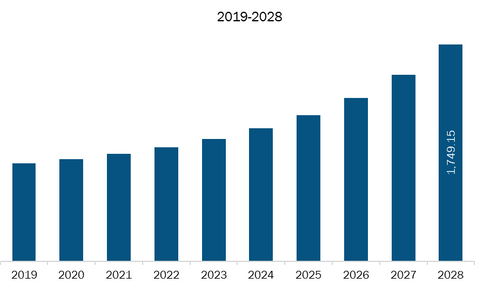

The APAC submarine cable system market is expected to grow from US$ 235.85 million in 2021 to US$ 546.78 million by 2028; it is estimated to grow at a CAGR of 12.8% from 2021 to 2028.

Market Introduction

Submarine cables are laid using ships that are modified specifically for this purpose, transporting, and laying the “wet plant” infrastructure slowly and precisely on the seabed. These special ships can carry thousands of kilometers of optical cables through the sea. Once the desired route is finalized, specialist ships begin the work of laying the cable, which is dropped to the ocean floor. Since their installation, submarine cables have been an important part of the communications infrastructure. The future trends in adopting optical submarine cable systems are expected to enhance the network configuration flexibility and transmission capacity. Developments in technology for configuring the mesh network are expected to be a crucial factor in the enhancement of network configuration flexibility.

Strategic insights for the APAC Submarine Cable System provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the APAC Submarine Cable System refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

APAC Submarine Cable System Strategic Insights

APAC Submarine Cable System Report Scope

Report Attribute

Details

Market size in 2021

US$ 235.85 million

Market Size by 2028

US$ 546.78 million

Global CAGR (2021 - 2028)

12.8%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Service

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

APAC Submarine Cable System Regional Insights

Market Overview and Dynamics

The major stakeholders in the APAC submarine cable system market analysis ecosystem include service providers and end-users. The service providers are the companies engaged in supplying and installation of submarine power cables, it also provides offering desktop study, marine route survey, permitting, cable procurement, civil construction at each cable landing site, vessel logistics, and submarine cable deployments, and maintenance services for submarine cable systems. Thus, wide scope demand for submarine cable systems in the APAC submarine cable system market is anticipated to positively influence the services APAC submarine cable system market for submarine cable systems.

The energy sector in the Asia Pacific is experiencing a transitional shift toward adopting renewable and green energy owing to factors such as the APAC submarine cable system market growth initiatives to reduce carbon emissions, fossil fuel depletion, and climate change. Various government policies support the adoption of green, sustainable, and low-carbon energy. Offshore wind farms play a major role in the quest to increase the use of renewables and reduce their carbon footprint. The wind energy sector in Asia-Pacific is set for rapid expansion and could make up nearly a quarter of the power capacity mix. Thus, regulatory support followed by significant initiatives for incorporating clean energy propels the adoption of offshore wind energy, which increases the installation of submarine cable systems across APAC. Thus, the regulatory framework for the promotion of offshore wind power drives the APAC submarine cable system market growth.

The growing adoption of technologies, such as the Internet of Things (IoT), virtual and augmented reality, and 5G network, in the Asia Pacific, augment the demand for interconnection bandwidth. Among various industries, Cloud and IT services are expected to consume the most interconnection bandwidth, reaching 914 Tbps in the Asia-Pacific region. As per the Global Interconnection Index (GXI) study published by Equinix, interconnection bandwidth in Asia-Pacific is expected to grow at a CAGR of 56% to exceed 3,825 Tbps by 2022, contributing 29% of the global capacity. In addition, as per the study conducted by Ciena, a network specialist, Singapore and Korea have the fastest data centers in the region with more than two in five boasting networks with connections faster than 1Gbps to enterprise customers. This bandwidth is needed to enable next-generation technologies, such as virtualization, cloud, security, business continuity/disaster recovery, and mobility. Thus, the adoption of high bandwidth due to the emergence of the 5G network is expected to fuel the APAC submarine cable system market growth during the forecast period.

NEC Corporation, S. B. Submarine Systems Co., Ltd., SubCom, LLC, NTT WORLD ENGINEERING MARINE CORPORATION, and Alcatel Submarine Networks are among the key APAC submarine cable system market players profiled in the research study.

Impact of COVID-19 Pandemic on APAC Submarine Cable System Market

The global COVID-19 crisis drastically affected APAC countries, namely China, India, and Japan, especially in 2020. The consequent enactment of lockdown measures and the slowdown of manufacturing industries in these countries has led to a slowdown in the production of submarine cables. The submarine power cable installation capacity plummeted by ~3–4% in 2020 compared with the previous year, while the number of oil and gas rigs had fallen down significantly in the APAC submarine cable system market. A halt in the international movements and a temporary shutdown of factories and businesses were the other consequences of the COVID-19 pandemic. The shuttering of manufacturing factories did not have any immediate impact on global connectivity, but it pushed back the deployment of new systems. However, in 2021 and later, the APAC submarine cable system market is expected to start recovering from the impact of COVID-19 with the resumption of projects for renewable energy grids and communication networks.

The telecom industry is recovering at a faster pace from the diversities it faced during the early months of the global crisis owing to the rising number of internet users and growing inclination toward digital economies. The Asia Pacific has several island and archipelago countries—such as Indonesia, the Philippines, Japan, Singapore, and Australia—and coastal countries—including Malaysia, Thailand, Vietnam, Cambodia, and South Korea—which highlights the need for establishing suitable connectivity in the region. Thus, such growth prospects to enable effective connectivity between nations and ensure the future growth of digital economies are the prominent factors driving the growth of the submarine cable system market size in the APAC Submarine Cable System Market.

Key Market Segments

The APAC submarine cable system market share, based on service is segmented into installation services and maintenance & upgrade services. The installation services segment accounted for a larger share of the APAC submarine cable system market in 2020. The cable installation process includes landing cables onshore and laying across the ocean or body of water until reaching the other side. The cable handling and monitoring are crucial factors during the cable laying process as the cable can be damaged if the minimum bending radius, actual strain, or other limits are not carefully observed during installation in the APAC submarine cable system market. Submarine cable installations are expensive and highly engineered operations executed by large construction vessels in extremely harsh environments. Submarine cables comprise two key components, including optical fibers that carry the data and a conductive material that transmits the current used to feed the optical amplifiers located along the subsea cable. Additionally, cables are coated with several layers of protective materials to guard and protect them against water and corrosion in APAC Submarine Cable System Market.

Based on application, the APAC submarine cable system market is segmented into grid interconnection, offshore wind power, and communication segment. The grid interconnection segment is sub-segmented into the installation services in APAC Submarine Cable System Market

and maintenance and upgrades services market. The offshore wind power segment is sub-segmented into the installation services market and maintenance and upgrades services market. The communication segment is sub-segmented into the installation services market and maintenance and upgrades services. The communication segment accounted for the largest share in the APAC submarine cable system market size in 2020.

Major Sources and Companies Listed

The key players operating in the APAC submarine cable system market include NEC Corporation, Alcatel Submarine Networks, S. B. Submarine Systems Co., Ltd., HMN Technologies Co., Ltd., ASEAN Cableship Pte Ltd., SubCom, LLC, OMS Group Sdn Bhd., PT LIMIN MARINE & OFFSHORE, Dagang NeXchange Berhad, Kokusai Cable Ship Co., Ltd., NTT WORLD ENGINEERING MARINE CORPORATION and among others. Various other companies operating in the APAC submarine cable system market are coming up with new technologies and offerings which are helping the APAC submarine cable system market for submarine cable systems to expand over the years in terms of revenue.

Reasons to Buy Report

APAC Submarine Cable System Market Segmentation

APAC Submarine Cable System Market – by Service

APAC Submarine Cable System Market – by Application

APAC Submarine Cable System Market - Companies Mentioned

The List of Companies - APAC Submarine Cable System Market

The APAC Submarine Cable System Market is valued at US$ 235.85 million in 2021, it is projected to reach US$ 546.78 million by 2028.

As per our report APAC Submarine Cable System Market, the market size is valued at US$ 235.85 million in 2021, projecting it to reach US$ 546.78 million by 2028. This translates to a CAGR of approximately 12.8% during the forecast period.

The APAC Submarine Cable System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the APAC Submarine Cable System Market report:

The APAC Submarine Cable System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The APAC Submarine Cable System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the APAC Submarine Cable System Market value chain can benefit from the information contained in a comprehensive market report.