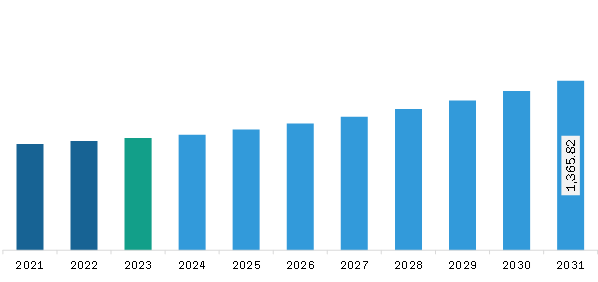

The Asia Pacific asphalt paver market was valued at US$ 903.67 million in 2023 and is expected to reach US$ 1,365.82 million by 2031; it is estimated to register a CAGR of 5.3% from 2023 to 2031.

Technological Advancements in Asphalt Pavers Boost Asia Pacific Asphalt Paver Market

Several major asphalt paver manufacturers have introduced new machines and systems that can optimize operations. The improved operating functions of the BOMAG paver BF 800 C-2 are intended to help improve performance and efficiency on the construction site. A key development is the new traffic light system that helps improve communication between the paver operator and the asphalt delivery truck driver. This ensures a consistent feed of material into the hopper and shows the truck driver when the hopper is full. In June 2021, BOMAG launched its new range of asphalt pavers, including BF 600 C-3, BF 600 P-3, and BF 800-C3, equipped with the latest technology. BOMAG's new generation of general-purpose and highway pavers is equipped with the company's Advanced Pave system, a digital co-pilot for pavers. It is being offered worldwide. The digital co-pilot allows the driver to control the machine efficiently, increasing productivity and enabling quick completion of asphalt paving. Control elements embedded in the armrests provide the operator with all important functions and thus enable greater concentration on the installation work. Thus, technological advancements integrated into the asphalt pavers are anticipated to create opportunities for the key players operating in the asphalt pavers market during the forecast period.

Asia Pacific Asphalt Paver Market Overview

In Asia Pacific, the presence of a large population has led to an increased demand for infrastructure construction. The region comprises several developing economies, including India and many other Southeast Asian countries, which poses a strong demand for different infrastructure projects. Further, governments of various countries are taking several measures to attract private investments in infrastructure development projects. Increasing investments in residential, commercial, and infrastructure construction projects are boosting the demand for construction machines, including asphalt pavers. For instance, in 2022, an investing firm, KKR, raised US$ 6.4 billion for infrastructure projects in Asia. In addition, in 2023, the Indonesian government announced the finalization of 190 National Strategic Projects (PSN) worth US$ 95 million. This project includes the construction of toll roads, dams, and airports, among others. In 2024, the Philippine Department of Public Works and Highways (DPWH) announced the completion of a road infrastructure project. Such initiatives are driving the asphalt paver market in APAC. According to the United Nations Economic and Social Commission for Asia and the Pacific Survey, the Asia-Pacific region would plan to invest more than US$ 196 billion annually in road transportation, and water & sanitation infrastructure development and also investments of US$ 434 billion planned for clean energy.

Further, the Asia Pacific region also comprises of several major manufacturers of asphalt pavers. Sany Global; XCMG; Changlin; Liugong; Shantui; XGMC; Zoomlion; Kesar Road Equipments; Uniter Engineering Products; Shitla Road Equipment; Sumitomo Heavy Industries, Ltd.; Sapna Constructions Company; HANTA MACHINERY Co., Ltd.; TOAROAD CORPORATION; Unipave Engineering Products; and Ashtvinayak Industries are among the major companies operating in the asphalt paver in Asia Pacific.

Asia Pacific Asphalt Paver Market Revenue and Forecast to 2031 (US$ Million)

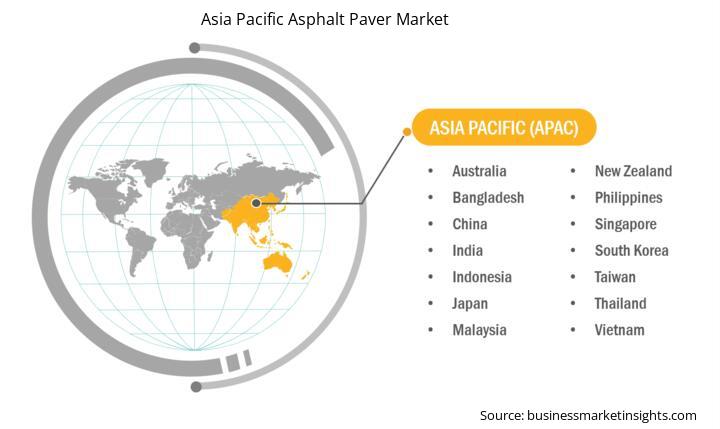

Strategic insights for the Asia Pacific Asphalt Paver provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Asphalt Paver refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Asphalt Paver Strategic Insights

Asia Pacific Asphalt Paver Report Scope

Report Attribute

Details

Market size in 2023

US$ 903.67 Million

Market Size by 2031

US$ 1,365.82 Million

Global CAGR (2023 - 2031)

5.3%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Paving Width

Regions and Countries Covered

Asia Pacific

Market leaders and key company profiles

Asia Pacific Asphalt Paver Regional Insights

Asia Pacific Asphalt Paver Market Segmentation

The Asia Pacific asphalt paver market is categorized into type, paving width, and country.

Based on type, the Asia Pacific asphalt paver market is bifurcated into wheeled asphalt pavers and tracked asphalt pavers. The tracked asphalt pavers segment held a larger market share in 2023.

In terms of paving width, the Asia Pacific asphalt paver market is bifurcated into below 2.5 meter, 2.5 to 5 meter, and above 5 meter. The above 5 meter segment held the largest market share in 2023.

By country, the Asia Pacific asphalt paver market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific asphalt paver market share in 2023.

AB Volvo, Astec Industries Inc, Caterpillar Inc, Sany Heavy Industry Co Ltd, Sumitomo Corp, XCMG Construction Machinery Co Ltd, Deere & Co, FAYAT GROUP, S.P Enterprise, and Leeboy are some of the leading companies operating in the Asia Pacific asphalt paver market.

The Asia Pacific Asphalt Paver Market is valued at US$ 903.67 Million in 2023, it is projected to reach US$ 1,365.82 Million by 2031.

As per our report Asia Pacific Asphalt Paver Market, the market size is valued at US$ 903.67 Million in 2023, projecting it to reach US$ 1,365.82 Million by 2031. This translates to a CAGR of approximately 5.3% during the forecast period.

The Asia Pacific Asphalt Paver Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Asphalt Paver Market report:

The Asia Pacific Asphalt Paver Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Asphalt Paver Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Asphalt Paver Market value chain can benefit from the information contained in a comprehensive market report.