Africa Heavy Construction Equipment Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031234 | Category: Manufacturing and Construction

No. of Pages: 150 | Report Code: BMIRE00031234 | Category: Manufacturing and Construction

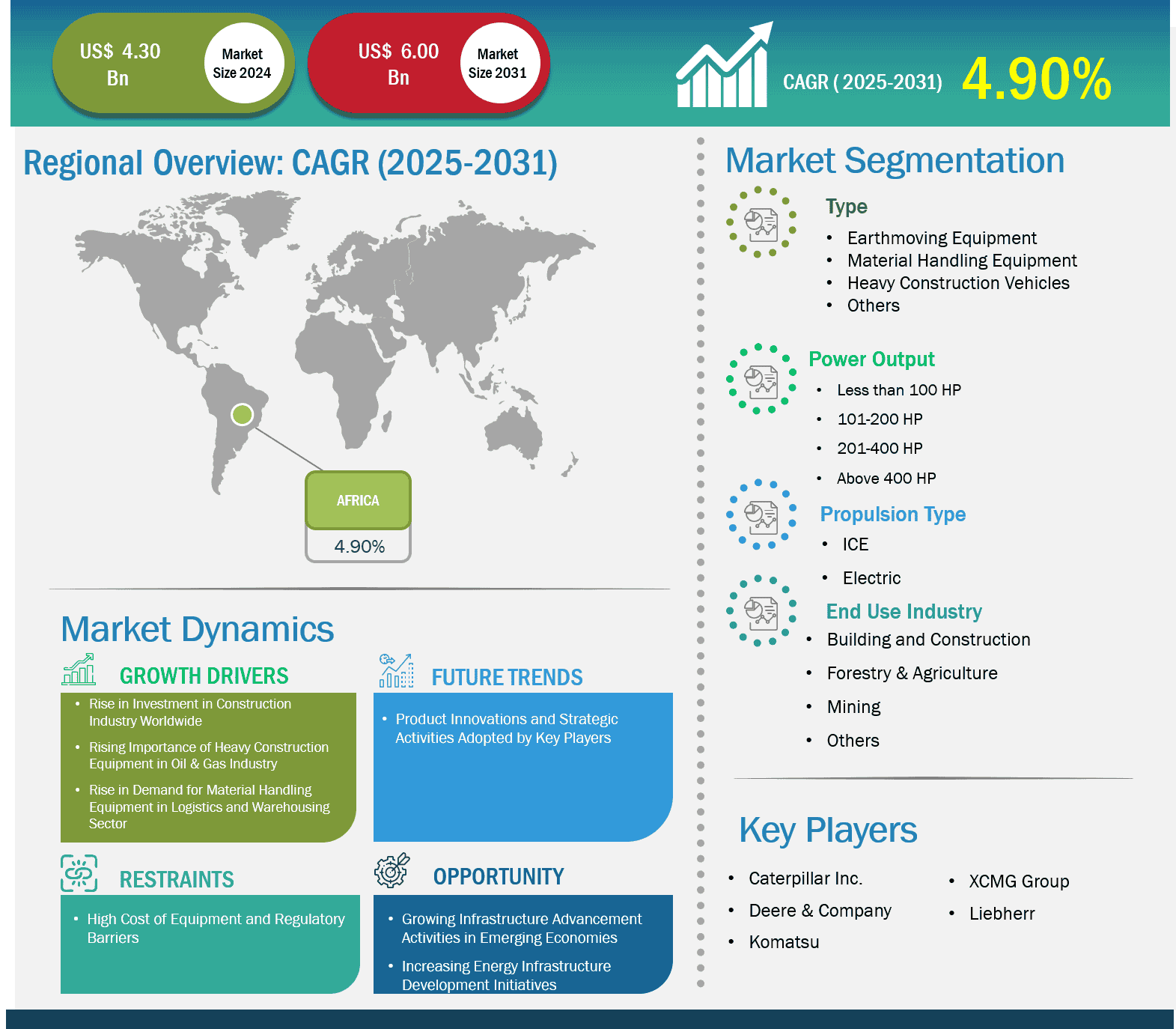

The Africa Heavy Construction Equipment market was worth US$ 4.21 billion in 2023 and is projected to reach US$ 6.12 billion by 2031; it is expected to register a CAGR of 4.8% from 2023 to 2031.

The heavy construction equipment market in South Africa has been experiencing steady growth, driven by increased infrastructure development, urbanization, and mining activities. As one of the largest economies in Africa, South Africa is a key player in the continent's construction industry. A demand for robust and reliable machinery for projects in sectors such as infrastructure, mining, and transportation characterizes the market.

The South African government has been focusing on infrastructure projects to improve transportation, urban development, and energy sectors. Key projects, such as road construction, railway development, and smart city initiatives, are major drivers of demand for heavy construction equipment such as bulldozers, excavators, cranes, and loaders.

The South African National Roads Agency (SANRAL) has continued to invest in improving road networks. At the same time, urbanization has led to a rise in residential, commercial, and industrial construction, which, in turn, increases the need for construction equipment.

South Africa's mining industry remains a key contributor to the demand for heavy equipment. Mining companies require machinery for tasks like excavation, hauling, drilling, and material handling. Equipment such as dump trucks, excavators, and wheel loaders are essential for these operations.

The Egypt heavy construction equipment market is experiencing notable growth, driven by large-scale infrastructure development, ongoing government initiatives, and ambitious projects aimed at modernizing the country's urban and industrial landscapes. As one of the largest economies in the Middle East and North Africa (MENA) region, Egypt is heavily investing in critical infrastructure to enhance its transportation networks, energy sector, and real estate developments. These efforts are creating a rising demand for heavy construction machinery, including cranes, excavators, bulldozers, and other specialized equipment.

The Egyptian government has launched numerous initiatives to address the country's infrastructure needs, improve connectivity, and stimulate economic growth. These investments are integral to Egypt's Vision 2030, a strategic plan for sustainable development that includes large-scale infrastructure projects aimed at transforming Egypt into a regional economic hub.

New Administrative Capital (NAC): The development of Egypt's new administrative capital, which is set to house government buildings, embassies, commercial centers, and residential zones, is one of the most ambitious construction projects in the country. The development of this city requires significant use of heavy construction machinery for land preparation, road construction, and the building of large-scale infrastructure.

Roads and Highways: Egypt is investing heavily in expanding and modernizing its road networks. Projects such as the Cairo Ring Road expansion, the Cairo-Alexandria Desert Road, and the Suez Canal Axis Road are key initiatives driving demand for construction equipment. The road construction and repair efforts require earthmoving machinery, asphalt pavers, and other heavy equipment.

The South African government continues to prioritize infrastructure development through programs like the Infrastructure Investment Plan and National Development Plan (NDP), which stimulate demand for heavy equipment. Smart Cities and Technology Infrastructure

Smart City Developments: South Africa is increasingly focusing on the development of smart cities that incorporate technology, sustainability, and innovation. The Waterfall City project near Johannesburg, which integrates digital technologies, green spaces, and sustainable infrastructure, grew in 2024, attracting business and residential developments.

South Africa's construction sector in 2024 was defined by key infrastructure investments across energy, transport, housing, and commercial projects. With a focus on sustainable growth, urban development, and addressing social needs, these projects are expected to create jobs, stimulate the economy, and improve the country's overall infrastructure. These large-scale developments align with South Africa's longer-term vision of economic diversification, modernization, and inclusivity. Such an increase in the infrastructure development projects in South Africa has created a massive demand for heavy construction equipment.

Nigeria's heavy construction equipment market is experiencing significant growth, fuelled by the country's ongoing infrastructure development, economic diversification efforts, and population growth. Nigeria is focusing on modernizing its infrastructure to accommodate its large and growing population while diversifying away from its dependence on oil revenues. This has led to an increased demand for heavy construction machinery to support the development of transportation, energy, real estate, and industrial sectors.

The Nigerian government has made significant investments in large-scale infrastructure projects to improve the country's transportation networks, utilities, and urban infrastructure. These investments are part of the country's long-term economic development strategy, including the Economic Recovery and Growth Plan (ERGP), which aims to address the infrastructural gap and improve the country's competitiveness.

Railway Expansion: Nigeria is investing heavily in modernizing and expanding its rail network to improve transportation efficiency. The Abuja-Kaduna Railway, Lagos-Ibadan Railway, and Lagos-Kano Rail Project are key initiatives requiring construction equipment for track laying, station development, and supporting infrastructure.

Key segments that contributed to the derivation of the xx market analysis are type, vehicle type, and end-use.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 4.21 Billion |

| Market Size by 2031 | US$ 6.12 Billion |

| Global CAGR (2025 - 2031) | 4.8% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Machinery Type

|

| Regions and Countries Covered | Africa

|

Some of the key players operating in the market include Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Liebherr Group, and Hitachi Construction Machinery, which have global reach and extensive product portfolios, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

Africa Heavy Construction Equipment Market Country and Regional Insights

Africa Heavy Construction Equipment Key Sources Referred:

The Africa Heavy Construction Equipment Market is valued at US$ 4.21 Billion in 2024, it is projected to reach US$ 6.12 Billion by 2031.

As per our report Africa Heavy Construction Equipment Market, the market size is valued at US$ 4.21 Billion in 2024, projecting it to reach US$ 6.12 Billion by 2031. This translates to a CAGR of approximately 4.8% during the forecast period.

The Africa Heavy Construction Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Africa Heavy Construction Equipment Market report:

The Africa Heavy Construction Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Africa Heavy Construction Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Africa Heavy Construction Equipment Market value chain can benefit from the information contained in a comprehensive market report.