The aircraft wheels and brake market in APAC is estimated to grow at a significant CAGR, owing to the significant demand from the air transportation sector. APAC’s massive population and increase in disposable income are projected to boost air travel in the next few years. According to the International Air Transport Association (IATA), China alone is anticipated to produce an additional 2.1 billion travelers a year by 2036, which is more than half of the projected growth for the entire world. Asia is expected to account for approximately 40% of future aircraft production. Increasing passenger volumes is compelling authorities to expand the existing infrastructure. The rising manufacturing of aircraft fleet to meet the consumer demand is bolstering the growth of aircraft wheels and brake market. Substantial increases in the defense spending across APAC, owing to the economic development and rise in security threats have increased the demand for high-speed military aircraft to carry out air-to-air combat missions. In March 2019, China allocated US$ 177.61 billion for the defense budget which was 7.5% higher compared to the previous year. Procurement of new products and replacement of the existing fleet with newer generation aircraft have boosted the demand for advanced wheels and brake systems in the region. An increase in aircraft orders from countries such as Japan, Australia, and South Korea and the introduction of fifth-generation stealth fighter aircraft in countries such as India and China are significantly encouraging the manufacturers to use advanced technologies in designing lightweight and efficient aircraft wheels, brakes, and brake systems. The Aviation Industry Corporation of China (AVIC), Lockheed Martin Corporation, and Hindustan Aeronautics Limited (HAL) are among the prominent manufactures in the APAC’s aviation industry. The region is tremendously promoting the aircraft MRO sector, especially in India, China, and Southeast Asian countries. Lower labor costs and availability of MRO facility set areas are supporting the growth of the MRO sector. The need for MRO of wide-body aircraft fleet is shifting from European and North American countries to APAC countries, which pose noteworthy business opportunities for aircraft wheels and brakes market players to distribute their products to the MRO facilities in the APAC countries. The major MRO service providers in the region include Singapore Airline Engineering Company, Singapore Technologies Aerospace Ltd., Air India, China Aircraft Services Limited, and Sepang Aircraft Engineering. The MRO facilities in the region offer their services to numerous aircraft models and provide extensive services for wheels and brakes MRO. The continuously rising demand for wheels and brakes MRO, coupled with massive growth in the aircraft fleet, is projecting a promising growth of the aircraft wheels and brakes market.

The COVID-19 pandemic has disrupted the economy of APAC and its aerospace market, along with changing the customer attitude toward the sector. The region has witnessed a significant decline in the air transportation. As per IATA estimates Asia-Pacific airlines recorded a year-on-year revenue decline of US$ 113 billion in 2020. The reduction in air travel demand, and border restrictions have resulted in the grounding of aircraft at an unprecedented scale. ~18,000 aircraft, including the Boeing 747 and Airbus A380, were shelved in 2020 due to the collapse in passenger demand and bankruptcies. China is one of the leading aerospace manufacturing countries in the region and has been one of APAC's most affected countries by the pandemic during Q1 and Q2 of 2020. Airbus and Boeing manufacturing facilities in China were shut down for a long period, which resulted in substantially low demand for various components and systems, including wheels and brakes. Similarly, OMAC, an indigenous aircraft manufacturer in China, also halted its production of C919 during Q1.

Strategic insights for the Asia Pacific Aircraft Wheels and Brakes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

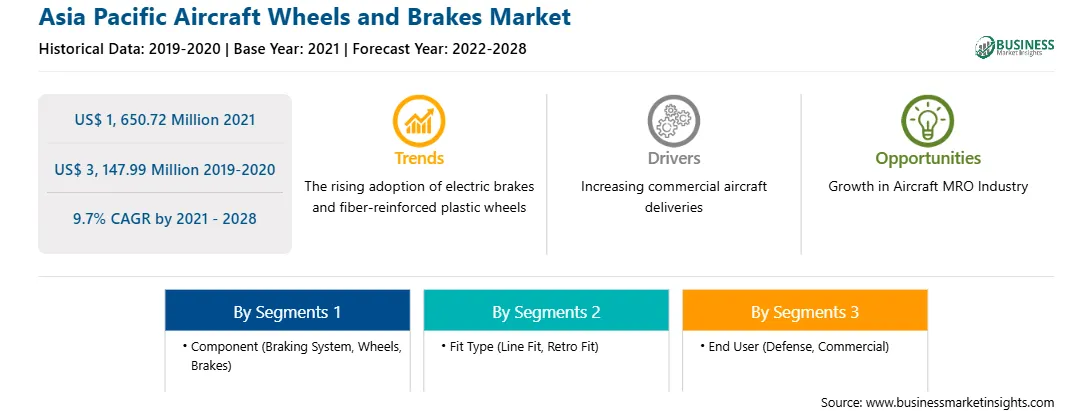

| Market size in 2021 | US$ 1, 650.72 Million |

| Market Size by 2028 | US$ 3, 147.99 Million |

| Global CAGR (2021 - 2028) | 9.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Aircraft Wheels and Brakes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The aircraft wheels and brakes market in Asia Pacific is expected to grow from US$ 1

Based on component, the market is segmented into braking systems, wheels, and brakes. In 2020, the brakes segment held the largest share Asia Pacific aircraft wheels and brakes market. Based on fit type the market is divided into line fit and retro fit. In 2020, the retro fit segment held the largest share Asia Pacific aircraft wheels and brakes market. Based on end user, the market is segmented into defense and commercial. In 2020, commercial segment held the largest share Asia Pacific aircraft wheels and brakes market.

A few major primary and secondary sources referred to for preparing this report on the aircraft wheels and brakes market in Asia Pacific are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Collins Aerospace, Crane Aerospace & Electronics, Honeywell International Inc., Meggitt PLC, Parker Hannifin Corporation, and Safran among others.

The Asia Pacific Aircraft Wheels and Brakes Market is valued at US$ 1, 650.72 Million in 2021, it is projected to reach US$ 3, 147.99 Million by 2028.

As per our report Asia Pacific Aircraft Wheels and Brakes Market, the market size is valued at US$ 1, 650.72 Million in 2021, projecting it to reach US$ 3, 147.99 Million by 2028. This translates to a CAGR of approximately 9.7% during the forecast period.

The Asia Pacific Aircraft Wheels and Brakes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Aircraft Wheels and Brakes Market report:

The Asia Pacific Aircraft Wheels and Brakes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Aircraft Wheels and Brakes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Aircraft Wheels and Brakes Market value chain can benefit from the information contained in a comprehensive market report.