APAC has become one of the largest aviation markets, with air passenger count in billions every year. Over 100 million new passengers are anticipated to reach in the coming years. The rising number of air passengers has led to increase in the number of aircraft flights every day; therefore, the airport operators in Asia have started evaluating the efficiency of their operations. With a goal to bring advanced technologies in airport processes to enhance productivity, all the airport operators take the digitalization approach. For instance, in July 2020, Thailand's aviation agencies inked a 5G Smart Airport to give 5G networks and services at different airports in Thailand. The government bodies of Thailand are collaborating with Huawei to introduce 5G networking. Steps to introduce smart airports in the Asian economy would trigger the adoption of technologies such as asset tracking and asset management at these facilities. Rapid developments in technologies, initiatives from governments, digitalization of economies, and rising disposable income of the middle-income class group are among the factors propelling the region's overall economic growth, driving it from a developing stage to a developed stage. Thailand, Vietnam, China, India, and Hong Kong are a few of the countries witnessing new airports in their territories. Thus, the construction of new airports and integration of advanced technologies for asset management would propel the airport asset tracking market growth in APAC during the forecast period. Also, technologically advanced airports are being built which is the major factor driving the growth of the APAC airport asset tracking market.

Furthermore, COVID-19 is having a negative impact over APAC region. APAC is characterized by the presence of a large number of developing countries, positive economic outlook, high industrial presence, strategic government initiatives, huge population, and rising disposable income. All these factors make APAC a major growth driving region for various solutions and services markets, including asset tracking systems and solutions. The outbreak of coronavirus had an impact on industries owing to the uncertainty in the supply chain and user demand. APAC accounts for the largest count of new airport construction and airport expansion. China leads the table in the APAC with significantly in terms of numbers and investments followed by India. Both the countries have been experiencing tremors of COVID-19 pandemic. This had led to a sudden suspension of construction activities in last few months, which, in turn, had a negative effect on the supply chain of technologies. Additionally, the airport businesses had also been adjourned temporarily, which led to slow down the adoption rate of technologies among the airport authorities and airlines. This is negatively affecting the airport asset tracking market in the current scenario. However, as the governments of several countries have granted the permission for reopening businesses and construction activities, the demand for airport assets and their associated technology solutions is expected to gain momentum likely in the last quarter of 2020 and positively in 2021.

Strategic insights for the Asia Pacific Airport Asset Tracking provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

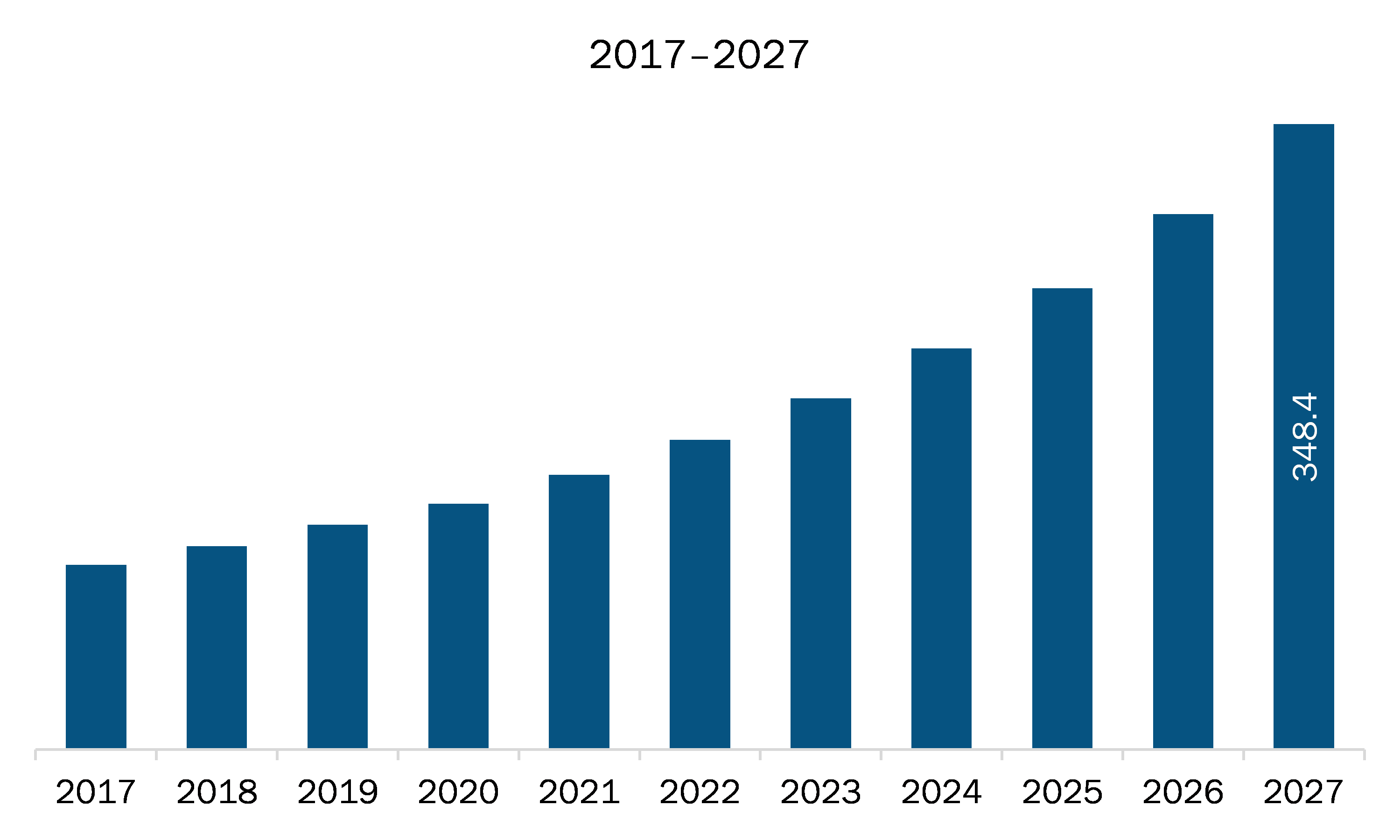

| Market size in 2019 | US$ 125.1 Million |

| Market Size by 2027 | US$ 348.4 Million |

| Global CAGR (2020 - 2027) | 14.3% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Offering

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Airport Asset Tracking refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The airport asset tracking market in APAC is expected to grow from US$ 125.1 million in 2019 to US$ 348.4 million by 2027; it is estimated to grow at a CAGR of 14.3% from 2020 to 2027. Governments across APAC are striving toward bringing advancements in the aviation sector, as well as associated industries. The growing investments toward the construction of newer airports and expansion of the existing ones are encouraging the adoption of enhanced solutions for better operations, which is contributing to the airport asset tracking market growth. As per the Airport Council International (ACI), the growth rate of air passengers in APAC region was estimated as 10%. To accommodate steadily rising passenger count, considerable investments are being made to build new airports or expand existing infrastructures. As per the Center for Aviation (CAPA), the investments on new airport construction were significantly high in 2019, with Asia Pacific being a frontrunner. Similarly, there was substantial capitalization on airport renovation activities or expansion activities in 2018, 2019, and 2020. Further, with the rising number of air travelers, there has been an increase in the expansion of existing airport facilities with a greater number of terminals. This reflects in an escalated demand for passenger boarding management, baggage management, and cargo area management solutions. Therefore, a growing number of airports in APAC is bolstering the airport asset tracking market.

In terms of offering, the hardware segment accounted for the largest share of the APAC airport asset tracking market in 2019. In terms of asset type, the mobile assets segment held a larger market share of the APAC airport asset tracking market in 2019.

A few major primary and secondary sources referred to for preparing this report on the airport asset tracking market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Asset Fusion Limited, Ctrack, Geotab Inc., Steerpath Oy, Unilode Aviation Solutions.

The Asia Pacific Airport Asset Tracking Market is valued at US$ 125.1 Million in 2019, it is projected to reach US$ 348.4 Million by 2027.

As per our report Asia Pacific Airport Asset Tracking Market, the market size is valued at US$ 125.1 Million in 2019, projecting it to reach US$ 348.4 Million by 2027. This translates to a CAGR of approximately 14.3% during the forecast period.

The Asia Pacific Airport Asset Tracking Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Airport Asset Tracking Market report:

The Asia Pacific Airport Asset Tracking Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Airport Asset Tracking Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Airport Asset Tracking Market value chain can benefit from the information contained in a comprehensive market report.