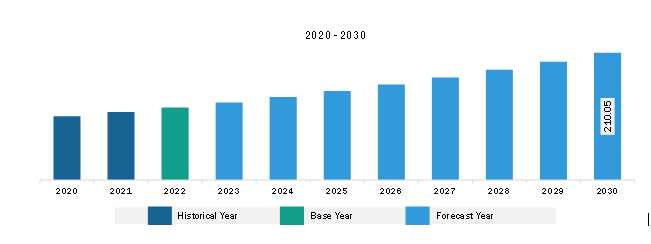

The Africa revenue assurance market was valued at US$ 119.99 million in 2022 and is expected to reach US$ 210.05 million by 2030; it is estimated to record a CAGR of 7.3% from 2022 to 2030. Rise in Internet Penetration Fuels Africa Revenue Assurance Market

As internet usage continues to grow, more businesses are conducting their operations online, leading to an increase in the generation of digital transactions and revenue streams. According to World Bank data, globally, the number of individuals using the Internet in 2021 was 63%, an increase from 60% in 2020. With more people accessing the Internet, more digital transactions are taking place. This includes online purchases, digital payments, and other online financial activities. The larger the volume of transactions, the greater the need for effective revenue assurance measures to ensure accurate billing, prevent revenue leakages, and detect fraudulent activities. Moreover, the rise in internet penetration has fueled the growth of the e-commerce industry. Online retail platforms and marketplaces are experiencing increased activity, with more businesses and consumers participating in online buying and selling. Revenue assurance is crucial in ensuring accurate revenue recognition, managing inventory, and preventing revenue leakages in e-commerce. There is a significant increase in the use of mobile internet. As more people access the Internet through their mobile devices, there is a need for revenue assurance solutions that can effectively monitor and manage revenue streams from mobile services, such as mobile data, voice calls, and value-added services. Hence, the rising internet penetration is a significant driver for the revenue assurance market.Africa Revenue Assurance Market Overview

The upsurge in mobile technology is one of the major factors propelling the revenue assurance industry growth in Africa. Mobile technology is set to play a crucial role in the way people live and businesses operate, enabling new digital solutions for both large and small enterprises and enhancing the support available to consumers through expanded online channels. The adoption of 4G technology has grown significantly in recent years, mainly due to the increasing demand for higher speeds, particularly among younger consumers. In the next five years, the adoption of 4G in Sub-Saharan Africa is projected to more than double, reaching a penetration rate of 45%. The momentum for 5G deployment is also gaining traction, with an initial focus on urban areas and industrial locations with greater demand for advanced connectivity. The introduction of 5G is expected to contribute US$ 11 billion to the Sub-Saharan African economy by 2030, accounting for over 6% of the overall economic impact of the mobile industry.

Africa Revenue Assurance Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Africa Revenue Assurance provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Africa Revenue Assurance refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Africa Revenue Assurance Strategic Insights

Africa Revenue Assurance Report Scope

Report Attribute

Details

Market size in 2022

US$ 119.99 Million

Market Size by 2030

US$ 210.05 Million

Global CAGR (2022 - 2030)

7.3%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Component

By Deployment

By Organization Size

By Vertical

Regions and Countries Covered

Africa

Market leaders and key company profiles

Africa Revenue Assurance Regional Insights

Africa Revenue Assurance Market Segmentation

The Africa revenue assurance market is categorized into components, deployment, organization size, vertical, and country.

Based on component, the Africa revenue assurance market is bifurcated into solution and services. The solution segment held a larger market share in 2022.

Based on deployment, the Africa revenue assurance market is bifurcated into on-premises and cloud-based. The cloud-based segment held a larger market share in 2022.

Based on organization size, the Africa revenue assurance market is bifurcated into SMEs and large enterprises. The large enterprises segment held a larger market share in 2022.

Based on vertical, the Africa revenue assurance market is categorized into BFSI, hospitality, telecom, utilities, and others. The telecom segment held the largest market share in 2022.

By country, the Africa revenue assurance market is segmented into the Northern Africa, Western Africa, Southern Africa, Eastern Africa, and Central Africa. Northern Africa dominated the Africa revenue assurance market share in 2022.

Nokia Corp, Tata Consultancy Services Ltd, Amdocs, BDO South Africa Inc, Araxxe SAS, Panamax Inc, and Adapt IT Holding Proprietary Ltd are some of the leading companies operating in the Africa revenue assurance market.

1. Nokia Corp

2. Tata Consultancy Services Ltd

3. Amdocs

4. Araxxe SAS

5. BDO South Africa Inc

6. Panamax Inc

7. Adapt IT Holdings Proprietary Ltd

The Africa Revenue Assurance Market is valued at US$ 119.99 Million in 2022, it is projected to reach US$ 210.05 Million by 2030.

As per our report Africa Revenue Assurance Market, the market size is valued at US$ 119.99 Million in 2022, projecting it to reach US$ 210.05 Million by 2030. This translates to a CAGR of approximately 7.3% during the forecast period.

The Africa Revenue Assurance Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Africa Revenue Assurance Market report:

The Africa Revenue Assurance Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Africa Revenue Assurance Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Africa Revenue Assurance Market value chain can benefit from the information contained in a comprehensive market report.