Africa Last Mile Delivery Market Reposrt (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031248 | Category: Automotive and Transportation

No. of Pages: 150 | Report Code: BMIRE00031248 | Category: Automotive and Transportation

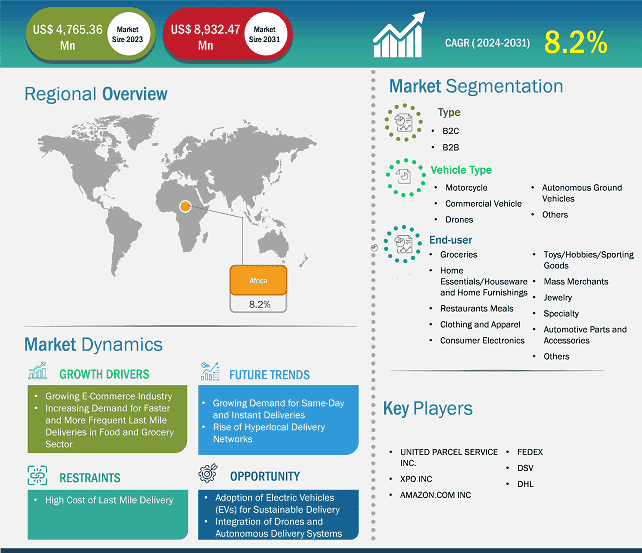

The Africa last mile delivery market was worth US$ 4,765.36 million in 2023 and is projected to reach US$ 8,932.47 million by 2031; it is expected to register a CAGR of 8.2% from 2023 to 2031.

The booming e-commerce industry increased mobile internet penetration, urbanization, and a rising middle class steadily drive the demand for last-mile delivery in Africa. However, despite its potential, the sector faces a variety of challenges due to infrastructure limitations, security concerns, and operational inefficiencies. Nigeria has one of the largest internet user bases in Africa, with over 150 million internet users and a mobile penetration rate of over 90%. A high mobile and internet penetration has led to a surge in online shopping and digital transactions, both of which directly propel the demand for efficient last-mile delivery services. Mobile apps and websites for ordering products have made it easier for Nigerians to access e-commerce platforms, which, in turn, drives the need for fast and reliable delivery services.

The rise of hyperlocal delivery models is a prominent trend in Nigeria's last-mile delivery sector. Hyperlocal delivery services involve quick delivery from local retailers to consumers within a few hours; these services are gaining popularity, particularly in urban areas such as Lagos. These services cater to the growing demand for faster fulfillment and aid in convenience for consumers. Food delivery services such as Jumia Food, Uber Eats, and Bolt Food are leading the charge in hyperlocal delivery. Other sectors, such as pharmaceuticals, groceries, and electronics, are also adopting the trend.

Environmental sustainability has become an important consideration for many logistics providers. Electric vehicles (EVs) are starting to make an appearance in Nigeria's last-mile delivery market, especially in urban areas. These vehicles offer a sustainable alternative to traditional delivery vans, reducing carbon emissions and noise pollution. Additionally, some delivery companies are exploring the use of motorcycles or bicycles for smaller packages in congested urban areas. While the adoption of EVs is still limited due to the high initial investment, the growing focus on green logistics represents a significant trend in the sector.

One of the primary drivers of the market is the increasing e-commerce sector globally. The demand for efficient, cost-effective, and timely last-mile delivery solutions has grown in countries such as Algeria, South Africa, Egypt, and Nigeria. Despite facing several challenges, including infrastructure issues and relatively low internet penetration, the last-mile delivery market in Algeria is experiencing gradual growth, driven by an expanding middle class, ongoing urbanization, and increasing mobile access. The rapid growth of e-commerce in Algeria is one of the primary factors fueling the development of the last-mile delivery market.

The Algerian government has recognized the importance of developing its logistics and e-commerce infrastructure to enhance economic growth. It has made efforts to improve transportation networks, particularly in urban centers, by investing in roads, ports, and railways. This focus on infrastructure development provides a foundation for more efficient last-mile delivery services. Additionally, the government has introduced measures to support local e-commerce initiatives, such as incentivizing digital payments and improving postal services, which can be leveraged to boost last-mile delivery capabilities.

The rise of hyperlocal delivery models is a prominent trend in Nigeria's last-mile delivery sector. Hyperlocal delivery services involve quick delivery from local retailers to consumers within a few hours; these services are gaining popularity, particularly in urban areas such as Lagos. These services cater to the growing demand for faster fulfillment and aid in convenience for consumers.

The last-mile delivery market in Nigeria is positioned for significant growth, driven by the expansion of e-commerce, urbanization, and the increasing demand for fast and reliable delivery services. However, challenges such as infrastructure deficiencies, traffic congestion, high operational costs, and security concerns continue to impact the efficiency of the sector. Nevertheless, technological innovation, rural market expansion, and digital payment solutions are likely to serve as opportunities for the market players, enabling them to overcome these challenges.

Key segments that contributed to the derivation of the last mile delivery market analysis are type, vehicle type, and end-use.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 4,765.36 Million |

| Market Size by 2031 | US$ 8,932.47 Million |

| Global CAGR (2025 - 2031) | 8.2% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Africa

|

Some of the key players operating in the market include Kerry Logistics Network Ltd., FedEx Corp., United Parcel Service Inc., DHL Group, WumDrop, Picup Technologies, Pargo, SENDR, RUSH, Fastvan, and Kobo360, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Africa Last Mile Delivery Market is valued at US$ 4,765.36 Million in 2024, it is projected to reach US$ 8,932.47 Million by 2031.

As per our report Africa Last Mile Delivery Market, the market size is valued at US$ 4,765.36 Million in 2024, projecting it to reach US$ 8,932.47 Million by 2031. This translates to a CAGR of approximately 8.2% during the forecast period.

The Africa Last Mile Delivery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Africa Last Mile Delivery Market report:

The Africa Last Mile Delivery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Africa Last Mile Delivery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Africa Last Mile Delivery Market value chain can benefit from the information contained in a comprehensive market report.