Africa Automotive Composites Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031212 | Category: Chemicals and Materials

No. of Pages: 150 | Report Code: BMIRE00031212 | Category: Chemicals and Materials

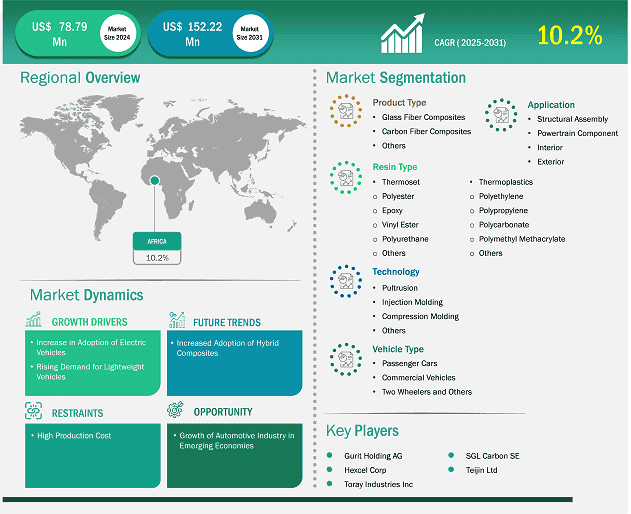

The Automotive Composites Market size is expected to reach US$ 152.22 million by 2031 from US$ 78.79 million in 2024. The market is estimated to record a CAGR of 10.2% from 2025 to 2031.

The automotive composites market in Africa is accelerating owing to the growing demand for lighter, more durable, and fuel-efficient vehicles. Composites, including fiberglass, carbon fiber, and natural fiber materials, are increasingly being incorporated into vehicle manufacturing processes in the region as automakers strive to meet global sustainability standards. The shift toward electric vehicles (EVs) and the desire to reduce carbon footprints fuel the adoption of advanced materials, with composites offering significant weight-saving benefits that enhance energy efficiency. This trend is expected to accelerate as the government and businesses in the country embrace more environmentally conscious policies and practices.

Key segments that contributed to the derivation of the automotive composites market analysis are product type, resin type, technology, vehicle type, and application.

The number of manufacturers setting up operations across key markets such as South Africa, Nigeria, Egypt, and Morocco is increasing in the country. South Africa has emerged as a prominent automotive hub, attracting international automakers and fostering local production. This has created a growing need for high-performance materials, such as composites, to support vehicle production. Moreover, with the rise of the middle-class population and greater consumer demand for affordable yet high-quality vehicles, automakers are turning to composites to improve their products' performance and aesthetic appeal. Natural fibers are taken from local agricultural sources, such as hemp, jute, and sisal. These fibers are an alternative to synthetic composites, offering a more sustainable and cost-effective option. This approach supports the development of a more environmentally friendly automotive industry but also creates economic opportunities for local agricultural sectors. The future outlook for Africa's automotive composites market is positive, as demand for advanced materials continues to grow in line with the region's expanding automotive industry and evolving sustainability goals.

Based on region, the Africa automotive composites market is further segmented into Egypt, South Africa, Algeria, and Nigeria. South Africa held the largest share in 2024.

South Africa's automotive composites market is growing as the country's automotive industry increasingly adopts advanced materials to enhance vehicle performance, reduce weight, and improve fuel efficiency. Composites such as fiberglass, carbon fiber, and natural fibers are becoming more common in vehicle manufacturing, driven by the demand for more sustainable and efficient transportation solutions. According to the International Trade Administration, the total vehicle production in South Africa increased from 446,210 units in 2020 to 510,000 units in 2022. South Africa launched the South Africa Automotive Masterplan (SAAM) 2021–2035 in 2021, aimed at producing 1.4 million vehicles, representing 1% of global vehicle production per annum by 2035. The country's seven original equipment manufacturers (OEMs) in the automotive sector invested ~US$ 460 million in 2021. South Africa's well-established automotive sector, which includes major global automakers, is shifting toward EVs, further boosting the use of lightweight materials. As the market for environmentally friendly vehicles expands, South Africa's automotive composites industry is poised to grow, supporting domestic and export demands.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 78.79 Million |

| Market Size by 2031 | US$ 152.22 Million |

| Global CAGR (2025 - 2031) | 10.2% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Fiber Type

|

| Regions and Countries Covered | Africa

|

| Market leaders and key company profiles |

Gurit Holding AG, Hexcel Corp, Mitsubishi Chemical Group Corp, SGL Carbon SE, Solvay SA, Teijin Ltd, DuPont de Nemours Inc, Toray Industries Inc, Atlas Fibre, and Elaghmore Advisor LLP are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note:

All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Africa Automotive Composites Market is valued at US$ 78.79 Million in 2024, it is projected to reach US$ 152.22 Million by 2031.

As per our report Africa Automotive Composites Market, the market size is valued at US$ 78.79 Million in 2024, projecting it to reach US$ 152.22 Million by 2031. This translates to a CAGR of approximately 10.2% during the forecast period.

The Africa Automotive Composites Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Africa Automotive Composites Market report:

The Africa Automotive Composites Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Africa Automotive Composites Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Africa Automotive Composites Market value chain can benefit from the information contained in a comprehensive market report.