The aircraft wheels MRO market in APAC is sub segmented into China, India, South Korea, Australia, Japan, and the Rest of APAC. The region is characterized by the presence of emerging economies such as China, South Korea, India, Malaysia, and Vietnam. Factors such as rising GDP per capita along with the growing share of upper-middle-class and middle class, presence of a large youth population, and growing inclination toward leisure and business tourism are boosting the commercial aviation industry growth. According to Boeing, APAC is expected to receive ~17,390 deliveries during 2019–2038. Thus, the proliferation of the commercial aviation industry is subsequently driving the aircraft wheels MRO market growth in the region. Further, governments across APAC are supporting the development of the aerospace and defense sector. For instance, the Government of India, in March 2020, reduced the Goods and Service Tax (GST) on MRO services from 18% to 5%. Moreover, the region is becoming an MRO hub as various aircraft and component manufacturers, as well as independent aircraft MRO players, are expanding their footprints in the region. For instance, in July 2021, Turkish Technic announced its plans to expand its operations in APAC by joining forces with Sapura Technics, a local maintenance service provider. In August 2021, Lockheed Martin Corporation proposed to set up an MRO facility for F-21 aircraft in India. Furthermore, in July 2021, Air Manas, Kyrgyzstan, awarded an A220 flight-hour services contract to Airbus. In September 2019, STARLUX Airlines, a Taiwan-based airline, awarded Triumph Group a two-year aircraft wheel MRO contract for its A321neo fleet. Strategic tie-ups for defense aircraft wheels MRO services and increasing MRO activities in emerging economies in APAC are the major factor driving the growth of the APAC aircraft wheels MRO market.

In case of COVID-19, APAC is highly affected specially India. The COVID-19 outbreak has resulted in a massive financial loss in the APAC region. The governments of countries in APAC have imposed lockdowns to contain the spread of virus, which has negatively affected the manufacturing sector. China is one of the leading aerospace manufacturing countries in the region; however, owing to the spread of the virus in 2020, the manufacturing facilities have been witnessing severe challenges in generating revenues from different markets. India, Japan, and several Southeast Asian countries are still combating the virus, which is a critical factor slowing the growth of the aircraft MRO market in the region. The aircraft maintenance service providers are observing noteworthy downfall in respective businesses, which is directly attributed to the lesser demand for the same among various end users, including airline operators. The outbreak has substantially disrupted the aircraft MRO services in the region, which had a negative impact on the market. The recovery period is expected to be faster than other regions, as several countries are anticipated to gain new airports in the coming years and governments of various countries, including China, are taking various initiatives to reduce the losses from the aviation industry. Several airlines in the region have retired their wide-body jets and narrow-body jets, which were prime customers of aftermarket products and services. This factor is anticipated to inhibit the aircraft wheels MRO market for the next few months. Thus, the retirement and long-term storage of wide-body jets is creating tremors in the aircraft wheels MRO market.

Strategic insights for the Asia-Pacific Aircraft Wheels MRO provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

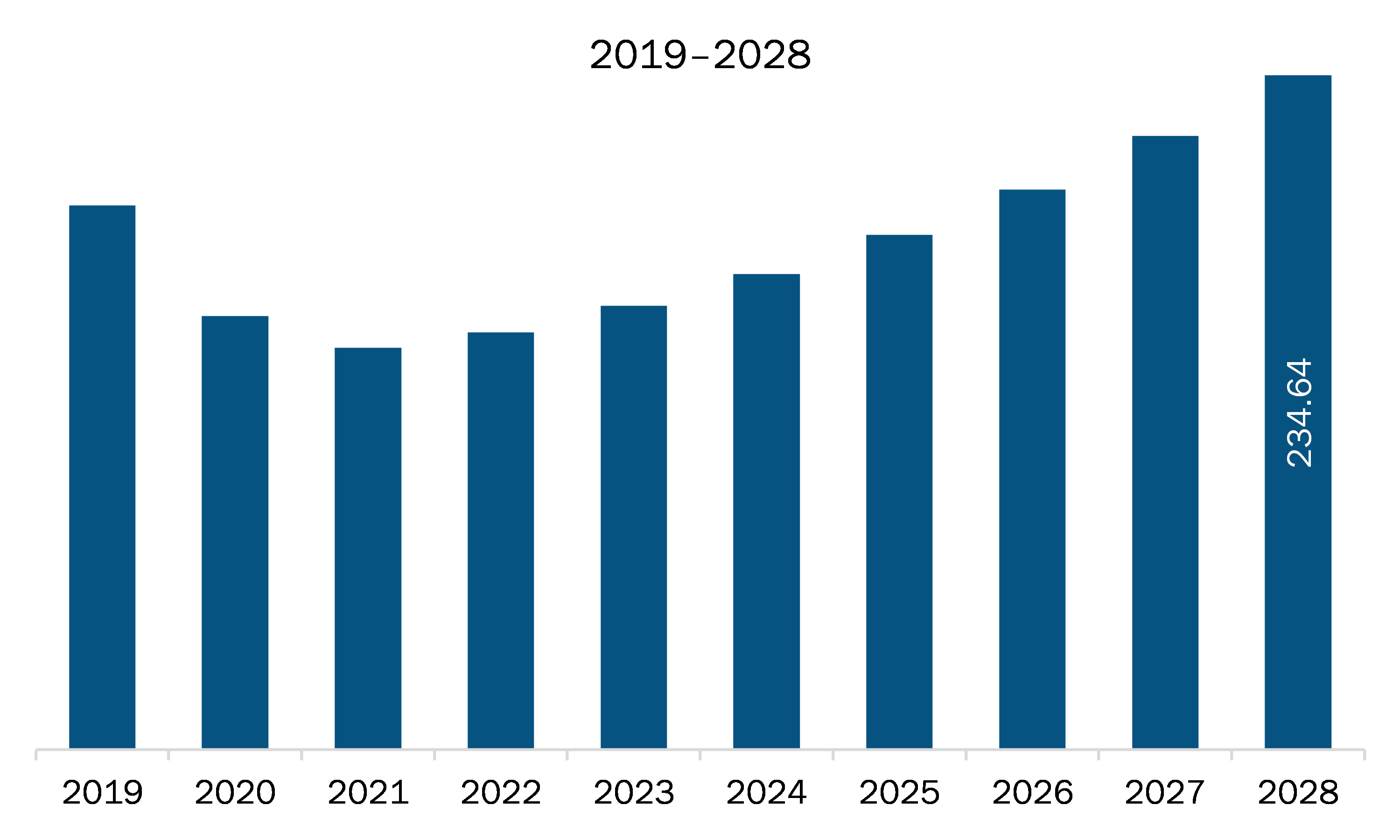

| Market size in 2021 | US$ 139.89 Million |

| Market Size by 2028 | US$ 234.64 Million |

| Global CAGR (2021 - 2028) | 7.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Wheel Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia-Pacific Aircraft Wheels MRO refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC aircraft wheels MRO market is expected to grow from US$ 139.89 million in 2021 to US$ 234.64 million by 2028; it is estimated to grow at a CAGR of 7.7% from 2021 to 2028. The need for aircraft wheels maintenance, repairing, and overhauling (MRO) services has increased significantly in the past few years, owing to the rise in demand for passenger airline services. The growing demand for passenger airline services is resulting in extended flying hours of aircraft as well as frequent landing and takeoffs. The extended operational hours of aircraft are leading to a greater risk of wear and tear on aircraft wheels, subsequently underlining the need for a more frequent wheel retrofitting. In addition, major airline companies across the region are expanding their aircraft fleets to meet the escalating demand for airline services. In October 2019, Indigo Airlines decided to extend its aircraft fleet size and placed an order of 300 Airbus 320 neo aircraft. The increasing aircraft fleet sizes are further fueling the businesses of aircraft wheels MRO companies across the APAC region.

In terms of wheel type, the main wheel segment accounted for the largest share of the APAC aircraft wheels MRO market in 2020. In terms of aircraft type, the narrowbody aircraft segment held a larger market share of the APAC aircraft wheels MRO market in 2020. Further, the non-destructive testing segment held a larger share of the APAC aircraft wheels MRO market based on technology in 2020.

A few major primary and secondary sources referred to for preparing this report on the APAC aircraft wheels MRO market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AAR CORP; AEROSPACE MRO CO., LTD.; AMETEK Inc.; Lufthansa Technik; and TP Aerospace.

The Asia-Pacific Aircraft Wheels MRO Market is valued at US$ 139.89 Million in 2021, it is projected to reach US$ 234.64 Million by 2028.

As per our report Asia-Pacific Aircraft Wheels MRO Market, the market size is valued at US$ 139.89 Million in 2021, projecting it to reach US$ 234.64 Million by 2028. This translates to a CAGR of approximately 7.7% during the forecast period.

The Asia-Pacific Aircraft Wheels MRO Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Aircraft Wheels MRO Market report:

The Asia-Pacific Aircraft Wheels MRO Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Aircraft Wheels MRO Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Aircraft Wheels MRO Market value chain can benefit from the information contained in a comprehensive market report.