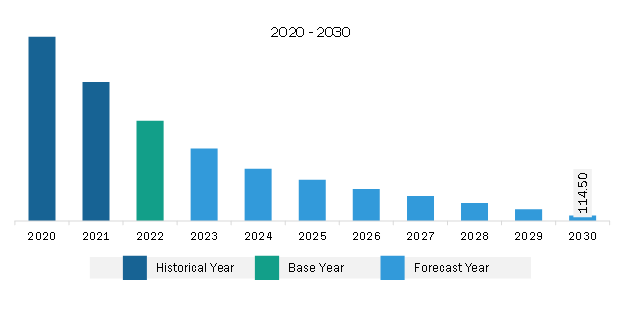

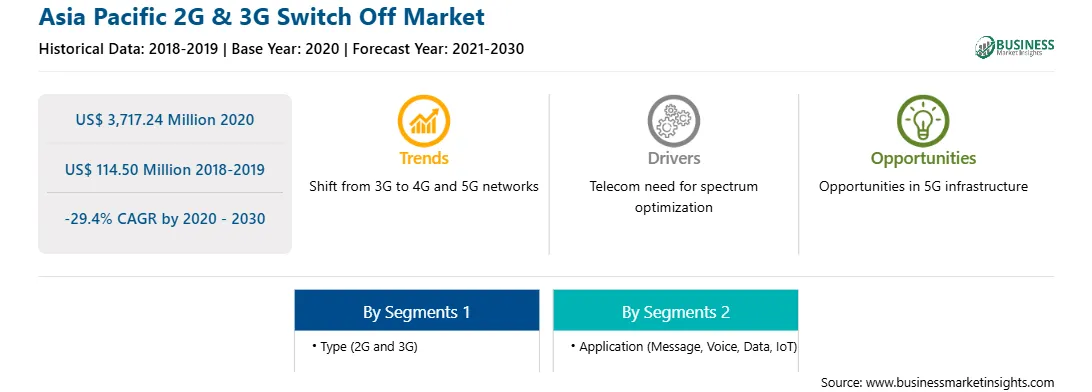

The Asia Pacific 2G & 3G switch off market was valued at US$ 3,717.24 million in 2020 and is expected to reach US$ 114.50 million by 2030; it is estimated to register a CAGR of -29.4% from 2020 to 2030.Rising Digital Transformation Across SME's Boosts Asia Pacific 2G & 3G Switch Off Market

According to research by the industry association Federation of Indian Chambers of Commerce & Industry (FICCI), small and medium-sized (SMEs) firms have been adopting digital technology for various purposes. Specifically, 60% of SMEs use it for human resources, 51% for sales and marketing, and 48% for finance. The study also showed that the most popular digital tools used by SMEs were accounting software (Tally, Vyapar, Busy, etc.) and business apps such as ERP and CRM. Thus, several manufacturers across the globe are adopting digital transformation. Numerous production enterprises in the Chinese city of Foshan are transforming their businesses using 5G, the cloud, and other digital technologies. Midea, Huawei, and China Unicom Guangdong are cooperating to give these small and medium-sized businesses (SMEs) the 5G connection and IT infrastructure required to increase efficiency and production significantly.

The implementation of Foshan City's action plan for digital transformation and upgrading the Foshan manufacturing industry, launched in July 2021, is made possible by Unicom Guangdong's 5G, cloud, and MEC infrastructure. According to the plan, Foshan will fund the digital transformation of industrial businesses with an investment of 10 billion yuan (US$ 1.48 billion) over the next three years. To accelerate the digital transformation of 3,000 manufacturing businesses, Foshan plans to construct "50 digital benchmark factories" and "100 digital benchmark workshops" by the end of 2023. Thus, such rising digital transformation across SMEs creates opportunities for using higher networks and switching off the 2G and 3G networks.Asia Pacific 2G & 3G Switch Off Market Overview

The Asia Pacific 2G & 3G switch off market is segmented into Australia, India, China, Japan, South Korea, and the Rest of Asia Pacific. According to the ISG, a global technology research and IT advisory firm, 29 operators in Asia Pacific are estimated to sunset their 2G/3G networks by 2025. India plans to sunset 2G by the end of 2023. Vodafone will sunset its 2G in 2022, while Japan declared a nationwide 2G sunset in 2012. Moreover, several regional operators are switching off the 2G and 3G networks. For instance, as of February 2021, Vodafone Idea Ltd (VIL), the telecom operator providing services under the "Vi" brand, completely shut down 3G services across all its circles in India by the financial year 2022 and move over to 4G. The network operator is ready to provide 5G.

As of January 2024, Japanese telco SoftBank Corp. announced that it would shut down its 3G network. The company has told its customers who are using 3G handsets and price plans that from February 1, 2024, they will be unable to use its communication services, and it has even warned that it will automatically cancel 3G plans. Also, as of February 2023, the Australian network provider Telstra confirms the switch off of the 3G network after June 2024. The signal for the same will be turned off, making many devices and systems redundant. Thus, several shutdowns of 2G and 3G networks in the region will lower the market share of 2G and 3G networks.

Asia Pacific 2G & 3G Switch Off Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific 2G & 3G Switch Off provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific 2G & 3G Switch Off refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific 2G & 3G Switch Off Strategic Insights

Asia Pacific 2G & 3G Switch Off Report Scope

Report Attribute

Details

Market size in 2020

US$ 3,717.24 Million

Market Size by 2030

US$ 114.50 Million

Global CAGR (2020 - 2030)

-29.4%

Historical Data

2018-2019

Forecast period

2021-2030

Segments Covered

By Type

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific 2G & 3G Switch Off Regional Insights

Asia Pacific 2G & 3G Switch Off Market Segmentation

The Asia Pacific 2G & 3G switch off market is categorized into type, application, and country.

Based on type, the Asia Pacific 2G & 3G switch off market is bifurcated into 2G and 3G. The 3G segment held a larger market share in 2020.

In terms of application, the Asia Pacific 2G & 3G switch off market is segmented into message, voice, data, and IoT. The IoT segment held the largest market share in 2020.

By country, the Asia Pacific 2G & 3G switch off market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific 2G & 3G switch off market share in 2020.

AT&T Inc, China Mobile Ltd, Deutsche Telekom AG, KDDI Corp, NTT Data Corp, Orange SA, Telenor ASA, and Vodafone Group Plc are some of the leading companies operating in the Asia Pacific 2G & 3G switch off market.

1. AT&T Inc

2. China Mobile Ltd

3. Deutsche Telekom AG

4. KDDI Corp

5. NTT Data Corp

6. Orange SA

7. Telenor ASA

8. Vodafone Group Plc

The Asia Pacific 2G & 3G Switch Off Market is valued at US$ 3,717.24 Million in 2020, it is projected to reach US$ 114.50 Million by 2030.

As per our report Asia Pacific 2G & 3G Switch Off Market, the market size is valued at US$ 3,717.24 Million in 2020, projecting it to reach US$ 114.50 Million by 2030. This translates to a CAGR of approximately -29.4% during the forecast period.

The Asia Pacific 2G & 3G Switch Off Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific 2G & 3G Switch Off Market report:

The Asia Pacific 2G & 3G Switch Off Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific 2G & 3G Switch Off Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific 2G & 3G Switch Off Market value chain can benefit from the information contained in a comprehensive market report.