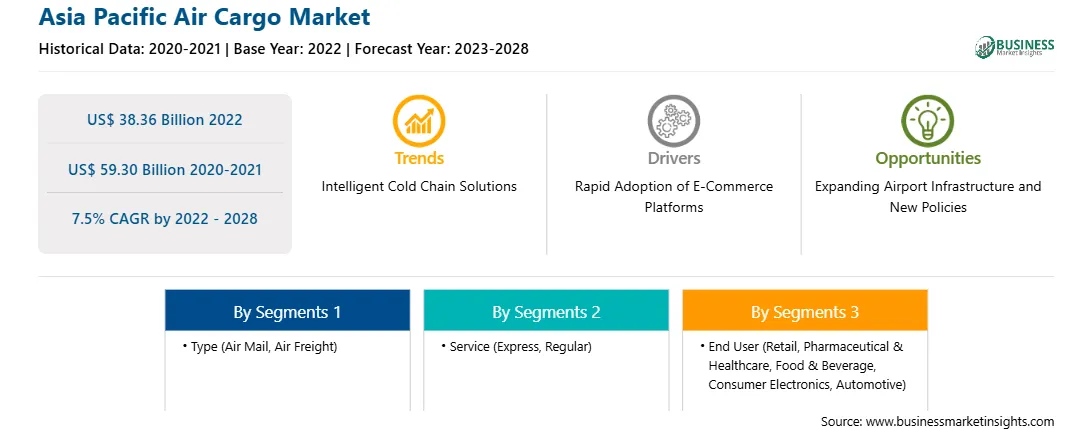

The Asia Pacific air cargo market is expected to grow from US$ 38.36 billion in 2022 to US$ 59.30 billion by 2028. It is estimated to grow at a CAGR of 7.5% from 2022 to 2028.

Expanding Airport Infrastructure and New Policies is Fuelling Asia Pacific Air Cargo Market

Air cargo stakeholders have a huge opportunity in Southeast Asian countries such as Singapore, Thailand, and Indonesia. Airports in the Southeast Asian countries are the fastest growing airports. The airports of Singapore, Incheon, Hong Kong, and Taiwan are supporting national carriers to expand air freights and encouraging operators to increase services. These initiatives are expected to reduce the trade with China and increase in some transfer cargo traffic in Taiwan form ASEAN. Companies such as APEX Logistics and SEKO Logistics have strategically expanded their operations in Southeast Asian countries. According to Boeing’s Commercial Market Outlook, the intra-Southeast Asian market by 2039 will be the fifth largest and the vast domestic and regional air network across the region positions it well for a post-pandemic recovery. With the developing policies and infrastructure, it is expected that Southeast Asian countries will exhibit huge opportunity for air cargo vendors during the forecast period. Southeast Asia’s fundamental growth drivers remain robust. The region’s economy has grown by 70% approximately in the last decade that increases propensity to travel with expanding middle-class and growing private consumption. In addition, governments in the region recognize the travel and tourism sectors as one of the most important drivers of economic growth.

Asia Pacific Air Cargo Market Overview

Huge demand for air cargo in Asia Pacific is attributed to the robust economic growth of the region and increased focus on retail enactment. Foreign players prefer Asian countries for the expansion of their manufacturing activities due to the availability of a cheaper workforce. Factors such as continuous urbanization, strong economic growth, and a large middle-class population create high domestic demand for fast-moving consumer goods, personal automobiles, household items, and luxury items. Additionally, companies in the e-commerce market opt for various logistic alternatives, including surface transport and air transport, to deliver items to their clients. Thus, with the flourishment of the e-commerce business, different purchase habits and trends have been noted in various countries in Asia Pacific. The proliferating e-commerce industry is likely to boost the air cargo market in Asia Pacific in the coming years with the rise in demand for parcel delivery services around the region. After several years of trade slack, the marketplace in Asia Pacific entered the recovery phase from 2013 onward, followed by a quick rebound. The marketplace in the region has sustained a strong uptick in air cargo demand with a significant Y-o-Y rise every year. China continues to be a powerhouse for the air cargo market in Asia Pacific due to the high demand from the e-commerce segment. The e-commerce industry in this region focuses on maintaining pace with the global manufacturing sector. However, the depressed passenger business remains a concern. According to the International Air Transport Association (IATA), demand for international air cargo fell by 3.2% in January 2021 compared to the same month in 2019. In addition, the decrease in demand reached 4% in December 2020. Furthermore, airlines in Asia Pacific had the greatest international load factor at 74.0%.

Asia Pacific Air Cargo Market Revenue and Forecast to 2028 (US$ Billion)

Strategic insights for the Asia Pacific Air Cargo provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Air Cargo refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Air Cargo Strategic Insights

Asia Pacific Air Cargo Report Scope

Report Attribute

Details

Market size in 2022

US$ 38.36 Billion

Market Size by 2028

US$ 59.30 Billion

Global CAGR (2022 - 2028)

7.5%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Service

By End User

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Air Cargo Regional Insights

Asia Pacific Air Cargo Market Segmentation

The Asia Pacific air cargo market is segmented based on type, service, end user, and country.

Based on type, the Asia Pacific air cargo market is segmented into air mail and air freight. The air freight segment held a larger Asia Pacific air cargo market share in 2022.

Based on service, the Asia Pacific air cargo market is segmented into express and regular. The regular segment held a larger Asia Pacific air cargo market share in 2022.

Based on end user, the Asia Pacific air cargo market is segmented into retail, pharmaceutical & healthcare, food & beverage, consumer electronics, automotive, and others. The others segment held the largest Asia Pacific air cargo market share in 2022.

Based on country, the Asia Pacific air cargo market has been categorized into China, India, Japan, South Korea, Australia, and the Rest of Asia Pacific. Our regional analysis states that China dominated the Asia Pacific air cargo market in 2022.

ANA Cargo; Cargolux; Cathay Pacific Airways Limited; DHL International GmbH (Deutsche Post DHL Group); Emirates SkyCargo; Etihad Cargo; FedEx Corporation; Lufthansa Cargo AG; United Parcel Service of America, Inc.; and Zela Aviation The Air Charter Company are the leading companies operating in the Asia Pacific air cargo market.

The Asia Pacific Air Cargo Market is valued at US$ 38.36 Billion in 2022, it is projected to reach US$ 59.30 Billion by 2028.

As per our report Asia Pacific Air Cargo Market, the market size is valued at US$ 38.36 Billion in 2022, projecting it to reach US$ 59.30 Billion by 2028. This translates to a CAGR of approximately 7.5% during the forecast period.

The Asia Pacific Air Cargo Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Air Cargo Market report:

The Asia Pacific Air Cargo Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Air Cargo Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Air Cargo Market value chain can benefit from the information contained in a comprehensive market report.