The electronics industry is one of the largest and fastest-growing industries in the world. Electronic components are highly sensitive to static electricity. During the manufacturing process, static charges can accumulate on the surfaces of components, circuit boards, or assembly equipment. If not controlled effectively, electrostatic discharge (ESD) can cause damage to these sensitive electronic parts, resulting in product failures, decreased reliability, and increased costs. Moreover, the risk of static damage increases with the continuous miniaturization of electronic devices. Miniaturized components are more susceptible to ESD due to their reduced size and increased sensitivity. Antistatic brushes are used to dissipate static charges and prevent ESD, ensuring the integrity and quality of electronic products. According to Invest India, the global electronics manufacturing services market is anticipated to reach US$ 1,145 billion by 2026, at a CAGR of 5.4% during 2021–2026 (the forecast period). The India Brand Equity Foundation states that the Indian electronics manufacturing industry is projected to reach US$ 520 billion by 2025. The electronic industry is subject to strict quality standards and regulations to ensure the safety, performance, and reliability of electronic products. Compliance with industry standards such as ISO 9001, ISO 13485, and ESD Association (ESDA) standards requires the implementation of proper static control measures. Therefore, the rising demand from the proliferating electronic industry fuels the Asia Pacific antistatic brushes market growth.

The demand for antistatic brushes in Asia Pacific is in parallel with industrialization and vehicular production in the region. Under the Sustainable Development Goals 2030, the Asian Development Bank has planned to build resilient infrastructure, promote inclusive and sustainable industrialization, and foster innovation in Asia Pacific. Moreover, the rise in the number of on-fleet vehicles in countries such as China, India, and South Korea is fueling the demand for PCBs and semiconductors, further bolstering the need for antistatic brushes. According to the International Organization of Motor Vehicle Manufacturers (OICA), Asia-Oceania's vehicle production increased from 46.8 million in 2021 to 50.0 million in 2022. The development of automotive parts and components in the region with the rise of electric vehicle production will create lucrative opportunities for antistatic brushes. Extensive innovation and prototyping from major automakers is one of the major factors driving the market. Further, electronics and semiconductor manufacturing in Asia Pacific has been a major driver of global trade. Asia Pacific is a global hub for the production and export of technical consumer goods (TCG), including consumer electronics such as laptops & computers, cellphones, radio sets & sound systems, and televisions, among others as well as other essential electronic parts, small and big domestic appliances. According to the Association of Southeast Asian Nations, the electronics sector accounts for 20% to 50% of the total value of export of most countries in Asia. All these factors are propelling the growth of the Asia Pacific antistatic brushes market.

Strategic insights for the Asia Pacific Antistatic Brushes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Antistatic Brushes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Antistatic Brushes Strategic Insights

Asia Pacific Antistatic Brushes Report Scope

Report Attribute

Details

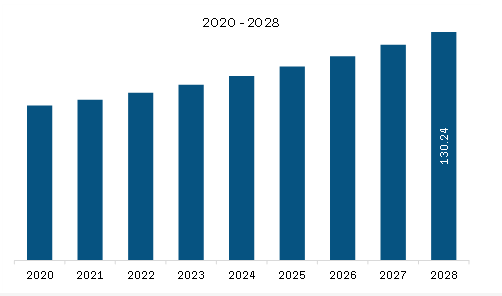

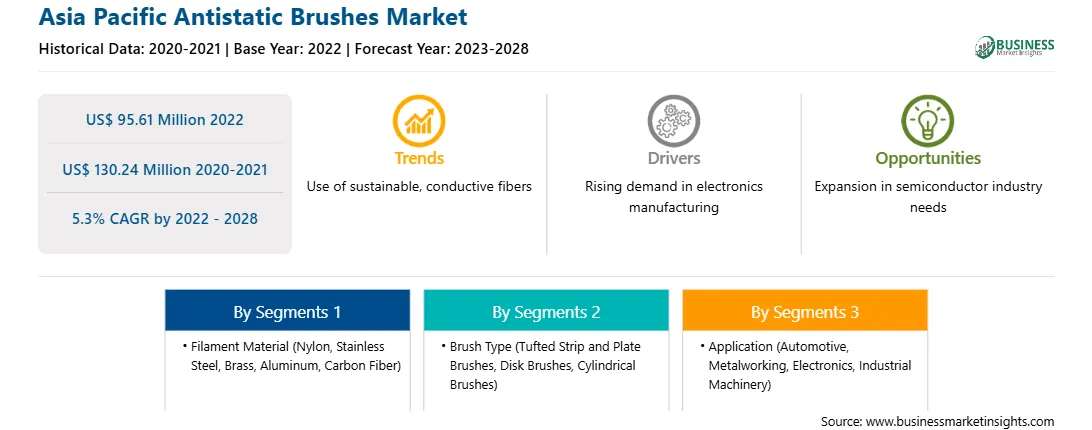

Market size in 2022

US$ 95.61 Million

Market Size by 2028

US$ 130.24 Million

Global CAGR (2022 - 2028)

5.3%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Filament Material

By Brush Type

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Antistatic Brushes Regional Insights

Asia Pacific Antistatic Brushes Market Segmentation

The Asia Pacific antistatic brushes market is segmented into filament material, brush type, application, and country.

Based on filament material, the Asia Pacific antistatic brushes market is segmented into nylon, stainless steel, brass, aluminum, carbon fiber, and others. In 2022, the others segment registered a largest share in the Asia Pacific antistatic brushes market.

Based on brush type, the Asia Pacific antistatic brushes market is segmented into tufted strip and plate brushes, disk brushes, cylindrical brushes, and others. In 2022, the tufted strip and plate brushes segment registered a largest share in the Asia Pacific antistatic brushes market.

Based on application, the Asia Pacific antistatic brushes market is segmented into automotive, metalworking, electronics, industrial machinery, and others. In 2022, the industrial machinery segment registered a largest share in the Asia Pacific antistatic brushes market.

Based on country, the Asia Pacific antistatic brushes market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. In 2022, China segment registered a largest share in the Asia Pacific antistatic brushes market.

Gordon Brush Mfg Co Inc; KIST + ESCHERICH GmbH; KOTI Industrial and Technical Brushes BV; and Ultrafab Inc are the leading companies operating in the Asia Pacific antistatic brushes market.

The Asia Pacific Antistatic Brushes Market is valued at US$ 95.61 Million in 2022, it is projected to reach US$ 130.24 Million by 2028.

As per our report Asia Pacific Antistatic Brushes Market, the market size is valued at US$ 95.61 Million in 2022, projecting it to reach US$ 130.24 Million by 2028. This translates to a CAGR of approximately 5.3% during the forecast period.

The Asia Pacific Antistatic Brushes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Antistatic Brushes Market report:

The Asia Pacific Antistatic Brushes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Antistatic Brushes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Antistatic Brushes Market value chain can benefit from the information contained in a comprehensive market report.