As per International Air Transport Association (IATA), the number of passengers traveling by air is expected to reach ~7.8 billion by 2036. The rapidly emerging middle-class segment majorly influences the growth in passengers travelling through airways in developing economies. In October 2021, world organizations such as United Nations World Tourism Organization (UNWTO) and the International Civil Aviation Organization partnered to support the safe restart of travel and tourism. In October 2020, UNWTO and IATA inked a Memorandum of Understanding to work together to restart global tourism. This agreement was focused on enhancing the confidence of the general public in air travel, which further helped increase air traffic.

An exponential growth of working groups in developing countries has increased freight traffic disposable income. According to the United Nations, the growing number of middle-class travelers, especially in China and India, is the primary factor contributing to the growth of air travel and various ancillary services. As the world recovers from economic contractions, the demand for air travel increases. The rising air travel demand has resulted in the augmented production of commercial aircraft, which has considerably contributed to the growth of various ancillary services, such as in-flight Wi-Fi, excess luggage, food and beverages, and in-flight shopping. According to IATA, in 2019, there were 4.54 billion air passengers, and in 2023, global air passengers reached 95% of pre-pandemic levels, which is 4.35 billion people. These mounting numbers of passengers across the world are demanding various parameters to make flight hours more exciting and comfortable. In-flight catering or in-flight culinary is one of the key trends among full-service carriers as well as low-cost carriers. The increasing focus on offering enhanced services to flight passengers and the rising number of aviation passengers worldwide are driving the Asia Pacific airline ancillary services market.

Asia Pacific is a diverse region with more than 4 billion people and comprises dynamic economies that cumulatively generate 35% of the global GDP. The aviation industry in the region is a pivotal contributor to its social and economic development. Also, in Asia Pacific, government initiatives on airline ancillary services propel the Asia Pacific airline ancillary services market growth. In December 2022, the Singapore government provided an additional US$ 84 million to the aviation sector amid the COVID-19 pandemic to support the Asia Pacific airline ancillary services market. The funding will enable aviation companies to develop and deploy innovative technologies and measures to protect airport workers and aircrew from contracting the novel coronavirus that causes COVID-19. This led to increased demand for ancillary services such as aircraft and baggage sanitization systems, creating opportunities for service providers in the market.

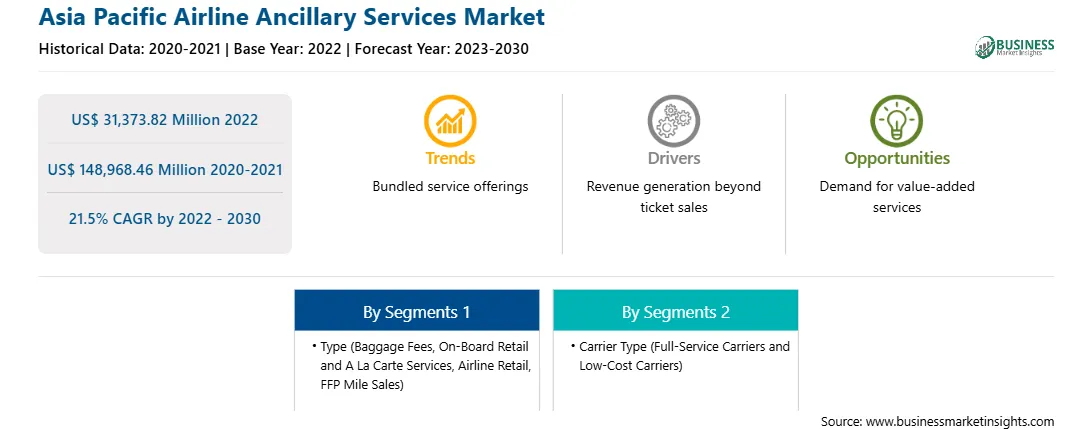

The Asia Pacific airline ancillary services market is segmented into type, carrier type, and country.

Based on type, the Asia Pacific airline ancillary services market is divided into baggage fees, on-board retail and a la carte services, airline retail, and FFP mile sales. The baggage fees segment held the largest market share in 2022.

By carrier type, the Asia Pacific airline ancillary services market is bifurcated into full-service carriers and low-cost carriers. The full-service carriers segment held a larger market share in 2022.

Based on country, the Asia Pacific airline ancillary services market is segmented into China, Japan, India, Australia, and the Rest of Asia Pacific. The Rest of Asia Pacific dominated the Asia Pacific airline ancillary services market in 2022.

Air France KLM SA, Delta Air Lines Inc, Deutsche Lufthansa AG, Qantas Airways Ltd, The Emirates, and United Airlines Holdings Inc are some of the leading companies operating in the Asia Pacific airline ancillary services market.

Strategic insights for the Asia Pacific Airline Ancillary Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 31,373.82 Million |

| Market Size by 2030 | US$ 148,968.46 Million |

| Global CAGR (2022 - 2030) | 21.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Airline Ancillary Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific Airline Ancillary Services Market is valued at US$ 31,373.82 Million in 2022, it is projected to reach US$ 148,968.46 Million by 2030.

As per our report Asia Pacific Airline Ancillary Services Market, the market size is valued at US$ 31,373.82 Million in 2022, projecting it to reach US$ 148,968.46 Million by 2030. This translates to a CAGR of approximately 21.5% during the forecast period.

The Asia Pacific Airline Ancillary Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Airline Ancillary Services Market report:

The Asia Pacific Airline Ancillary Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Airline Ancillary Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Airline Ancillary Services Market value chain can benefit from the information contained in a comprehensive market report.