ASEAN Heavy Construction Equipment Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031237 | Category: Manufacturing and Construction

No. of Pages: 150 | Report Code: BMIRE00031237 | Category: Manufacturing and Construction

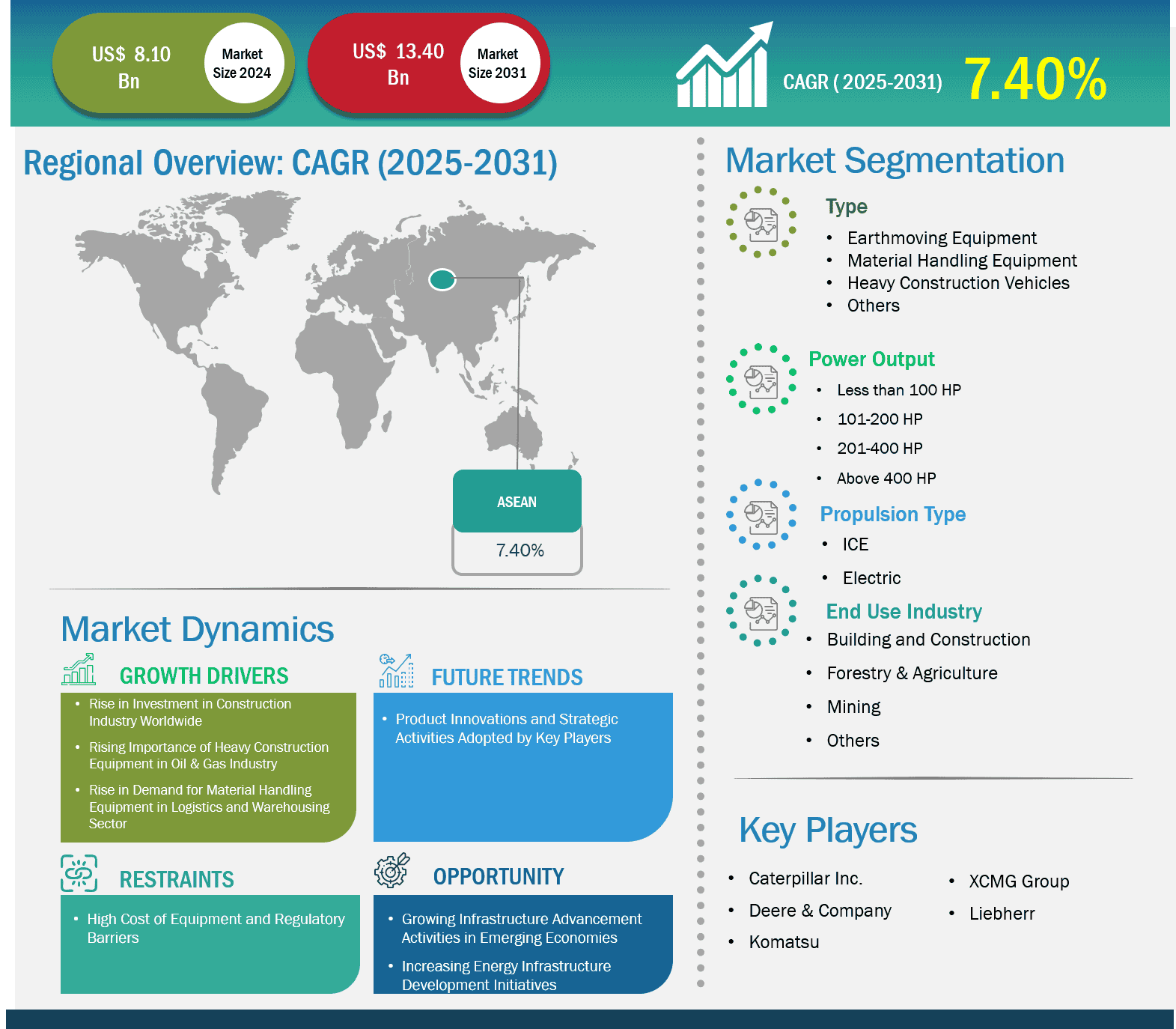

The Heavy Construction Equipment Market size is expected to reach US$ 13.36 million by 2031 from US$ 8.10 million in 2024. The market is estimated to record a CAGR of 7.4% from 2024 to 2031.

The construction industry in the ASEAN region is booming with rapid urbanization, growing populations, and substantial investments in infrastructure, housing, and industrial projects. With economic growth on the rise, governments, private investors, and multinational companies are driving large-scale projects across the 10 ASEAN countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam. The construction sector in ASEAN is witnessing robust growth driven by large-scale infrastructure projects, urbanization, and government initiatives in Indonesia, Vietnam, Thailand, the Philippines, etc. As the region invests heavily in infrastructure, transportation, and real estate development, the demand for heavy construction equipment such as excavators, cranes, bulldozers, wheel loaders, and dump trucks will continue to rise in the coming years.

Key segments that contributed to the derivation of the Heavy Construction Equipment Market analysis are machinery type, propulsion type, power output, and end use industry.

The ongoing expansion of Changi Airport, including the construction of Terminal 5, is likely to increase the airport's capacity to accommodate 135 million passengers annually, reinforcing Singapore's position as a major air hub in Asia. Singapore is redeveloping the Jurong Lake District into a vibrant business, residential, and leisure hub. The district will feature green buildings, smart mobility, and sustainable infrastructure. Cambodia is developing the Phnom Penh-Sihanoukville Expressway, a key project aimed at improving connectivity between the capital city and the country's main port. This project is expected to boost trade, tourism, and investment in the region. The Philippines is developing its first-ever subway system in Metro Manila to tackle traffic congestion and promote sustainable urban mobility. The project is expected to improve transport accessibility in one of the most densely populated cities in the world. Vietnam is investing heavily in expanding its aviation infrastructure with the development of Long Thanh International Airport in Dong Nai Province. This will become the country's largest airport, with a capacity of 100 million passengers per year, aimed at boosting Vietnam's connectivity with the world. Thus, growing infrastructure development is driving the growth of heavy construction equipment market.

Based on Geography, the ASEAN Heavy Construction Equipment Market comprises of Indonesia, Singapore, Malaysia, Thailand, Vietnam, Philippines. Indonesia held the largest share in 2024.

Rising infrastructure projects and increasing government funding are major factors driving the heavy construction equipment market in Indonesia. In September 2024, Millennium Challenge Corporation (MCC) and the Government of Indonesia launched an investment of US$ 649 million for Indonesia’s infrastructure development for the next five years up to 2028.

The grant focused on improving the quantity infrastructure and increasing access to finance for small and medium enterprises, drivers of the heavy construction equipment market growth. The construction sector in Indonesia plays a crucial role in the country's economy, contributing significantly to employment, infrastructure development, and overall economic growth. In recent years, Indonesia's construction industry has experienced steady growth driven by both government and private sector investments in various infrastructure projects, including roads, bridges, airports, and urban development. The sector has been pivotal in supporting the government's initiatives to modernize infrastructure, enhance connectivity, and promote industrial development, particularly under the National Medium-Term Development Plan (RPJMN).

The ongoing push for infrastructure development to address the challenges of urbanization, population growth, and the need for enhanced regional connectivity is fueling the expansion of the construction sector. The government's infrastructure spending has increased, with a focus on transportation (highways, railways, ports, and airports), energy (power plants, renewable energy projects), and public housing projects. The construction of toll roads has been a major initiative, easing traffic congestion and improving transportation efficiency across the archipelago.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 8.10 Million |

| Market Size by 2031 | US$ 13.36 Million |

| Global CAGR (2025 - 2031) | 7.4% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Machinery Type

|

| Regions and Countries Covered | ASEAN

|

Some of the key players operating in the market includes Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Liebherr Group, and Hitachi Construction Machinery among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisition to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conduct a significant number of primary interviews each year with industry stakeholders and experts to validate its data, analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The ASEAN Heavy Construction Equipment Market is valued at US$ 8.10 Million in 2024, it is projected to reach US$ 13.36 Million by 2031.

As per our report ASEAN Heavy Construction Equipment Market, the market size is valued at US$ 8.10 Million in 2024, projecting it to reach US$ 13.36 Million by 2031. This translates to a CAGR of approximately 7.4% during the forecast period.

The ASEAN Heavy Construction Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the ASEAN Heavy Construction Equipment Market report:

The ASEAN Heavy Construction Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The ASEAN Heavy Construction Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the ASEAN Heavy Construction Equipment Market value chain can benefit from the information contained in a comprehensive market report.