Advancements in technologies, various government initiatives, and a rise in number of airlines and aircraft fleet are among the factors propelling the overall economy of the region, driving it from a developing to developed phase. APAC is estimated to register the fastest CAGR in the APAC aircraft video surveillance market during the forecast period. This can be attributed to factors such as increasing investments in the commercial aircraft sector, rising number of new aircraft, and integration of new systems in the existing aircraft.

APAC has a strong import of advanced commercial aircraft over the past few years owing to the rising number of domestic and international flights. Increased international and domestic travelers from countries, such as India, China, Japan, and Taiwan are creating demand for additional flights. The commercial aircraft fleet in the region is expanding and generating demand for advanced security solutions such as video surveillance systems. The new regulation to improve security level in aircraft generating demand video surveillance solutions, such as cargo and cabin surveillance systems, and cockpit door surveillance systems. For instance, in December 2020, AirAsia India expanded their aircraft fleet with three new A320 neo planes. The company is further increasing its fleet by purchasing two more A320 neo planes by 2021. Further, the increasing aftersales services for aircraft in the region is supplementing the market growth. For instance, Singapore has more than 120 aerospace companies providing maintenance, repair, and operations (MRO) services.

According to the GMF AeroAsia, 2017, the MRO sector in Indonesia is predicted to grow by 10% annually over the next decade. Besides, according to the Boeing aviation market forecast, APAC countries would require 16,930 more airplanes by 2037 to accommodate the increasing number of travelers. The region is expected to account for ~40% of future airline production to suffice the aircraft demand. The rising count of passengers would create the need for additional aircraft, thereby propelling the need for video surveillance systems in the aircraft.

Rising investments in aircraft manufacturing activities by private companies and governments are bolstering the market growth. For instance, in July 2018, MRJ, a unit of Mitsubishi Aircraft Company, announced a new plan to increase the aircraft production activities in Japan. The company initiated the plan to lead the nation in the aerospace industry and reduce the dependency on other companies, such as Boing and Airbus. Similarly, the Government of India initiated “Make in India” campaign, under which new policies and regulations are introduced to support domestic aircraft manufacturers. Within a year, around 500 start-ups have begun to manufacture and provide service to aerospace industry. Therefore, the increasing number of airlines, aircraft manufacturers, and passengers is the key factor driving the demand for aircraft video surveillance systems in APAC.

Asia Pacific is adversely affected by the COVID-19 pandemic. According to the IATA, airlines in the Asia Pacific has witnessed the largest revenue drop, which is around US$ 113 billion in 2020 compared to 2019. Such a drop in revenue pressurized the airline companies to delay the ongoing expansion or aircraft purchase, which hinders the market growth during the COVID-19 pandemic situation.

Strategic insights for the Asia Pacific Aircraft Video Surveillance provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 91.79 Million |

| Market Size by 2027 | US$ 133.55 Million |

| Global CAGR (2020 - 2027) | 6.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By System Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Aircraft Video Surveillance refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

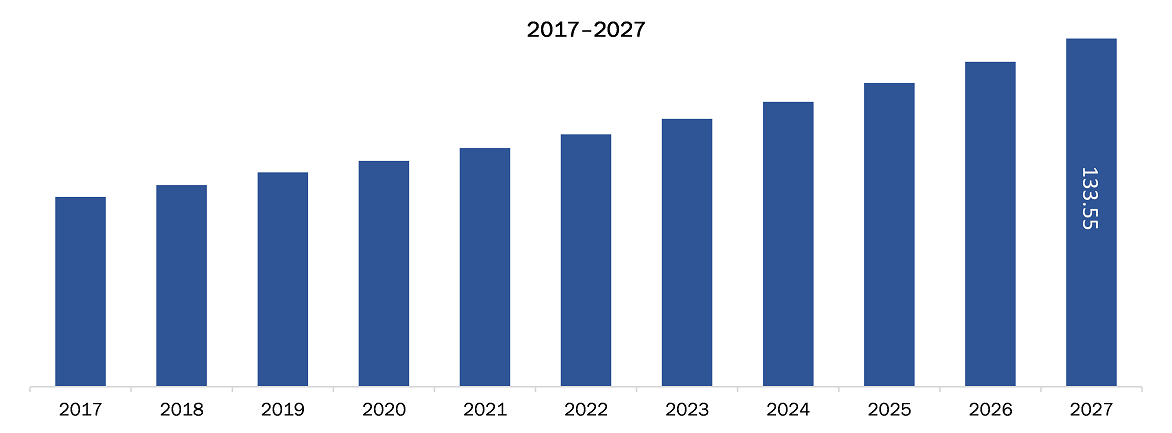

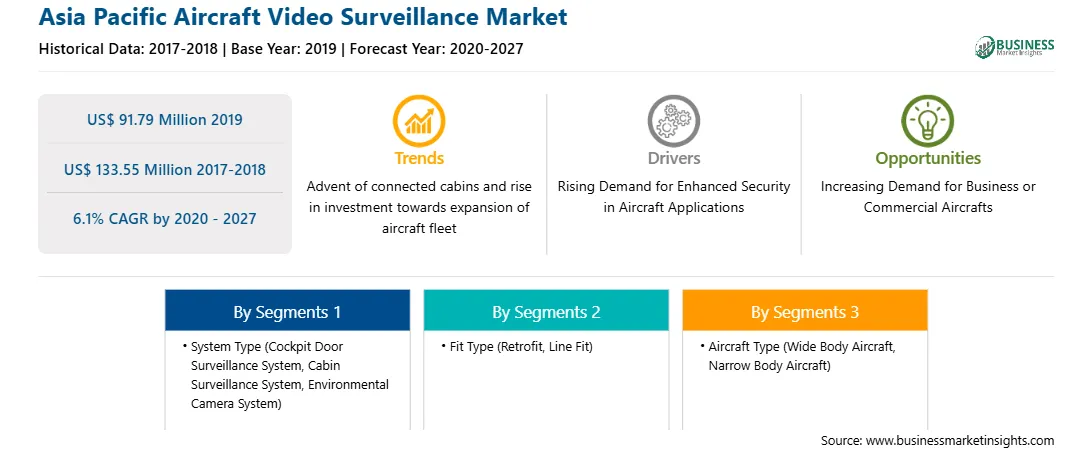

The Aircraft Video Surveillance market in APAC is expected to grow from US$ 91.79 Mn in 2019 to US$ 133.55 Mn by 2027; it is estimated to grow at a CAGR of 6.1% from 2020 to 2027. The boon in demand for enhanced security in aircraft in developed countries has led to increase in the adoption aircraft video surveillance. Countries with high GDP are vigorously carrying out large-scale industrialization and infrastructure developments. Moreover, rising volumes of aircraft order and delivery are further expected to bolster the market growth.

The market for aircraft video surveillance market is segmented into system type, fit type, aircraft type and country. Based on system type, the market is segmented into cockpit door surveillance systems, cabin surveillance systems, and environmental cameras system. In 2019, the cockpit door surveillance systems held the largest share APAC aircraft video surveillance market. Based on fit type the aircraft video surveillance market is divided into retrofit andLine-fit. Similarly, based on aircraft type, the market is bifurcated into wide body aircraft andnarrow-body aircraft. The narrow-body aircraft segment contributed a substantial share in 2019.

A few major primary and secondary sources referred to for preparing this report on the APAC aircraft video surveillance market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Some of the key companies listed in the report are AD Aerospace Ltd.

The Asia Pacific Aircraft Video Surveillance Market is valued at US$ 91.79 Million in 2019, it is projected to reach US$ 133.55 Million by 2027.

As per our report Asia Pacific Aircraft Video Surveillance Market, the market size is valued at US$ 91.79 Million in 2019, projecting it to reach US$ 133.55 Million by 2027. This translates to a CAGR of approximately 6.1% during the forecast period.

The Asia Pacific Aircraft Video Surveillance Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Aircraft Video Surveillance Market report:

The Asia Pacific Aircraft Video Surveillance Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Aircraft Video Surveillance Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Aircraft Video Surveillance Market value chain can benefit from the information contained in a comprehensive market report.