Africa Mobile Value Added Services and Wholesale Voice Carrier Market

No. of Pages: 156 | Report Code: BMIRE00030972 | Category: Technology, Media and Telecommunications

No. of Pages: 156 | Report Code: BMIRE00030972 | Category: Technology, Media and Telecommunications

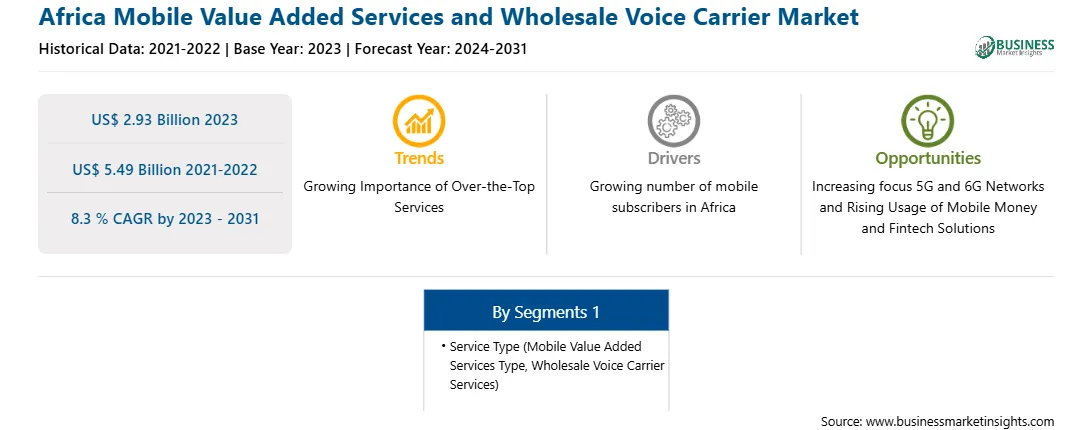

The Africa mobile value added services and wholesale voice carrier market size was valued at US$ 2.93 billion in 2023 and is expected to reach US$ 5.49 billion by 2031; it is estimated to record a CAGR of 8.3 % from 2023 to 2031.

Growing Importance of Over-The-Top Services is likely to remain a key market trend.

The growing importance of over-the-top (OTT) services, which provide content and communication directly via the Internet, is significantly transforming how people in Africa access media, communication, and entertainment. OTT communication platforms, such as WhatsApp, Facebook Messenger, and Skype, are dominating the communication space by offering free messaging and calling services over the Internet, bypassing traditional SMS and voice services. This has reduced the reliance on traditional mobile carrier services and increased the demand for data packages to access these OTT platforms.

As OTT platforms grow, telecom operators and MVAS providers are increasingly focusing on data-centric value-added services rather than traditional voice and SMS-based offerings. There is a strong push toward providing affordable data bundles, mobile internet services, and special offers that cater to OTT app users. In addition, African consumers are showing an increasing preference for localized OTT content, such as local movies, music, and series, which has increased the development of local OTT platforms catering to regional tastes and cultural preferences. For example, IrokoTV, or the "Netflix of Africa," offers a vast library of Nollywood (Nigerian) films. The platform partners with telecom operators across Africa to bundle their services with mobile data, allowing users to access local content on demand. Therefore, the growing importance of OTT services is expected to be a significant trend for the mobile value-added services and wholesale voice carrier market.

5G-related initiatives are gaining momentum across South Africa, encompassing activities such as spectrum auctions, pilot programs, and commercial trials aimed at fostering locally relevant 5G use cases. For example, South Africa's Independent Communications Authority (ICASA) successfully concluded its spectrum auction for the 700; 800; 2,600; and 3,500 MHz bands in May 2022. Such activities facilitate the rollout of 5G technology and enhance the overall telecommunications infrastructure. This factor generates the requirement for improved connectivity and service delivery, including high-speed data services and innovative value-added and communication services. With the widespread 5G rollout in South Africa, the connectivity requirements for individuals and enterprises drive the need for mobile value-added services and wholesale voice carrier services. In addition, the rising adoption of smartphones further contributes to the market growth in the country. For example, according to GSMA, the total adoption of smartphones is expected to rise from 67% of total connections in 2021 to 76% of total connections by 2025.

South Africa is focused on combating fraud and digital identity theft in sectors such as banking, finance, insurance, and retail. For instance, in February 2024, as part of the global GSMA Open Gateway initiative, South African operators, such as Cell C, MTN, and Telkom, will be able to implement world-class Number Verification and SIM Swap-Application Programme Interfaces (APIs). They will be available to all mobile commerce and financial institutions, as well as developers, allowing them to create new services to combat digital fraud and protect 47 million mobile subscribers across the country. Thus, standardizing APIs by mobile network operators (MNOs) to enhance security measures within banking applications and online banking platforms is likely to fuel the market growth in South Africa during the forecast period.

Wholesale voice carrier services are the purchase of voice over IP (VoIP) and telephony minutes in large quantities directly from telecommunications carriers at highly discounted wholesale rates. Wholesale voice is based on carriers selling excess network capacity and voice termination minutes to businesses, resellers, and service providers rather than leaving them unused. Wholesale voice carrier services provide cost-effective solutions to companies for effective communication. As the cost associated with voice services is higher, the organizations source voice termination services directly from carriers to save on call rates. According to Tech Knowledge Open Systems, businesses that purchase voice minutes in bulk directly from carriers can avoid the retail markup and get rates that are 60–80% lower than standard per-minute prices. For voice-intensive operations such as call centers, these savings can amount to tens of thousands of dollars per month in voice bills. In addition, companies only purchase the voice minute bundles required, with the ability to top up as demand increases. The adoption of this pay-as-you-go model eliminates the risk of overages and enables a more cost-effective alignment of voice capacity with actual call volumes.

The rise in mobile phone and internet penetration acts as a prime factor driving the market growth for the segment. For instance, according to GSMA, the number of unique mobile subscribers in sub-Saharan Africa was 489 million in 2022, and it is expected to grow to 692 million in 2030. The number of mobile internet users was 247 million in 2022, and it is expected to reach 438 million in 2030. In addition, the African diaspora is extensive, leading to a high demand for international call services. Wholesale voice carriers are increasingly catering to this need by offering competitive pricing for international call termination. The shift toward 5G and investment in 4G infrastructure further fulfill the demand for improved connectivity, facilitating more efficient voice services.

Orange SA, Tilil Technologies, Pearl Systems Zambia Limited, Cellfind (Pty) Ltd, Safaricom Limited, ALXTEL, Airtel Africa Plc, Teltac Worldwide, AfriCallShop, Tata communication Ltd, AstraQom International, and AT&T Inc are among the key Africa mobile value added services and wholesale voice carrier market players that are profiled in this market study.

Strategic insights for the Africa Mobile Value Added Services and Wholesale Voice Carrier provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.93 Billion |

| Market Size by 2031 | US$ 5.49 Billion |

| Global CAGR (2023 - 2031) | 8.3 % |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | Africa

|

| Market leaders and key company profiles |

The geographic scope of the Africa Mobile Value Added Services and Wholesale Voice Carrier refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Africa Mobile Value Added Services and Wholesale Voice Carrier Market is valued at US$ 2.93 Billion in 2023, it is projected to reach US$ 5.49 Billion by 2031.

As per our report Africa Mobile Value Added Services and Wholesale Voice Carrier Market, the market size is valued at US$ 2.93 Billion in 2023, projecting it to reach US$ 5.49 Billion by 2031. This translates to a CAGR of approximately 8.3 % during the forecast period.

The Africa Mobile Value Added Services and Wholesale Voice Carrier Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Africa Mobile Value Added Services and Wholesale Voice Carrier Market report:

The Africa Mobile Value Added Services and Wholesale Voice Carrier Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Africa Mobile Value Added Services and Wholesale Voice Carrier Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Africa Mobile Value Added Services and Wholesale Voice Carrier Market value chain can benefit from the information contained in a comprehensive market report.