The APAC includes countries including India, China, Japan, Australia, and Rest of APAC. This region boasts of some of the largest aircraft fleet countries such as China, Japan, and India. Huge middle-class population and a strong growth in the middle-class spending, coupled with a wide range of income levels are some of the factors that influence the aviation industry in the region. The presence of many dynamic and developing economies in APAC: has positively influence growth in the aviation industry. Conventionally, roadways and railways were the preferred means of transport for the domestic populations of APAC: region; however, the changing economic scenario and increasing standards of living of the middle-class population in the region have brought about a paradigm shift in the transportation sector. While the airfares continue to fall, the demand for air travel witnessed exponential increases in the region. This rise in the passenger traffic generates demands for larger commercial aircraft fleets to be operational in turn, creating demands for forged aircraft parts and components. Also, developing economies witnessing rise in MRO activities is the major factor driving the APAC aircraft wire & cable market.

The ongoing COVID-19 has caused havoc in the APAC region. APAC is characterized by many developing countries, a positive economic outlook, high industrial presence, huge population, and rising disposable income. These factors make APAC a major growth driving region for various markets, including aircraft wire & cable. The COVID-19 outbreak has resulted in a massive financial loss in the APAC region. The governments in APAC countries are taking possible steps to reduce its effects by announcing lockdown, negatively affecting the manufacturing sector. China is one of the leading aerospace manufacturing countries in the region and has been one of APAC's most affected countries. Due to this, the manufacturing facilities have been witnessing severe aircraft and aircraft-associated components manufacturing facilities. India and Indonesia are still combating the spread of the virus. However, the countries have eased the lockdown measures, which is reflecting the restart of manufacturing facilities. Nonetheless, the remarkable lower volumes of air travel passengers have slowed down the demand for various components among the OEMs and aftermarket players regionally and internationally. This has been negatively affecting the aircraft wire & cable market. Several airlines in APAC have retired their wide-body jets and narrow-body jets. This factor is anticipated to inhibit the aircraft wire & cable market for the next few months. For instance, Australia-based Qantas retired its Boeing B747 in mid-2020 to cope with the COVID-19 pandemic's financial pressure. Thus, the retirement of wide-body jets is foreseen to be creating tremors on aviation aftermarket and eventually on the aircraft wire & cable market.

Strategic insights for the Asia Pacific Aircraft Wire & Cable provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

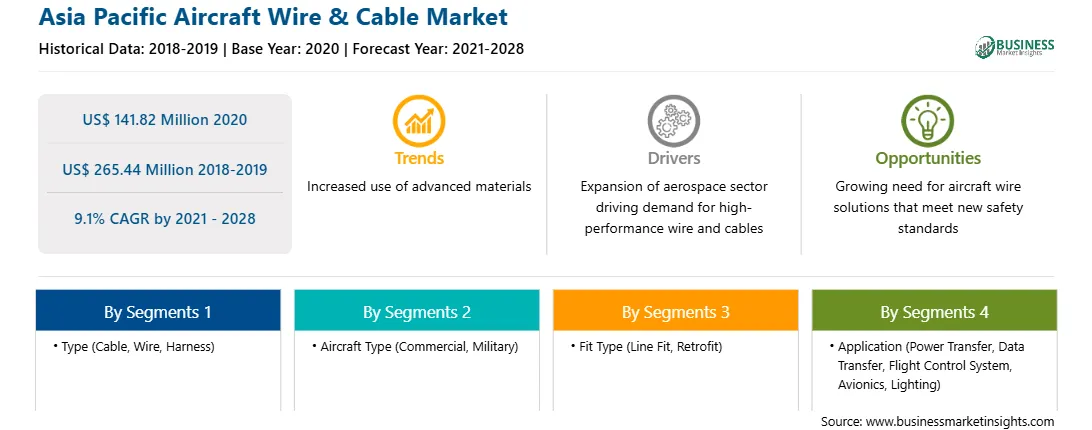

| Market size in 2020 | US$ 141.82 Million |

| Market Size by 2028 | US$ 265.44 Million |

| Global CAGR (2021 - 2028) | 9.1% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Aircraft Wire & Cable refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The aircraft wire & cable market in APAC is expected to grow from US$ 141.82 million in 2020 to US$ 265.44 million by 2028; it is estimated to grow at a CAGR of 9.1% from 2021 to 2028. In the coming years, APAC is expected to account for significant development and growth in passenger air transportation. In terms of population growth, APAC slightly exceeds the worldwide average, and it is expected to continue its lead during the forecast period. In the long run, state regulation of the industry by authorized bodies, policy of the states of the region to determine the access of foreign airlines to national domestic air transportation market, and significant financial problems for a number of airlines are few of the factors influencing the development of the air transportation in this region. These factors are projected to impact the demand for aircraft wire and cables in the region.

The APAC aircraft wire & cable market is segmented into type, fit type, aircraft type, and application. Based on type, the APAC aircraft wire & cable market is further segmented into harness, wire, and cable. Wire segment held a substantial market share in 2020. Based on fit type, the market is further categorized into line fit and retrofit. Line fit segment held a substantial market share in 2020. Further, the market is segmented based on aircraft type into commercial and military. Commercial segment held a substantial market share in 2020. Based on application, the market is classified into power transfer, data transfer, flight control system, avionics, and lighting. Power transfer segment held a substantial market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the aircraft wire & cable market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are A.E. Petsche Company; AMETEK Inc.; Amphenol Corporation; Axon Enterprise, Inc.; Collins Aerospace, a Raytheon Technologies Corporation Company; Draka; Glenair, Inc.; Harbour Industries, LLC; HUBER+SUHNER; Nexans; Radiall; TE Connectivity Ltd.; W. L. Gore and Associates, Inc.

The List of Companies - Asia Pacific Aircraft Wire & Cable Market

The Asia Pacific Aircraft Wire & Cable Market is valued at US$ 141.82 Million in 2020, it is projected to reach US$ 265.44 Million by 2028.

As per our report Asia Pacific Aircraft Wire & Cable Market, the market size is valued at US$ 141.82 Million in 2020, projecting it to reach US$ 265.44 Million by 2028. This translates to a CAGR of approximately 9.1% during the forecast period.

The Asia Pacific Aircraft Wire & Cable Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Aircraft Wire & Cable Market report:

The Asia Pacific Aircraft Wire & Cable Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Aircraft Wire & Cable Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Aircraft Wire & Cable Market value chain can benefit from the information contained in a comprehensive market report.